The China Briefing

The fragile stabilisation

Please find below our latest thoughts on China:

- Recent weeks have seen China equities pull back in line with other global markets.

- In October, China A-shares fell by 3.0% and offshore China equities by 4.3%, similar to both Europe and Japan equities (in USD terms)1 – although the underlying causes of the weakness are somewhat different.

- For China markets, the main issue is that the recent stabilisation in growth remains fragile and largely unconvincing to domestic investors, the key day-to-day price setters for China A-shares. Linked to this, the property crunch is not yet resolved.

- Indeed, prices of new and existing homes continued to fall modestly in September. The average month-on-month price change for new homes was down -0.3% (similar to August), while price declines for existing homes were down -0.5%.2 The price declines have been particularly noticeable outside the largest (tier 1) cities.

- A key ongoing issue continues to be the financial health of private real estate developers and whether those pre-sold apartments will be constructed and delivered on schedule.

- To give a sense of the challenge, a recent estimate was that around RMB 4-6 trillion (approx. USD 500-800 billion) would be needed to finish building all homes sold before 2020.3

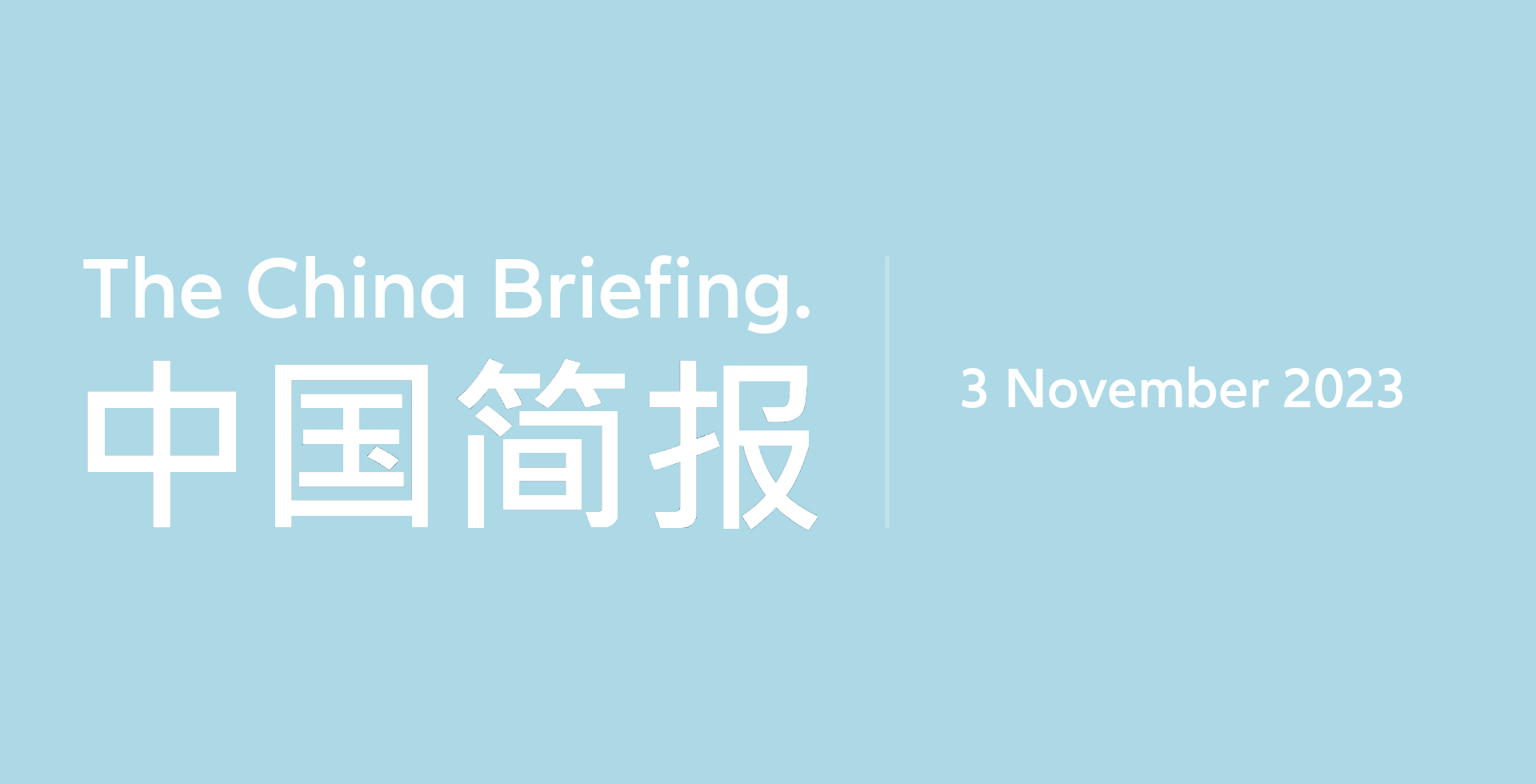

Chart 1: Property as proportion of China GDP (%)

Source: Goldman Sachs, October 2023.

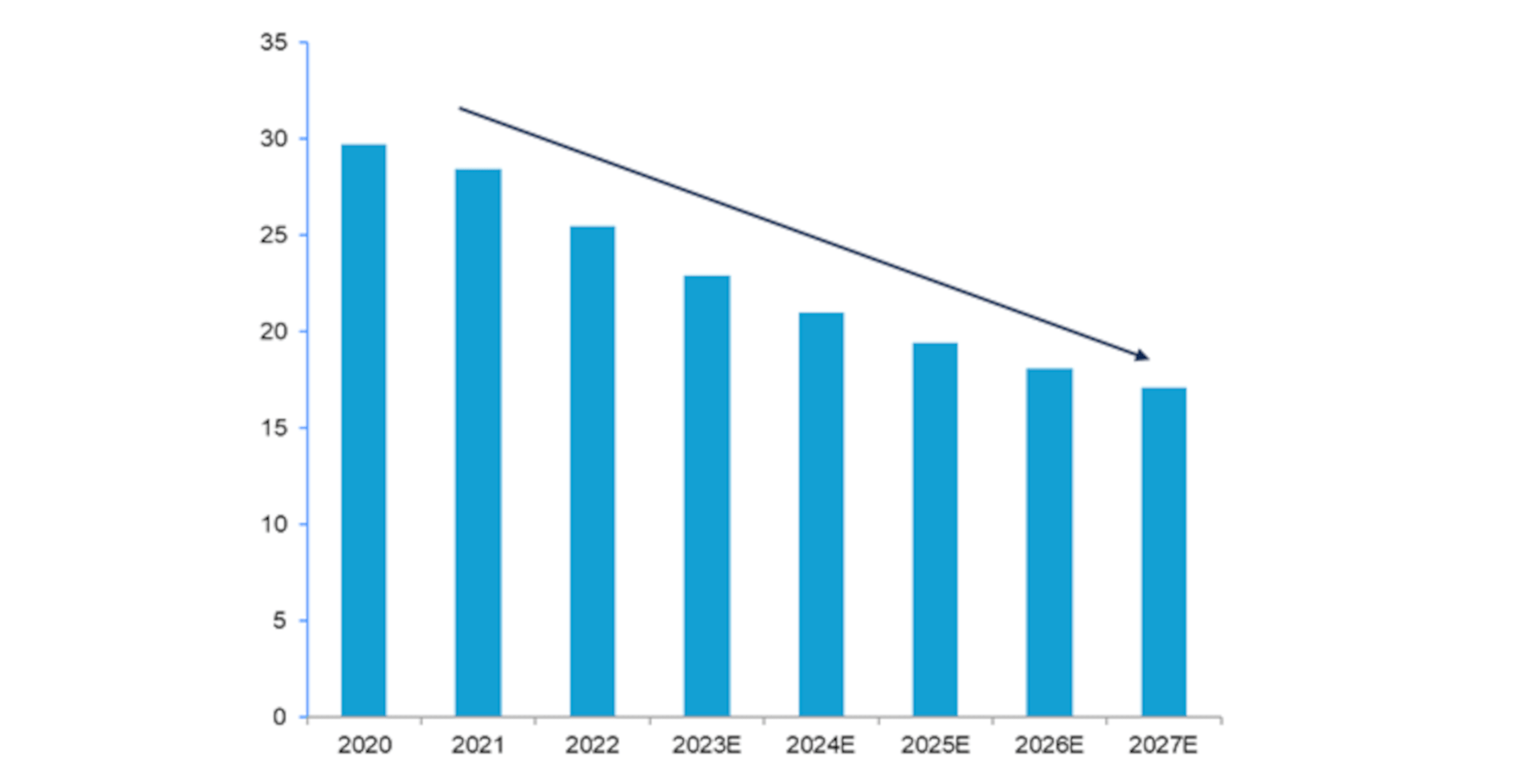

Chart 2: Composition of China household total assets

Source: Wind, Goldman Sachs, as of 31 December 2022. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

- The reason this is such an important issue is because of the overall contribution of property to GDP, estimated at close to 25%4 when including all related activity such as construction and building materials.

- Property is also by far the largest component of most people’s wealth, close to 60% of total household assets5. As such, the ongoing property weakness is an important contributory factor to the subdued level of consumption and high savings rates.

- Inevitably, the importance of the property sector is set to decline over time and this “gravity” effect will result in China’s headline GDP growth continuing to slow.

- The challenge for China is to make up for this “lost” growth with expansion in other areas, preferably those in less capital-intensive areas so that China’s overall debt levels remain manageable.

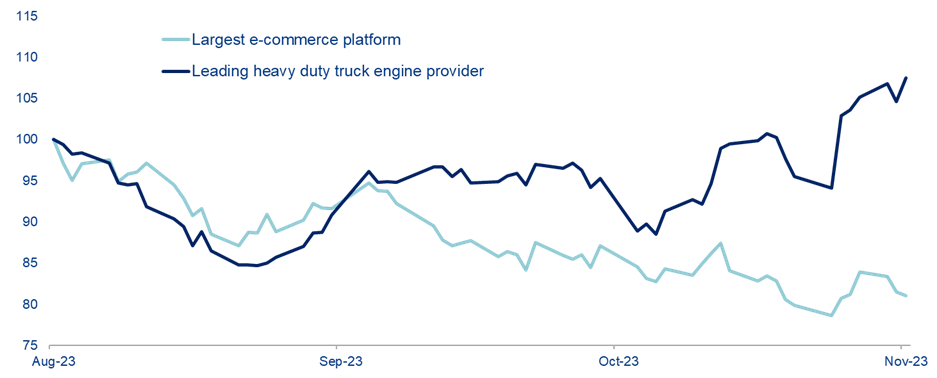

Chart 3: China’s largest e-commerce platform vs leading heavy duty truck provider, 3-month performance (USD, rebased to 100)

Source: Bloomberg, AllianzGI, Macrobond, as of 1 November 2023

- Hence the focus on upgrading technological capabilities across the manufacturing sector as well as renewed support for the services sector, which is likely to be an ongoing feature in coming years.

- In the face of these challenges, China government policy continues to adjust in search of the right balance between structural and cyclical priorities.

- Last week there was an eye-catching announcement when China’s top legislature approved RMB 1 trillion (approx. USD 130 billion) of additional central government bonds to fund infrastructure projects. It is estimated this will add around 0.8% to GDP.6

- The last time the central government’s fiscal budget was adjusted this way in the middle of the year was back in 1998 during the Asia financial crisis.

- From a macro perspective, this move should help to reduce some of the downside concerns. And it sends a clear message that China’s government is becoming more willing to deploy its balance sheet to achieve economic stability.

- This policy response has also been reflected in some of the near-term performance within the equity market with more traditional, infrastructure stocks performing better whereas “new economy” and consumption-related stocks generally remain subdued.

- Indeed, overall the MSCI China A Onshore Growth Index has lagged the Value Index by around 19% year-to-date and close to 25% since the end of 20217 as previously high-flying sectors have de-rated.

- Ultimately, we expect “growth” stocks – especially those supported by policy in line with China’s strategic priorities – to recover. However, the timing is likely dependent on improved domestic confidence in the overall macro situation.

1 Source: Bloomberg, 1 November 2023

2 Source: China National Bureau of Statistics, 19 October 2023

3Source: Nomura, 25 October 2023

4Source: Goldman Sachs, October 2023

5 Source: Wind, Goldman Sachs, October 2023

6 Source: Gavekal, 1 November 2023

7 Source: Bloomberg, 1 November 2023