The China Briefing

Snowballs and structured products

Selling pressure in January was caused to a large extent by technical factors linked to “snowball” derivative products and margin calls on stock pledged as collateral

Please find below our latest thoughts on China:

- China equities have been on a rollercoaster ride ahead of the Chinese New Year holiday. At one stage the MSCI China A Onshore Index had fallen 12% year to date (USD) before bouncing back sharply in recent days.1

- While the ongoing weakness in the Chinese economy has undoubtedly played a role, more recently a large part of the selling pressure can be linked to technical factors such as the unwinding of structured products and forced selling as a result of margin calls on pledged stock.

- The structured products topic is related to so-called “snowball” derivatives. Snowballs are structured products tied to the performance of an underlying index. They offer to pay investors bond-like coupons as long as that index stays within a predetermined range. The total size of snowball products is estimated to be around RMB 200 billion (USD 28 billion).2

- The snowballs provided by Chinese brokers typically offer annualised returns of between 12% and 20%. They are most frequently linked to the two most popular small-cap indices: the CSI 500 or CSI 1000. The name “snowball” came about as a reference to potential accumulating gains for investors who hold them.3

- The way they work is that if the index rises above the top of the range, then a so-called “knock-out” is triggered, in which the contract terminates and the investor receives the coupon for the period to date. If the index drops below the bottom of the range, then a “knock-in” occurs, in which the holders receive no coupon and potentially lose part of their capital.

Chart 1: MSCI China A Onshore Growth vs Value, 1 Year Performance (CNY, rebased to 100)

Source: Bloomberg, Allianz Global Investors as at 6 February 2024. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

- And as Chinese equities weakened, so this triggered selling pressure as brokers moved to hedge their positions. Volumes in CSI 500 and CSI 1000 futures contracts jumped appreciably in January.4

- Looking ahead, it seems that most of these derivatives have already fallen through their lower strike prices, so we expect that selling pressure from this source should already have peaked.

- The second technical factor relates to stock pledges. This is when major shareholders of listed companies (typically private enterprises) borrow money by pledging their shares as collateral. The recent stock market slump has led to big shareholders facing margin calls.

- The level of stock-pledged loans was a key factor behind the equity market weakness in 2018, and since then the securities regulator in China has been working to manage this risk. Indeed, the value of pledged shares has come down from a peak level of 10.5% of total market capitalisation in 2018 to around 3.4% currently.5

- Nonetheless this issue has continued to put downward pressure on the market – year to date, around 100 listed companies have disclosed that major shareholders are putting up additional collateral to avoid forced liquidation.6

- As well as contributing to market weakness, these technical factors have also played a major role in the extreme market rotation year to date. In particular, there has been a flight to large-cap, high-dividend stocks.

- To put some figures on this – so far this year, the MSCI China A Onshore Value Index has returned 0.2% compared to -13.1% for the MSCI China A Onshore Growth. The CSI Dividend Index has returned 4.5%. And the CSI 300 (China’s largest 300 stocks) has returned -3.1% year to date compared to -18.1% for the CSI 1000 small cap index (all figures in CNY).7

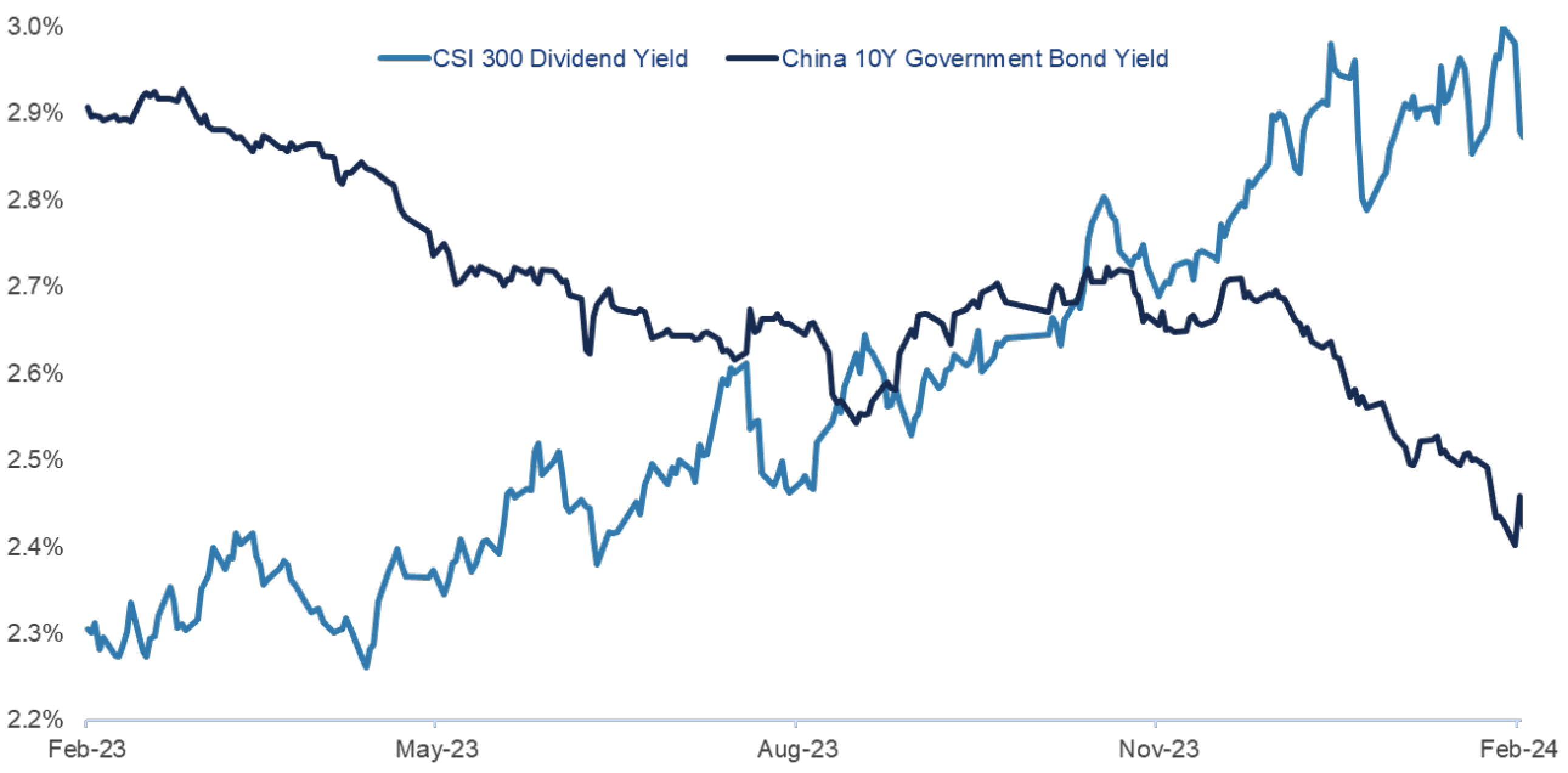

Chart 2: CSI 300 Dividend Yield vs China 10 Year Government Bond Yield

Source: Bloomberg, Allianz Global Investors as at 6 February 2024. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

- There are additional reasons for the popularity of high-dividend stocks – in most cases these are state-owned enterprises. As such, the dividend streams are likely to be secure, despite the challenging macro environment, as they are needed to support the revenues of local and central governments.

- Also, looking at this from the standpoint of a domestic investor, there are only limited investment options to generate income. China government bond yields are currently around 2.4%, compared to the CSI Dividend Index of around 6.3%.8

- The sharp market sell-down has triggered an increasing sense of urgency from Chinese regulators. In particular, state funds have stepped up share purchases. And the China Securities Regulatory Commission (CSRC) has stepped in to control securities lending and short selling.

- For the time being at least, this seems to have stabilised the situation, particularly in the run-up to Chinese New Year.

- And on that note, please be aware that the Shanghai and Shenzhen stock exchanges are closed from Friday 9 to Friday 16 February. The Hong Kong market is open for a half day on Friday 9 and then closed until Wednesday 14 February.

1 Source: Bloomberg as at 6 Feb 2024

2 Source: Gavekal as at 24 Jan 2024

3 Source: Bloomberg as at 23 Jan 2024

4 Source: Bloomberg as at 31 Jan 2024

5 Source: China Securities Regulatory Commission as at 5 Feb 2024

6 Source: China Securities Regulatory Commission as at 5 Feb 2024

7 Source: Bloomberg as at 6 Feb 2024

8 Source: Bloomberg as at 6 Feb 2024