The China Briefing

Making investment count

Investors have been discussing more on a structural topic on China about its high investment to GDP ratio and the corresponding payoff of this vast investment.

Please find below our latest thoughts on China:

- China released its August data on industrial activity, credit, inflation and trade last week, which saw mild improvement and was broadly better than the market had expected.

- Inventory seems to be stabilising, while fiscal stimulus is improving on special local government bond (LGSB) issuance. Meanwhile, summer travel has helped spur better momentum in consumption.

- Overall, the incremental policy support seems to be driving a stabilisation in economic data, keeping hopes alive that the economy has seen the worst.

- That said, the property sector is not out of the woods yet. While there has been some recovery in property sales in selective tier 1 cities since the relaxation of mortgage policies, the recovery is driven largely by pent-up replacement demand and has been focused on the secondary rather than primary market. Housing prices declined in 66 out of 70 cities in August1 – strong evidence of the discounts required to sweeten closing deals.

- Our view on China remains unchanged. We continue to expect a piecemeal announcement of policy support and stimulus, with targeted and measured resources to be mobilised. This should help prevent a further downturn in the economy, but equally we do not expect a rapid V-shaped recovery.

- Current market confidence remains low, and we would not be surprised to see continued equity market volatility until more concrete government support measures are implemented and begin to be reflected in the improving economic data. Typically, in times when confidence is low, the market becomes more sensitive to the policy cycle.

- On a structural topic, there have been discussions about China’s high investment to GDP ratio and the corresponding payoff of this vast investment.

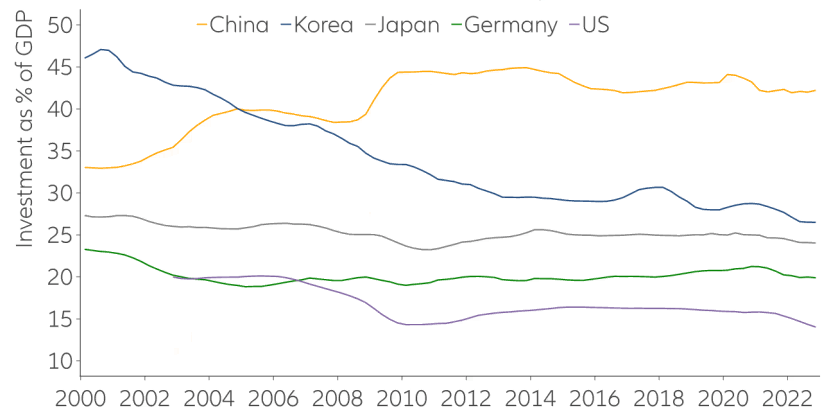

- Over the last decade, investment has accounted for more than 40% of China’s GDP – a level that is among the highest in the world. By comparison, the percentage of investment-to-GDP for a developing market is roughly around 30%, and this number is even lower for developed markets.

Chart 1: Investment as a percentage of GDP

Source: AllianzGI, Macrobond, as of 30 June 2023.

- High levels of investment contributed to great successes in China’s past economic growth trajectory, as this investment enabled the government to ramp up the urbanisation and industrialisation process via infrastructure investments and land-fiscal financing.

- However, if the country keeps investing irrespective of return, eg, in bridges or toll roads that few people will use, or unnecessary offices and residential buildings, this will likely result in rapid debt accumulation.

- To offset non-productive investment in property and certain infrastructure projects, while maintaining the targeted GDP growth rate (as we covered in a previous China Briefing) – we need to see capital mobilised towards innovative growth drivers like new energy vehicles (EVs), green tech software, and advanced manufacturing.

- These new investments, in turn, must be absorbed by domestic consumption, otherwise this excess capacity can be exported to other economies.

- Obviously, the latter option won’t be easy – just last week the European Union launched an investigation into whether to impose tariffs on Chinese EV imports, in an effort to protect its own markets.

- Therefore, domestic consumption plays an important role in China’s growth contribution going forward. Support for the private and internet sectors should help to partly alleviate the youth unemployment rate and rebuild incomes and confidence levels that induce Chinese people to spend.

- Putting aside the serious topics about China, the country has recently also been in the headlines for another reason – a new baijiu-infused latte went viral among Chinese consumers.

- This new product is a collaboration of a well-known Chinese coffee chain and a white-liquor brand. More than 5.4 million of the drinks were sold in one day – amounting to revenues of RMB 100 million. Chinese consumers took to social media to show off the popular drink!

- It seems obvious that unleashing this type of spending power requires having the right product. Other businesses should take note. While it may be a bit difficult to imagine how a white-liquor infused latte would taste, maybe the Chinese consumer is more awake than markets seem to believe? The proof is in the caffeine!

1 Source: Macquarie, China National Bureau of Statistics, as of 15 September 2023