The China Briefing

Is China getting into balance sheet recession?

Many market participants breathed a sigh of relief over the softer US core consumer price index (CPI) inflation print for June.

Please find below our latest thoughts on China:

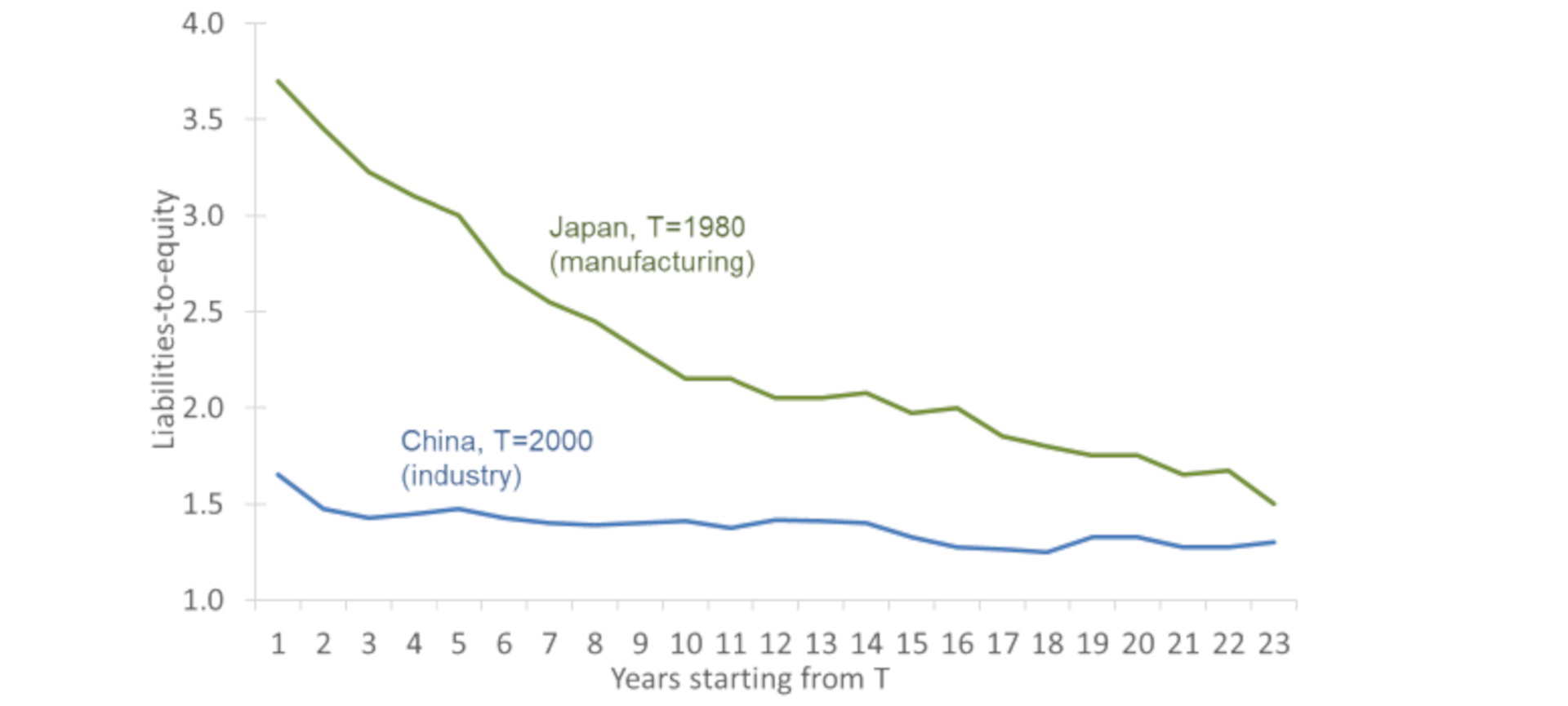

- A recent popular topic surrounding the economic data out of China’s economy has been balance-sheetrecession, as some investors are drawing a comparison between China today and Japan back in the 1990s.

- What exactly is a balance-sheet recession? A balance-sheet recession happens when corporates are notborrowing, even though interest rates have fallen to zero. Instead, they focus on paying down debt. This typicallyoccurs when asset prices plunge but the liabilities remain. As a result, significant attempts are made todeleverage balance sheets.

- Any surplus private sector savings leak out of the income cycle, creating a severe deflationary spiral thatultimately sinks growth in the economy. This is what happened in Japan in the 1990s when its real estate bubbleburst. It took Japan approximately 20 years to emerge from a balance-sheet recession. The wounds are stillfresh.

- Overall, most investors hold the view that the situation in China is different from Japan in the 1990s. Unlike inJapan, where corporates across various sectors were negatively affected by the decline in property values, theimpacts of deleveraging in China are largely concentrated in the real estate sector and are not more far-reaching.

- Put simply, the excess leverage issues were more widespread in Japan in the 1990s than in China today.

- Nonetheless, given slowing growth in the urban population, China’s property sector is bound to see a structuralcontraction as new demand for housing declines. Property developers are deleveraging due to a combination ofstrict regulatory constraints, of course, and reduced expectations of future demand for homes. This is different China Briefing 11 AUGUST 2023 from what Japan experienced in the 1990s.

- The real question is what should be done to stabilise the economy as China transitions from a previously property-led growth model to a future of more sustainable and broad-based growth?

- On the one hand, it is encouraging to see China acknowledge the need for more effective measures on property, such as lower home mortgage rates and down-payment ratios for first-time home buyers to boost home purchases, bringing much-needed confidence into this critical sector and the overall economy.

- More importantly, in the recent Politburo meeting and other forums, policymakers in China have reinforced support towards the private and internet sectors. Supportive tones towards these areas should be a key catalyst to rekindle animal spirits among both households and corporates.

- Private enterprise plays a crucial role in creating higher-paying jobs that appeal to China’s talent pool and suit workers’ hard-earned skills. This should help absorb the alarming level of youth unemployment.

- On a separate topic, amid concerns over weak consumption driven by middle-income consumers in mainland China, there have been reports that a sharp increase in Hong Kong visitors to Shenzhen and neighbouring areas is keeping many restaurants and shops in that area alive.

- This is interesting as it used to be the other way round, with mainland Chinese tourists crowding into luxury shops and restaurants in Hong Kong.

- Hong Kong residents have been travelling to Shenzhen for weekend or day trips in large numbers. According to recent statistics by the Immigration Office of Hong Kong, there were more than 4.47 million visits from Hong Kong to mainland China last month. Based on an average spending statistic of a Hong Kong tourist in mainland China from 2015, it is estimated that Hong Kong visitors spent almost HKD 4 billion (equivalent to USD 512 million) in mainland China in the month of July alone.1

- Perhaps this is the consumption jumpstart that the Chinese economy needs?

Chart 1: China’s corporate leverage is much lower than Japan in the 1990s

Source: Gavekal Dragonomics / Macrobond, 21 July 2023

1 HK01 as of 3 August 2023, Immigration Department, Census and Statistics Department, the Government of the Hong Kong SAR of the People’s Republic of China.