The China Briefing

China A shares’ quiet advance

China A-shares have risen by more than 15%, putting them in positive territory year to date

Please find below our latest thoughts on China:

- China equity markets have continued their quiet advance in recent weeks.

- From the low point in early February, China A-shares have risen by more than 15%, putting them in positive territory year to date.1 Offshore equities are not far behind.

- The initial catalyst for the recovery was an abrupt change in supply and demand dynamics within the market.

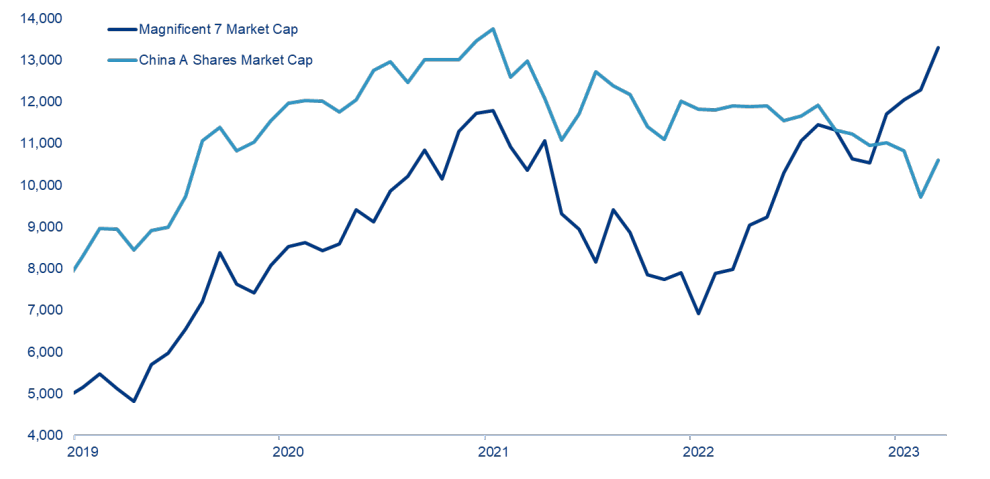

Chart 1: Market Cap of Magnificent 7 vs China A Shares (USD billion)

Source: Bloomberg, Allianz Global Investors as at 29 February 2024

- On the supply side, there had been extensive selling pressure from the unwinding of “snowball” derivative products linked to small cap indexes. This pressure plateaued in January. Many of these products have subsequently been closed so this is unlikely to be a source of weakness going forward.

- There has also been tightened scrutiny over IPOs, leading to a marked reduction in new issuance, and curbs on short selling.

- The increased demand for equities was initially spurred by “national team” buying, evident through a significant pick-up in domestic ETF volumes.

- More recently, the buying appears to have broadened out somewhat with market volumes overall picking up, and retail margin balances – a good proxy for local investor sentiment – increasing notably since Chinese New Year.2

- Contributing to the improved demand/supply balance was also a slew of coordinated share buyback announcements from state-owned enterprises as well as some high-profile companies hiking dividend payouts.

Chart 2: Citibank China Economic Surprise Index

Source: Bloomberg as at 20 March 2024

- This looks likely to become more of a market feature going forward. The newly appointed head of the Chinese securities regulator has pushed for companies to enhance shareholder returns, in a move that echoes recent governance changes in Japan and Korea.

- Looking ahead, our view is that the balance of risk and reward is looking considerably more favourable now than before. Certainly the “Beijing put” appears to have been successful so far in putting a floor under the market.

- Valuations are also helpful in providing some downside cushion. The forward PE of the MSCI China A Onshore Index is around 12x.3

- Also notable is that the dividend yield of the China A market has risen well above China government bond yields – an important consideration for domestic investors who have limited investment options given the country’s capital controls.

- In terms of some global context, the combined market cap of the Magnificent 7 stocks has grown to be meaningfully higher than the whole of the China A market (comprising more than 5,000 stocks).4 Whether this is more of a reflection of valuations in the US or China (or both) remains to be seen.

- The main factor holding China equities back at the moment is the macro environment which can be described as “weak but stable”.

- Earlier this month at the National People’s Congress (NPC), China announced a 2024 GDP target of “around 5%”. This is similar to GDP growth in 2023, which came in at 5.2%.5 But it will be a lot harder to achieve this year given the lack of a post-Covid bounce.

- Given that China has ended up meeting or beating its GDP target in 14 of the last 15 years (only failing to do so in one year because of Covid),6 it seems likely the government will need to ratchet up the level of policy support.

- The most recent economic data has been quite resilient, with the Citi Economic Surprise Index moving above zero, 7 indicating a slight beat overall compared to market expectations.

- The property sector continues to be the major drag, with a large backlog of delayed projects that have already been paid for because of China’s pre-sale model for new homes.

- Longer term, as China looks to move away from a growth model based on property and infrastructure, the importance of technological progress and innovation has for some time been a consistent theme in China’s official rhetoric.

- A key phrase that was front and centre at the NPC is “new productive forces”. Unknown just six months ago, this slogan is now being deployed by President Xi to express his ambitions for China’s high-technology drive.

- This new strategic focus goes beyond self-sufficiency. There looks to be a distinct change of emphasis from relying less on imported technologies to instead making China an outright leader in technologies of the future.

- This is likely to lead to a focus on areas including humanoid robots, nuclear and hydrogen energy, industrial internet and next-generation mobile telecoms.

1 Source: Bloomberg, 20 March 2024

2 Source: Bloomberg, 20 March 2024

3 Source: Bloomberg, 20 March 2024

4 Source: Bloomberg, 29 February 2024

5 Source: Macquarie, 24 January 2024

6 Source: Macquarie, 24 January 2024

7 Source: Bloomberg, 20 March 2024