The China Briefing

Messages from China’s diverging bond and equity markets

China’s sovereign wealth fund increased its stake in the biggest banks this week for the first time since 2015.

Please find below our latest thoughts on China:

- Given the deluge of negative media coverage on China in recent months, it’s perhaps surprising that financial market performance has not been weaker.

- From the end of Q2 into the early days of October, offshore China equities are down 1.5% and China A-shares have returned -4.1%. This is broadly similar to other global markets (S&P 500 -1.2%, MSCI Europe -4.1%, MSCI Japan -2.1% – all figures in USD as at 11 October 2023).1

- One of the factors providing a degree of support more recently has been that China’s policy towards both the economy and markets has become noticeably more positive.

- Central and local governments are easing property financing substantially, the duty on stock purchases has been lowered, and securities regulators are allowing more margin trading and pledging to control the pace of new equity fundraising.

- The market also reacted positively this week to news that China’s sovereign wealth fund increased its stake in the nation’s biggest banks for the first time since 2015, when efforts were made to put a floor under equity markets.

- Although the size of the investment is relatively small (around USD 65 million each in four banks2), nonetheless the announcement was splashed across the front pages of China’s top financial newspapers.

- Recent economic data has also come in slightly ahead of expectations. September’s official manufacturing Purchasing Managers’ Index (PMI) nudged above 503, suggesting the manufacturing sector expanded for the first time in six months.

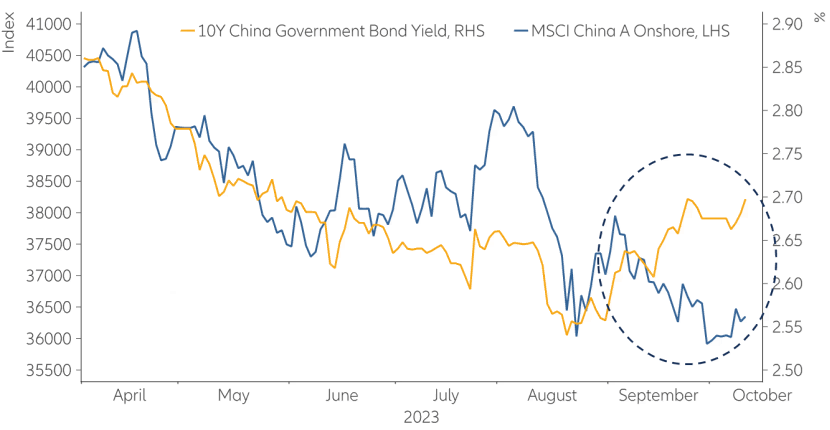

- It has been interesting to observe the different reaction to this across China’s financial markets. In particular, China bond markets look to have started pricing in a somewhat better growth outlook, while equity markets have remained subdued.

- In our view the different reactions reflect the underlying structure of the respective market participants. Bond yields tend to respond more incrementally with the markets dominated by domestic institutions who process new information and adjust growth expectations at the margin.

Chart 1: China A-Shares compared to 10 year bond yields, 6 months

Source: AllianzGI, Macrobond, as of 11 October 2023

- In contrast, the key price setters in China’s domestic equity markets are higher net worth individual investors who typically are more momentum-driven. A bigger injection of confidence will likely be needed to move the needle.

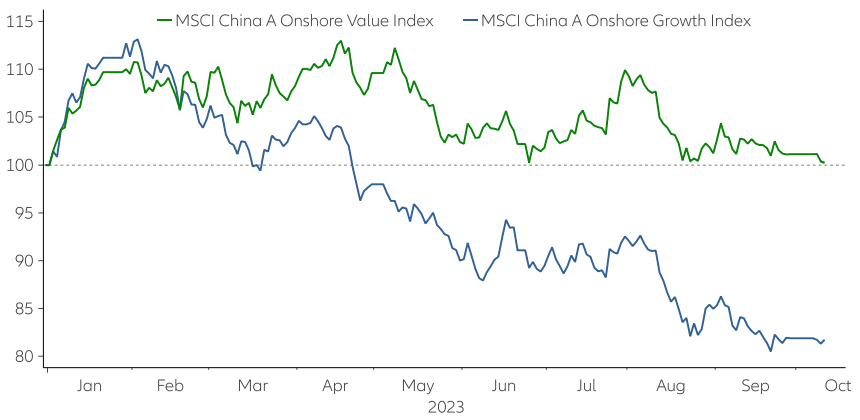

Chart 2: China A-Shares Growth vs Value, 2023 YTD

Source: AllianzGI, Macrobond, as of 11 October 2023

- On that note, data from the recent ‘Golden Week’ has been reassuring in the sense that it shows demand for services consumption remains decent, while also emphasizing the ongoing caution around the property market.

- By way of background, “Golden Weeks” are week-long national holidays. There are three Golden Weeks per year: the lunar new year Golden Week (Chinese New Year) in January or February, the Labour Day Golden Week which begins on 1 May, and the National Day Golden Week which begins around 1 October.

- Golden Weeks began in 2000 and have played an important role in driving consumption, especially tourism, as most people in China do not have flexible working holidays.

- The good news from the recent Golden Week is that domestic tourism is now tracking slightly ahead of prepandemic levels in 2019.4 However, weak property sales continue to undermine consumer confidence, especially in the smaller cities.

- Indeed, news this week that China’s largest private developer, Country Garden5, has warned of a potential default highlights the ongoing stresses in the system. This will likely nudge policymakers towards further policy action.

- Overall our view remains that China is at a strategic crossroads. We believe the government has sufficient tools to manage the current challenges – especially around property and local government financing – but equally they will also take a prolonged period to work through.

- In the meantime, the country’s future growth will be based around credit-light, innovation-rich industries. This is where much of our investment due diligence is focused at the moment.

- The more positive news here is that after a sustained de-rating of many growth stocks – even this year the MSCI China A Onshore Growth Index has lagged the Value Index by around 20%6 - we see a number of ‘micro’ opportunities which should still be able to thrive even in a slower macro environment.

1 Source: Macquarie, China National Bureau of Statistics, as of 15 September 2023

2 Source: Bloomberg as at 12 October 2023

3 Source: China National Bureau of Statistics, 29 September 2023

4 Source: Nomura Global Economics, 9 October 2023

5 Source: Financial Times, 10 October 2023

6 Source: Bloomberg as at 11 October 2023