The China Briefing

Run, rabbit, run

Please find below our latest thoughts on China:

- “Run, rabbit, run” might be an appropriate description of China’s equity markets so far this year. In January, the MSCI China Index rose by 12% and the MSCI China A Onshore by 10%1 .

- A notable feature of the recovery, which started at the end of October 2022, has been the strong outperformance of offshore markets. These have risen by over 50% since the low point2 .

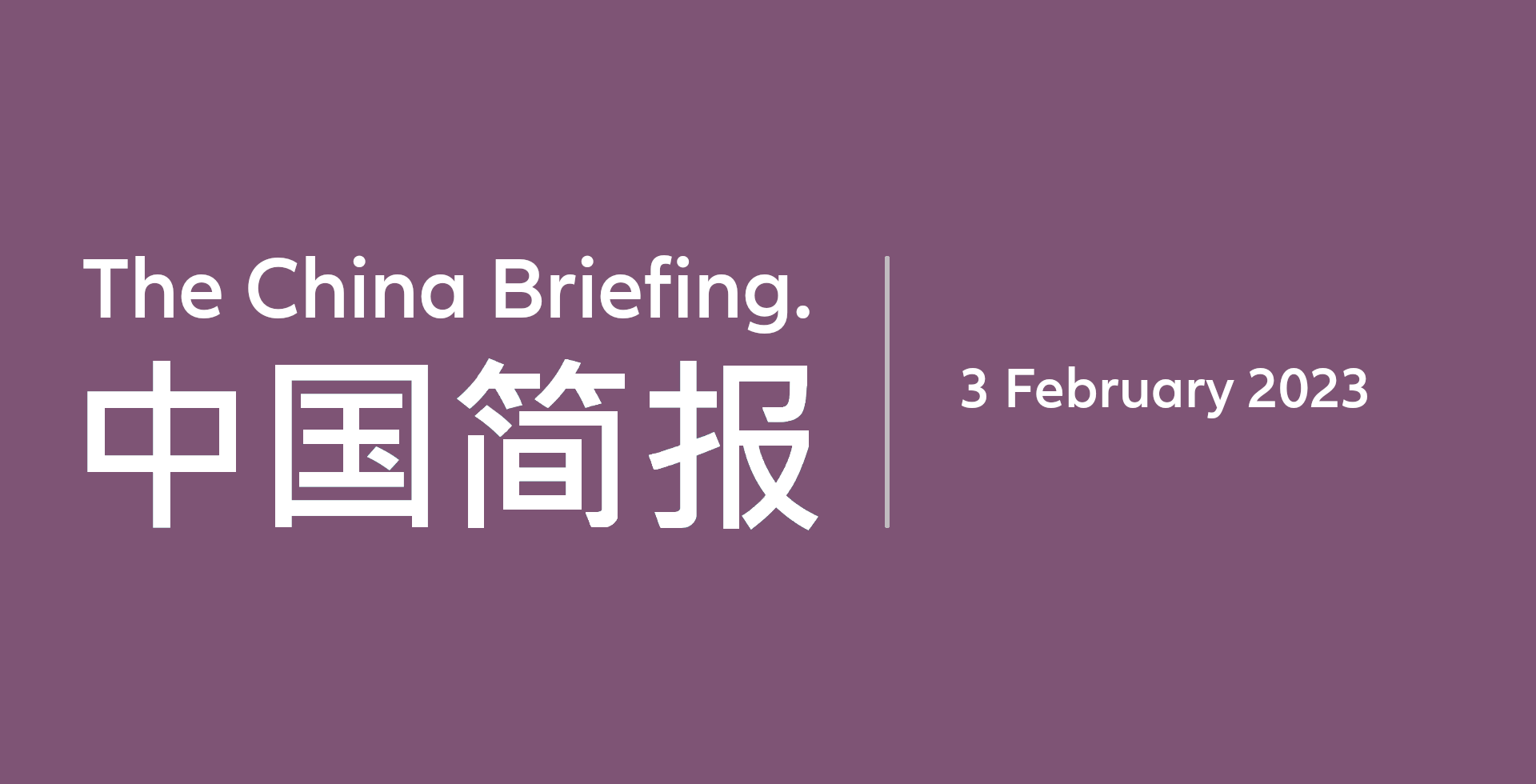

- One way to view this is through the Hang Seng Stock Connect AH Premium Index, which tracks the price premium (or discount) of A-shares over H-shares for companies that are dual-listed in mainland China and Hong Kong.

Chart 1: Hang Seng Stock Connect China AH Premium Index (3 years)

Source: Bloomberg, Allianz Global Investors as at 1 February 2023

- In October 2022, dual-listed A-shares reached the highest premium level vs. H-shares in 15 years3 – a reflection of how weak sentiment in offshore markets became following China’s National Party Congress.

- In a matter of weeks, however, the surge in offshore markets has led to the premium falling back close to the lowest levels seen since the start of the pandemic.4

- This begs the question – why have global investors been so much more prepared to buy into China equities than domestic investors?

- Not only have global investors been buying Hong Kong-listed stocks, they have also actively bought into China A-shares – there was around USD 19 billion of net inflows through Stock Connect in January, which compares to USD 13 billion in the whole of 2022.5

- There are a number of factors at play here in our view. Offshore markets had previously been sold down more heavily – especially the internet space – and the growing evidence that regulatory pressure has peaked has prompted significant relief and support for valuations.

- In addition, much of the recent buying appears to have come from hedge funds, part of which has been to cover previous short positions.

- But over and above this, there also appears to be more of a willingness for global investors to buy into the China recovery story in advance of an actual improvement in economic data or corporate earnings.

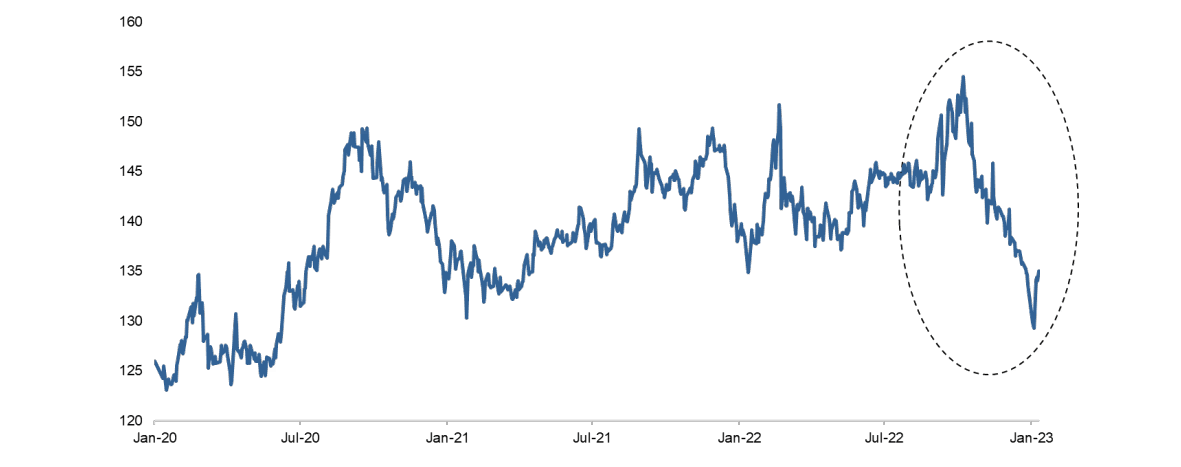

Chart 2: Margin trading outstanding balance in China A-Shares (CNY billion)

Source: Wind, Allianz Global Investors, as of 1 February 2023

- This has been helped by careful choreography in signalling that China is again open for business – such as Vice Premier Liu He’s widely publicised comments at Davos, and a string of global financial services companies being granted additional licenses to expand their operations in China.

- In comparison, domestic retail investors have so far taken more of a “wait and see” approach.

- One factor is that the upcoming earnings season will be challenging as it reflects the worst of the economic conditions.

- And there is a major political event in March called the “Two Sessions” where China’s top legislature and political advisory bodies hold their annual meetings. This is when the closely-watched 2023 GDP growth target should be announced together with policy details about how the target will be achieved.

- A useful real-time domestic sentiment indicator is the level of China margin trading balances (Bloomberg code: CHMDBMT). With domestic investors dominating daily turnover in Shanghai and Shenzhen, a recovery in local animal spirits will be a key input for China A-shares to make significant further headway.

- A final point this week is encouraging news on China’s capital market infrastructure. Draft rules have been published on long-awaited plans to reform the cumbersome IPO process.

- Under the current system it can take companies one to two years to receive approval for listing and there are strict controls on areas such as capping IPO valuations at a maximum level, minimum historical profitability levels, and limiting daily price moves in the days after listing.

- The new proposed system, which is similar to the US-style IPO mechanism, was first adopted by the tech-focused STAR board. The plan is now to expand this to the main boards in Shanghai and Shenzhen.

- Combined with other recent news that the Stock Connect schemes will be expanded to include a wider range of companies, this confirms China’s focus on continuing to improve its capital market infrastructure, which is essential for providing the necessary funding for China’s growth ambitions.

1 Source: Bloomberg, 1 February 2023

2 Source: Bloomberg, 1 February 2023

3 Source: Bloomberg, 31 October 2022

4 Source: Bloomberg, 27 January 2023

5 Source: Wind, 1 February 2023