The China Briefing

Where’s the consumer

China has actively reengaged with prominent figures from the West, toning down the Sino-US geopolitical tensions would be an important market driver.

Please find below our latest thoughts on China:

- The China market has recovered since our last briefing, although the longevity of this recovery has been called into question by a turn in direction over the last week, reflecting the ongoing rotational nature of investor sentiment.

- Originally, the market was hoping for announcements of new supportive policies and fresh stimulus after the State Council meeting in mid-June, but the meeting ended somewhat disappointingly as nothing concrete was announced.

- Consequently, investors will need to wait until the end July for the next Politburo meeting to take place for signs of a more notable step-up in policy intensity.

- The State Council meeting coincided with US Secretary of State Antony Blinken’s visit to the mainland, which yielded a warmer-than-expected reception from China, thus beating the low expectations that the market had placed on the event prior to Blinken’s postponed and widely followed visit.

- Unfortunately, the optimism was soon overshadowed by concerns around ongoing weak economic data, along with continued escalation on the information technology transfer front between China and the US. Just this week, media sources revealed that the US is considering additional sanctions on exports of artificial intelligence (AI) chips to China in what continues to be an area of tense relations.1

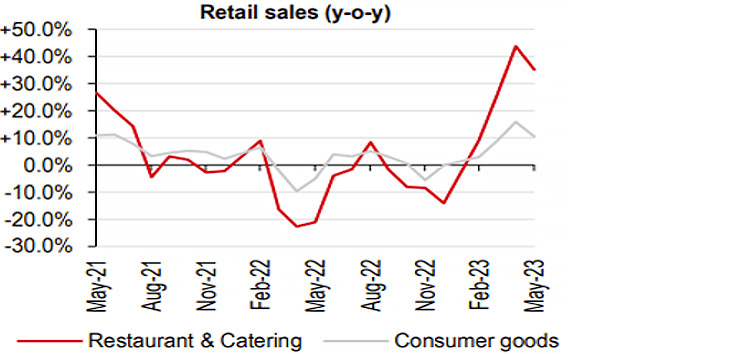

- On the data side, May economic activity prints were below consensus estimates across industrial output, retail sales, exports and property investment. But on a positive note, services-related consumption remains robust, particularly in the restaurants and catering category.2

Chart 1: Service-related consumption remains robust

Source: Wind, HSBC, Qianhai Securities. Data as at 27 June 2023.

- Clearly, Chinese people enjoy eating great food and have proven willing to pay for a good dining experience amid a tightening of belts in other aspects of consumption. Similarly, trips for tourism during last week's Dragon Boat Festival holiday exceeded levels seen pre-pandemic.3

- Such a confluence of generally weak data raises the urgency for more stimulus, as many market observers have been anticipating some form of policy intervention to boost consumption and help get the economic recovery back on track.

- As a response to deteriorating economic conditions, China did react by cutting its 7-day reverse repo rate on 12 June4 and shortly thereafter the 1-year margin lending facility rate5 – its key medium-term policy rate – by 10 basis points each. The market seems to expect further easing measures to keep liquidity sufficient, although expectations are for more limited and targeted stimulus compared to past economic downturns.

- China wishes to orchestrate a more gradual, stable recovery this time around rather than reintroduce leverage and speculation into the market after its reform efforts, especially in the areas of infrastructure and real estate.

- We have written extensively on China’s housing market challenges over the last few years. Overall, we believe that while property has been instrumental to China’s economic success, it is now set for a period of structural decline. From a long-term perspective, China needs to wean itself off the housing sector and look towards a more diversified set of future growth drivers in technology and a more modern and self-sufficient manufacturing base.

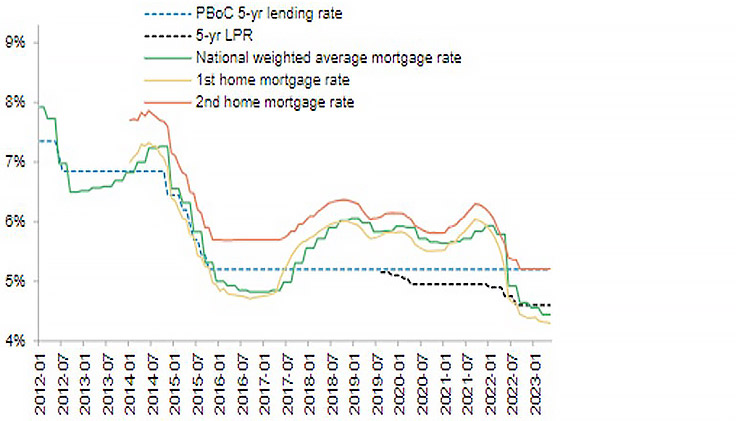

- That said, we do not take the view that the property downturn represents a systemic risk – we believe resources will be mobilised to prevent this – as we have already seen since late last year – including lowering mortgage rates, some easing of previous curbs on property transactions, and direct financing support to developers.

- In doing so, we acknowledge that policymakers face a difficult challenge in stabilising the housing market without easing so much that it reinflates the sector. It’s worthwhile to note that the national mortgage rate in China is already at its lowest level in over a decade, implying increased affordability and accessibility for the average Chinese homebuyer.

- Yet, new home sales fell, new launches stalled, and prices of existing homes have declined.6 More can be done at the local level to boost property sales, but again, it is likely to be a more gradual policy response rather than large-scale stimulus packages.

Chart 2: China’s national mortgage rate is already at its lowest level in over a decade

Source: CEIC, Morgan Stanley Research. Data as at 21 June 2023.

- We are often asked about how consumption-driven growth will unfold and why the propensity of the average Chinese person to consume remains underwhelming. It is no secret that the Chinese consumer has historically been more conservative than its developed markets counterparts.

- From 2016 to 2020, Chinese households spent 64% of their income vs. 87% in the US, the “poster child” for a consumption-driven economic recovery post-pandemic.7 There is ample evidence of the Chinese consumer being willing to live with less or trade down for cheaper products since the reopening.

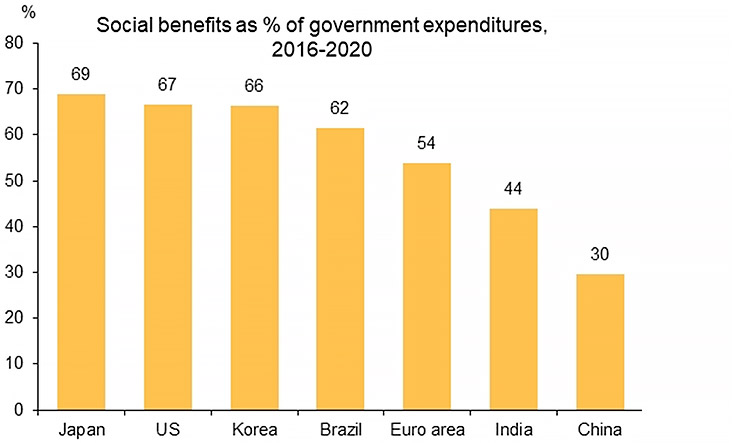

- While a culture of savings is widespread in China, more limited government expenditure on social benefits relative to other large economies remains a relevant concern. Furthermore, lower government land sale revenues in the current property environment put increased pressure on any further improvement in this area, despite marked increases in the social safety net in recent years.

Chart 3: Government expenditure on social benefits is more limited than other large economies

Source: MoF, IMF, Wind, Macquarie Macro Strategy. Data as at 27 June 2023.

- Perhaps the clearest evidence of weak sentiment is reflected in the outperformance of state-owned enterprises (SOEs) and sectors like communication services, energy and utilities this year – defensive territory that has historically been associated with lower volatility of returns, but also lower growth and lower valuations.

- As the market finds its footing in what is a less than ideal macro backdrop, we believe that quality and growth names should deliver. Any improvement in liquidity and supportive policies would back up these views and lead to a more fundamentally driven equity market.

- In recent weeks, it is encouraging that China has actively reengaged with prominent figures from the West, eg, Bill Gates meeting with President Xi Jinping in Beijing, Elon Musk’s China tour and meetings with top officials including China’s Foreign Minister Qin Gang, and Premier Li’s first overseas visits in Germany and France since taking up this position. More recently, US Treasury Secretary Janet Yellen announced her intentions of travelling to China in the next month.

- These interactions send a strong message that China is not looking to decouple entirely with the rest of the world. Toning down the Sino-US geopolitical tensions would be an important market driver and one that’s currently not reflected in valuations, whereby the China A market is trading around 12x forward P/E relative to its long-term (15- year average) of 14x.8 In such a weak market environment, further downside should largely be buffered, and any good news rewarded.

- We believe what is needed is an injection of greater macro confidence and evidence that easier fiscal and monetary policies are feeding through into the real economy. Only then would more sustainable and broad-based returns be supported.

1 Source: Reuters, 29 June 2023

2 Source: HSBC, 27 June 2023

3 Source: Reuters, 26 June 2023

4 Source: Reuters, 13 June 2023

5 Source: Reuters, 20 June 2023

6 Source: Morgan Stanley, 21 June 2023

7 Source: Macquarie, 27 June 2023

8 Source: Bloomberg, Allianz Global Investors, 30 June 2023