The China Briefing

China’s extend and pretend

Please find below our latest thoughts on China:

- It has been an uncomfortable period for investors in China. After a bright start to the year, both onshore and offshore markets have given up their gains as doubts about the economic recovery have increased.1

- In particular, after the re-opening ‘sugar rush’, consumption has started to slow and, linked to this, the property recovery is still fragile

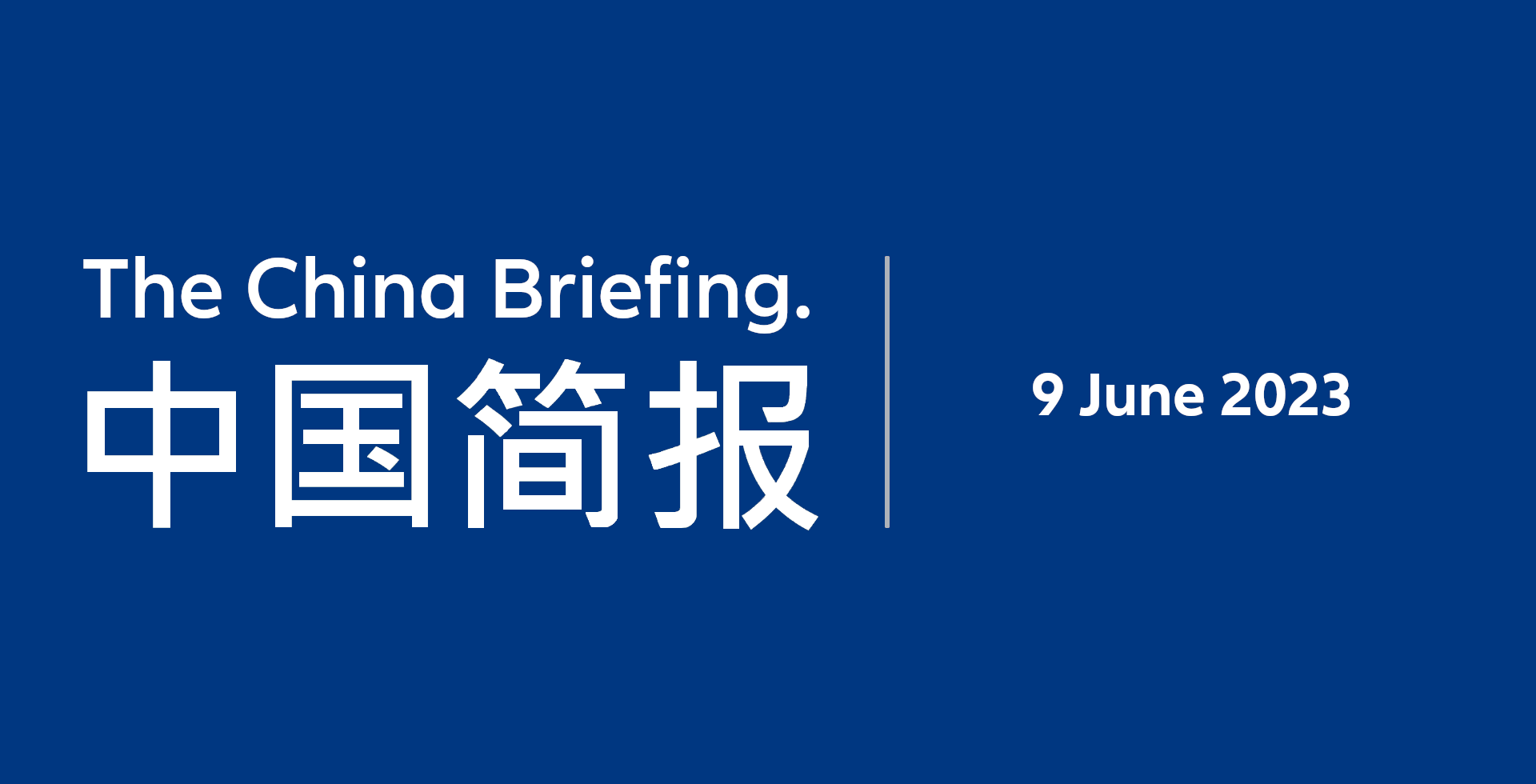

- It is notable how consumers continue to be in saving rather than spending mode. From January to April this year, for example, household bank deposits rose by more than 20% over the same period a year ago.2

Chart 1: Household deposits, January to April last 5 calendar years (RMB trillion)

(rebased to 100)

Source: Allianz Global Investors, Wind, as at June 2023

- Clearly three years of lockdowns and pressure on the private sector has taken a toll, and confidence remains low for the time being.

- Another issue in the spotlight recently has been local government debt, with news of a scrambled, last minute bond repayment in Yunnan, as well as a Guizhou government think tank posting an article online effectively asking for state aid.

- The original article from Guizhou, as well as subsequent public appeals from other local governments reporting financial stress, were all quickly removed from the internet. But not before the media had reported on them and the point had been made.

- Guizhou and Yunnan are both relatively poor provinces in China’s southwest, where weak finances mean they are more exposed to the economic challenges most local governments are now facing, in particular from much lower land sale revenues.

- These have not recovered from the collapse in 2022 as property developers remain cautious. Sales of land-use rights are a particularly important source of local government revenue as they do not have to be shared with the central government.

- The move from local authorities to increasingly go public can be seen as part of a complicated bargaining process with the central government and state-backed financial institutions to allocate the costs of absorbing the debt.

- Based on the prospectuses of local government financing vehicles (LGFV) – which are used to fund regional infrastructure projects for example - around USD 500 billion in such bonds will mature in 2023, similar to the peak level last year.3

- All players in this negotiating game are state institutions – and hence none of them have an interest in triggering a default that would cause wider financial instability.

- Our view is the previous playbook of ‘extend and pretend’ will be rolled out for a while longer. In practice this will involve debt restructuring and maturity extensions to defuse the risks of any imminent default.

- It is also quite likely that state owned financial institutions will be called upon to provide support, hence the weakness of banks and insurance stocks in recent weeks.

- The housing market is at the core of these macro challenges. And this is also likely to be where we see further policy action.

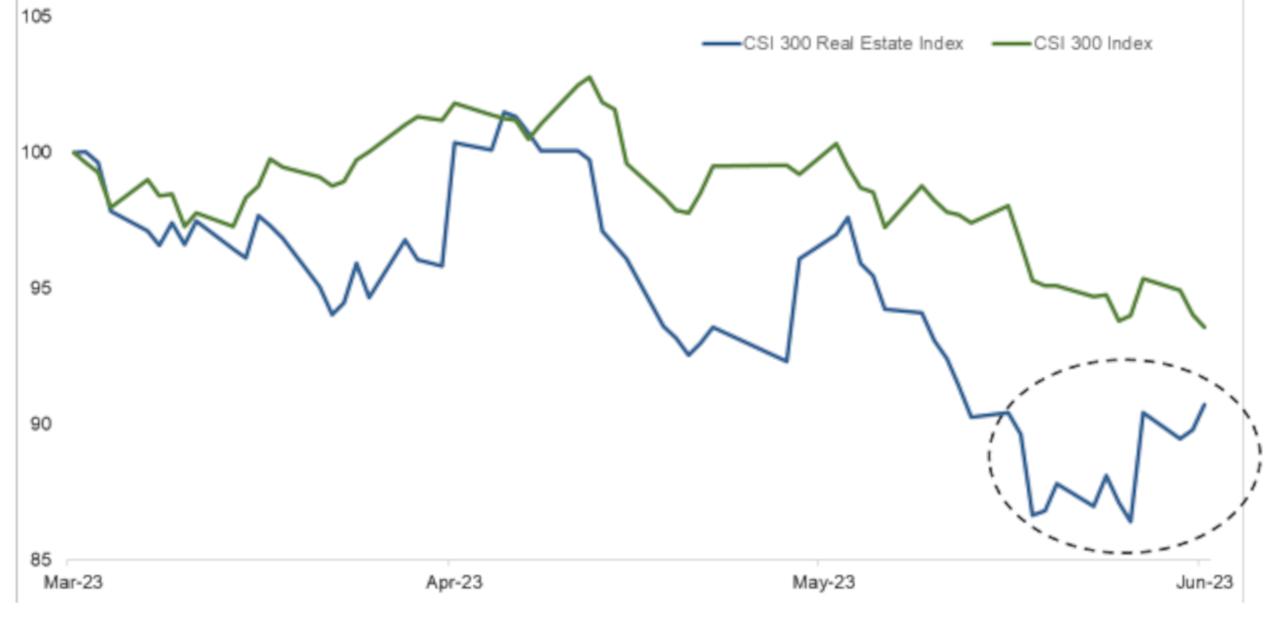

Chart 2: CSI 300 Real Estate vs CSI 300 Index performance (3 months, rebased to 100)

Source: Allianz Global Investors, Bloomberg, as at 7 June 2023

- Indeed, recent editorials in State media have urged more support such as the lowering of housing purchase restrictions and reduced initial down-payments on new houses.

- This has led to a recent pick up in the performance of the listed real estate sector, which has been a notable laggard in the market decline year to date.4

- In recent days there have also seen signs of further monetary easing with large banks cutting interest rates on local and US dollar deposits. This also sends a strong signal that the PBoC is paving the way for a cut in lending rates. The last lending rate cut was in September 2022.5

- So, what does this all mean for the equity market outlook?

- Our view is that while the near-term macro news has been disappointing and sentiment is depressed, nonetheless equity valuations already discount a lot of the bad news.

- The forward PE of the MSCI China A Onshore Index is around 11x. This compares to an average of 13x over the last decade. And at a micro level, we see many stocks with a Price Earnings to Growth (PEG) ratio of less than one.6

- What is needed now for the market to make significant headway is an injection of greater macro confidence, and evidence that easier fiscal and monetary policies are feeding through into the real economy.

2 Source: Wind, 6 June 2023

3 Source: Gavekal, 7 June 2023

4 Source: Bloomberg, 7 June 2023

5 Source: Nomura, 7 June 2023

6 Source: Bloomberg, 7 June 2023