The China Briefing

Tip-toeing towards negotiations

US-China trade, China's economic outlook, potential stimulus, and the focus on technology and innovation.

Please find below our latest thoughts on China:

- While there have been signs in recent days of the US and China tip-toeing towards the negotiating table, there remain few concrete indications of progress.

- China appears to have concluded that it can sustain a war of economic attrition longer than the US and that it has tools – such as supply chain leverage in areas including rare earths – to inflict significant pain.

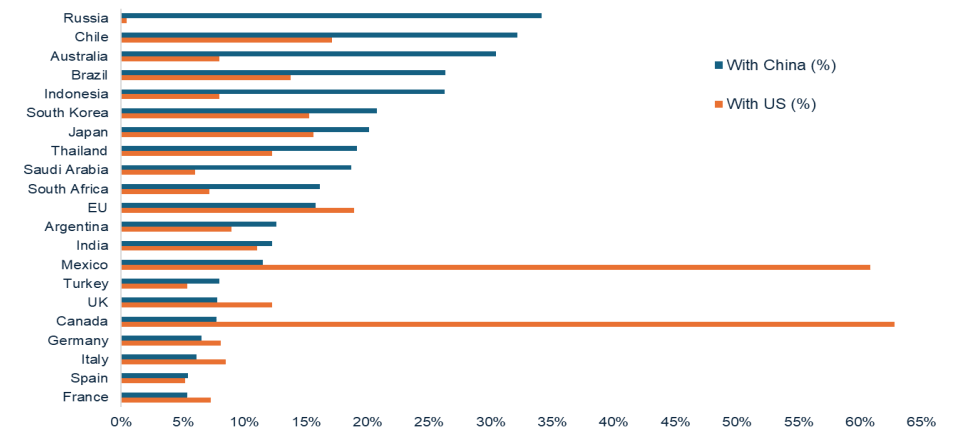

- US policy has seemingly turned to trying to isolate China by concluding trade deals with other countries that limit China’s involvement in their economies. However, the reality is that around 70% of countries now trade more with China than with the US.1

Chart 1: Share of total trade with China and with the US (ranked by share of trade with China)

Source: Allianz Global Investors, IMF DOTS as at 30 April 2025. Note: EU excludes intra-EU trade.

- While it is quite possible, therefore, that the stalemate persists for some time, nevertheless there are powerful economic incentives for both sides to negotiate.

- China’s economy faces a significant economic shock. And although China has significantly ramped up its selfsufficiency in recent years, key industries remain vulnerable. Electric vehicles, for example, still rely primarily on imported semiconductors.2

- As such, while China is very unlikely to make the first diplomatic moves, it is very likely to be a willing partner if Trump can find a face-saving way to start discussions.

- For China equity investors, a key issue remains the extent to which there are renewed efforts to stimulate domestic demand in the face of the looming economic slowdown.

- In this respect, we are in a wait-and-see mode. The most recent Politburo meeting at the end of April reaffirmed that policymakers will dial up fiscal and monetary stimulus in coming months. But it provided relatively few clues as to what steps it might take.

- Officials are, in our view, conserving their firepower for several reasons. Partly because a previously announced fiscal expansion is still in progress. Partly because the precise impact on exporters is hard to gauge, especially due to the potential for large-scale tariff avoidance. And partly because it’s unclear where negotiations with the US stand.

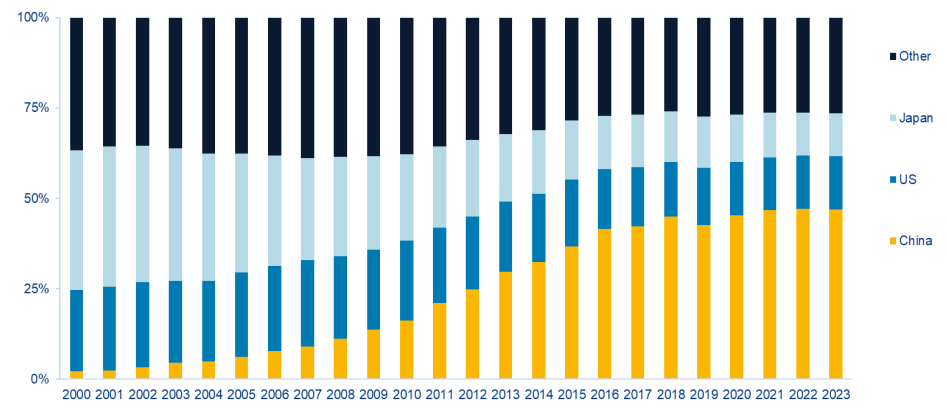

Chart 2: Share of global patents by country

Source: World Intellectual Patent Organisation as of 31 December 2023

- It is, in practice, much easier for the Trump administration to withdraw tariff threats than for Beijing to withdraw stimulus announcements.

- Our view is that it is increasingly likely there will be decisive and forceful policy changes including the government stepping up support for asset prices, not just in equities but in the crucial housing market as well.

- In the meantime, while there is much global coverage of geopolitics, within China there continues to be a heavy focus on technology.

- ‘Auto Shanghai’, one of the world’s largest car shows, has just concluded. The total exhibition area was 360,000 square meters with participation from close to 1,000 companies.3

- Historically, a showcase for car companies to introduce their latest models, the exhibition has evolved into a much broader tech-oriented event. This year, for example, a number of brands focused on expansion into ‘low altitude industries’ including futuristic flying cars.

- Another widely followed recent event was the first humanoid robot half marathon. Taking place in Beijing last month, it featured humans and robots running together for the first time (Bing Videos).

- While the winning robot took just 2 hours 40 mins to finish, only 6 of the 21 robots completed the course,4 showing the technology has some way to go. Nonetheless, the fact this took place within China is another pointer towards the intense research efforts ongoing in tech-oriented industries.

- This is reinforced by global patent figures where China’s share has steadily increased over the last 15 years.5 Of course, not all patents have value or can be commercialised. But the number of patents granted still gives a good sense of overall commitment to innovation and the pursuit of technological leadership.

- The technology focus also partly explains the strong buying of the Hong Kong market from mainland China investors.

- Year to date there have been around USD 78 billion of net flows through the ‘Southbound’ Stock Connect. That is already around 75% of the full year 2024 figures, with buying of AI tech names not available in the Shanghai and Shenzhen markets a key focus.6

1 Source: Gavekal as at 25 April 2025

2 Source: Gavekal as at 23 April 2025

3 Source: Global Times as at 2 May 2025

4 Source: BBC as at 19 April 2025

5 Source: World Intellectual Patent Organisation as at 31 December 2024

6 Source: Goldman Sachs as at 28 April 2025