The China Briefing

China’s mirror image

China's early 2024 market reflects last year's trends, with muted policy response and a potential need for fiscal stimulus amidst economic challenges

Please find below our latest thoughts on China:

- China equity markets in the early days of the new year have been almost a mirror image of a year ago.

- At the start of 2023, China equities were buoyed by the release from Covid restrictions and prospects of a strong rebound in consumption fuelled by pent-up demand.

- In the event, China economic activity turned out to be a disappointment and the reopening bounce steadily fizzled away.

- Looking ahead, the key question now – as it has been for much of the last year – is to what extent there will be a fiscal and monetary response to offset the economic weakness.

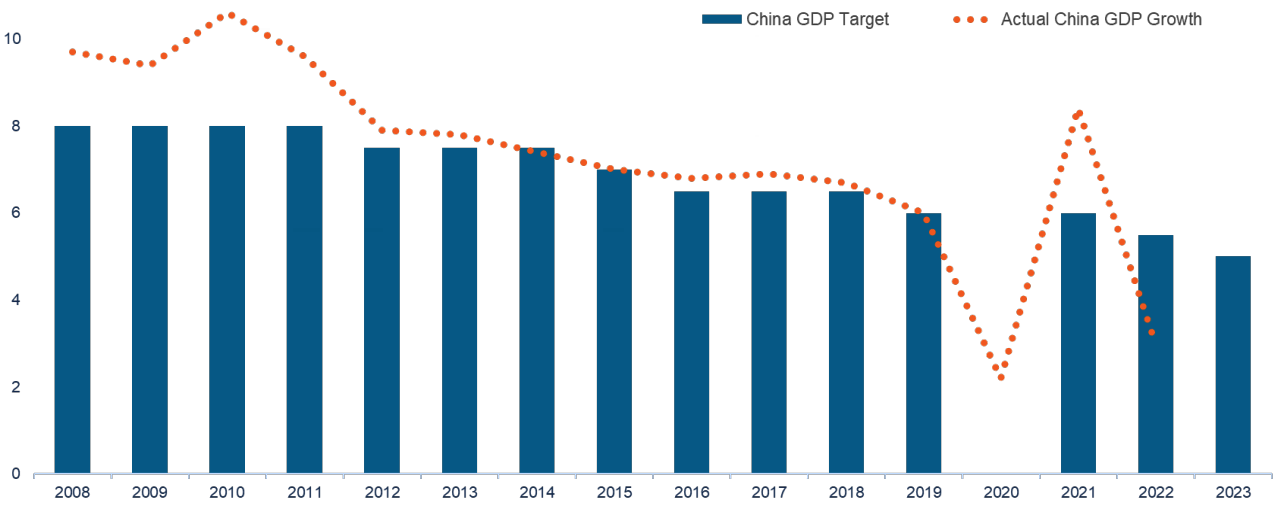

- Although China posted headline-grabbing GDP growth of 5.2% in Q4 2023,1 the reality is this figure is flattered by easy comparisons with the previous year.

Chart 1: China Annual GDP Growth: Target vs Actual

Source: Allianz Global Investors, Macrobond as at 13 December 2023. Note: In 2020 there was no GDP target due to the Covid-19 pandemic. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

- Moreover, nominal GDP growth in Q4 2023 was just 3.7%. This marks the third consecutive quarter that nominal GDP growth has been lower than real GDP growth, highlighting the ongoing deflationary pressures.2

- Two events in the past few days have elevated market concerns that China’s policy response will remain quite muted.

- First, the People's Bank of China (PBoC) surprised the market this week by not cutting its key policy rate.

- And second, Premier Li Qiang’s speech at Davos compared the Chinese economy to a healthy person with a strong immune system, with last year’s growth being achieved “without resorting to massive stimulus”.

- Premier Li led a large government delegation and is the most senior Chinese official to attend the World Economic Forum since President Xi Jinping in 2017.3

- As such, the speech was mainly targeted at global business leaders to emphasise the country remains open to international business – “we embrace investments across businesses of all countries with open arms,” he said.

- However, the equity market interpretation has been to question to what extent more policy support is in the pipeline.

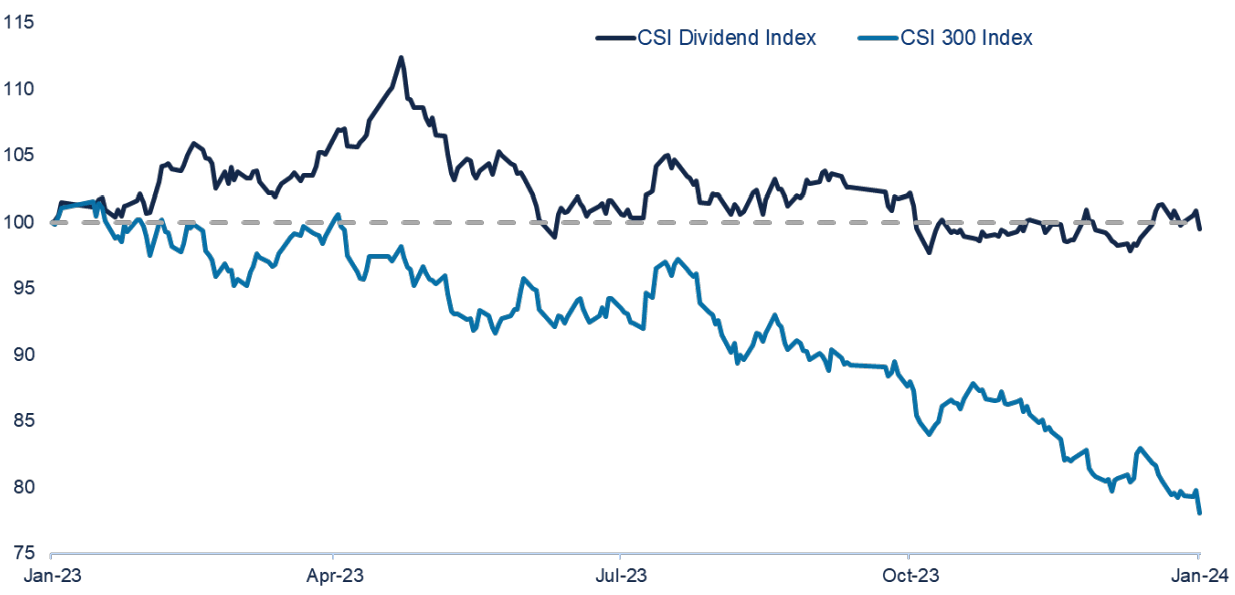

Chart 2: CSI Dividend Index vs CSI 300 Index, 1Y performance (CNY, rebased to 100)

Source: Bloomberg, Allianz Global Investors as at 17 January 2024. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

- We should get more clarity around this quite soon. Each of China’s provinces will set out their 2024 GDP targets in the coming weeks, before the country’s overall target is announced in March.

- Historically, China’s growth targets have typically not moved by more than 0.5% from year to year. And given the bullish commentary from Premier Li as well as the tone of comments from other senior policymakers, the 2024 target will likely be around 4.5-5%.

- Based on recent economic momentum, there is little chance this target will be achieved without a policy boost. Indeed, a number of sell-side commentators are forecasting 2024 GDP closer to 4%.

- So something has to give. In our view, once the previous stimulus announced last October (comprising additional infrastructure investment) has been implemented and the economic effect is more visible, then further fiscal support will likely be required.

- One effect of the economic weakness has been to prompt a significant rally in China bond markets, to the extent that recent months have seen a crossover of China’s equity and bond market yields.

- China’s 10-year government bond yield is currently around 2.5%. By comparison, the CSI 300 (China’s equivalent of the S&P 500) dividend yield is 2.8%.4

- Structurally, we expect to see a growing focus on yield in China given the country’s ageing demographics – notwithstanding that the upcoming Year of the Dragon typically sees more births than any other year in the Chinese zodiac.

- Babies born in the Year of the Dragon are traditionally seen as being luckier than others. And the number of babies born in China spiked in both 2000 and 2012, the last two dragon years.5

- Domestic investors have relatively few investment options to generate income, especially with the clampdown on higher-yielding wealth management products.

- Indeed, it is interesting to see how higher dividend yield stocks have significantly outperformed in the last six months.6

- Energy, utilities and financials have been the best-performing sectors over this period.7 These areas are heavily dominated by state-owned enterprises which play a key role in funnelling revenues (through dividends) to local and central governments.

- As such, the dividend streams are likely to be secure in most cases despite the challenging macro environment.

- And finally…Costco opened a new store in Shenzhen on 12 January, their sixth in the country.8 The queue to get in snaked through the parking lot and beyond as people waited more than three hours.

- Lots-o’-Huggin’ Bear, the fluffy villain from Pixar’s Toy Story 3, was in high demand. Social media was awash with images of people taking home the five foot bear. At a cost of RMB 2,000 (approx. USD 275), it seems that news of the demise of the China consumer may be somewhat premature.

1 Source: Macquarie, 17 January 2024

2 Source: Macquarie, 17 January 2024

3 Source: Reuters, 16 January 2024

4 Source: Bloomberg 17 January 2024

5 Source: South China Morning Post, 31 December 2023

6 Source: Bloomberg 17 January 2024

7 Source: Bloomberg 17 January 2024

8 Source: CNN, 13 January 2024