The China Briefing

Taking the bitter with the sweet

Many market participants breathed a sigh of relief over the softer US core consumer price index (CPI) inflation print for June.

Please find below our latest thoughts on China:

- Many market participants breathed a sigh of relief over the softer US core consumer price index (CPI) inflation print for June. Even ahead of the data release, the US dollar had begun to weaken on anticipation of the news, acting as a catalyst for the MSCI Asia Pacific ex Japan index to deliver a 6% gain last week.

- However, despite what turned out to be a pretty good week for regional equity markets in Asia, sentiment around China’s economy continues to focus on downside risks, and the China equity markets are discounting a rather bleak outcome.

- This is despite some clear green shoots that are individually important and collectively positive for China’s economy.

- The first is US Treasury Secretary Janet Yellen’s visit to China. The meetings, half of which were attended by Vice Premier He Lifeng, ended on good terms, with both sides characterising the visit as “constructive”. Yellen delighted the local public with her indulgence in exotic Yunnan mushrooms, and did nothing to upset the relationship.

- This set the stage for US climate envoy John Kerry, who also visited Beijing to discuss areas of cooperation on a topic where many think the US and China could present a unified front. Similarly, veteran US diplomat, centenarian and self-proclaimed “friend of China” Henry Kissinger met China's defence minister Li Shangfu in a surprise visit aimed at improving ties between the two nations.

- Should further such in-person meetings take place, we think there is scope for the Sino-US relationship to take a more productive and pragmatic trajectory, or at least stabilise.

- Second, Chinese regulators announced a RMB 7.12 billion fine on Alibaba’s Ant Financial, clearing the overhang from its failed IPO attempt in 2020. Similarly, the authorities announced a RMB 2.99 billion fine on Tencent’s Tenpay. These fines indicate a seemingly final verdict on the heavy regulations weighing on large fintech platforms, as most of the prominent issues have now been addressed.

- Going forward, we believe this should enable both Ant and Tencent to attain financial holding licences and the wider fintech industry to start launching new products again. In a nutshell, we have likely passed the peak for regulation.

- We are mindful that there may be slower growth for internet companies in the future on the back of the reform measures, but the valuations reflect this new reality. A more supportive regulatory environment could, in fact, help boost valuations in the near term, if the market starts to believe in the turn in policy direction.

- Last but not least, several regulations were announced for the property sector to help free up liquidity and boost confidence. The general thinking is that the stimulus is the first round of what will be more supportive – but incremental – measures to secure the 5% GDP growth target for the year. This target still looks achievable, in our view.

- On the topic of property, according to National Bureau of Statistics data, primary prices fell a modest 0.06% month-on-month in June, yet secondary prices dropped 0.44%.1 With signs of the physical market weakening, it is not a huge leap of faith to assume that this sector will see some form of help, whether in the form of looser restrictions on second home purchases, relaxation of down payment requirements, infrastructure or green project stimulus, or possibly an easing of mortgage policies.

- But the policies are not likely to be comprehensive, instead targeting a city-by-city format. In our view, any little helps, so long as it’s not overdone. In any case, the likelihood of “big bang” stimulus is undeniably low amid Beijing’s reluctance to ramp up leverage.

- The Politburo meeting later this month should shed additional light on the trajectory of economic policy and potentially any further stimulus or reforms.

- Meanwhile, outright bulls are still in the minority, harboring a “too little, too late” mentality towards any recent positive developments. Fund positioning data continues to illustrate that market expectations are low.

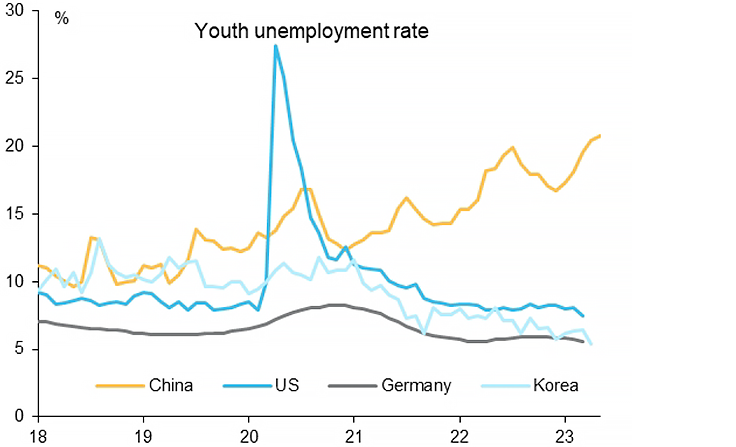

- An area gaining increasing attention and one of complexity and sensitivity is youth unemployment. As Chart 1 below shows, the unemployment rate among young people aged 16 to 24 was 21.3% in June, a new record high, although the data only started being published in 2018.

Chart 1: Youth unemployment has been trending up since 2018

Source: OECD, WIND, Macquarie Macro Strategy, July 2023.

- Bear in mind that there is some seasonality embedded in the data, which usually peaks in the summer before starting to decline in late Q3 given the timing of the graduation season. Unemployment is especially high right now too because the economy is particularly soft. As it recovers, there should be job growth.

- Structurally, though, some of the disciplines in which students have been trained no longer provide a large source of jobs – like the education and real estate sectors.

- Fewer graduates, especially among those with strong educational pedigrees, care to enter the manufacturing industry nowadays. Instead, they seek higher pay and a better quality of life, but this is proving difficult to find.

- Of course, there needs to be a better match between the education offered and the jobs available, but this won’t change in the short term. Meanwhile, there have been efforts to recruit more graduates into the military, higher salary offers for fresh graduates willing to work in less developed regions, and the creation of one million internships at state-owned enterprises for graduates over the next two years. The question is whether this is enough.

- Outside of the public sector, private enterprise also has an important role to play in creating not just more jobs, but also higher-paying jobs that appeal to China’s talent pool and suit their hard-earned skills.

- Internet companies could potentially help fill the gap, offering attractive job options with their heavy R&D budgets. This could also reinforce a governmental push for more support to this sector.

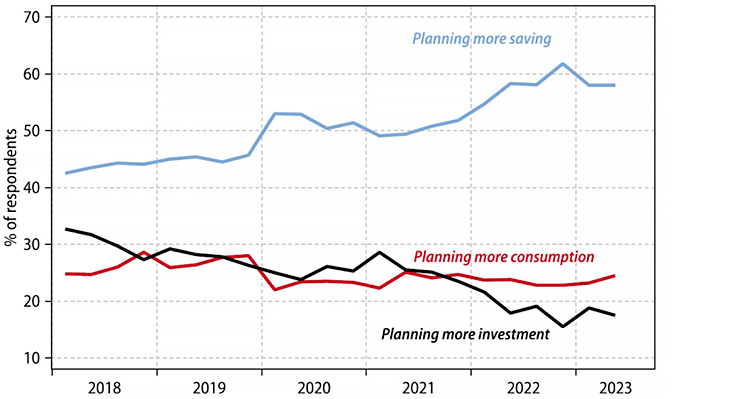

- With uncertainty around employment opportunities, it’s no surprise that most Chinese consumers (nearly 60%) preferred to save their earnings in the first six months of 2023, according to findings from a quarterly survey of urban depositors by the People’s Bank of China shown by Chart 2 below.

Chart 2: Household risk appetite has improved but only marginally

Source: Gavekal Dragonomics/Macrobond, 5 July 2023.

- We still expect domestic consumption to recover and are positioned within China towards the consumer sectors where this should play out.

- We observe with great interest the trend of consumer companies in China transforming from local to national brands and, in many cases, nailing that critical next step from national to global brands. We see increasing evidence of consumption preferences for domestic brands inside China vs. international ones.

- Once a signifier of cheap mass production, the “Made in China” label is taking on new meaning as China becomes an innovator and leader across a variety of categories. This is evident in areas as diverse as cosmetics, biotech, electric vehicles, ecommerce, robotics and fintech, to name a few.

- These products and services satisfy both the needs and wants of the domestic population. Global champions will likely surface from among this mix.

- The innovation story plays on in China, and when businesses tap into the vast local talent pool, we think the benefits could yield some compelling results for investors.

1 BofA Global Research, 17 July 2023.