The India Briefing

Tariffs and diamonds

This month, we unpack some of the tariff turmoil impacts on India equities and conclude with a bit of bling!

Please find below our latest thoughts on India:

- April has proved to be nothing short of exceptional in terms of market volatility and extreme sentiment shifts among investors.

- Amid the chaos, India’s capital markets – including equities, bonds and currency – have behaved as relative safe havens.

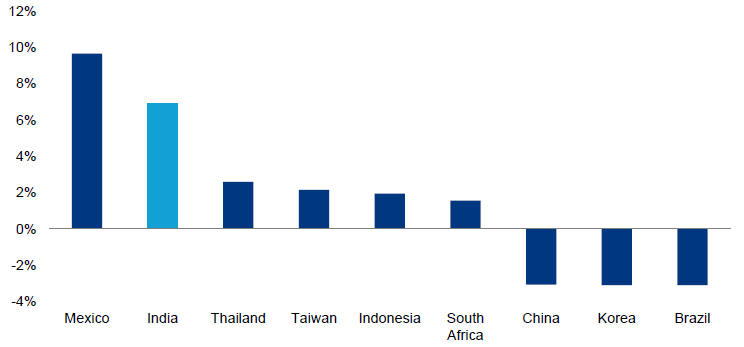

- It may seem counterintuitive that an emerging market should deliver relative stability amid the global tariff storm, but it is not the first time this has happened.

- In fact, India has historically demonstrated notable resilience during previous global economic shocks as compared to its broader emerging markets peer set. Contributing factors include its large and diversified economy and the sustained strength of domestic demand, which helps to offset external shocks.

- This time round, the direction of travel has been similar. After a weak finish to 2024, the MSCI India Index has rallied 14% since the end of February. This compares to an S&P500 return of nearly -10% over the same time period.1

Chart 1: Historical bear markets' relative return vs. MSCI Emerging Markets (in USD)

Source: Morgan Stanley, from 9 July 1997 to 24 October 2022.

- There are some positive domestic factors at play such as consumption stimulus from the government's income tax relief policies, central bank interest rate cuts, and a recovery in capital investment due to improved weather conditions. These measures have been undertaken to revitalise economic growth momentum after a period of tight credit conditions and weak corporate and consumer spending.

- On the trade front, the impact of US tariff policies on India has been quite limited. India is viewed as one of the “least hit” among emerging markets, especially as the revised 10% baseline tariff provides India with a significant advantage relative to the heavy tariffs levied on China, which vary by sector but, in aggregate, total more than 100%.

- Furthermore, India’s largest export industry in its listed equity universe—pharmaceuticals—has so far been exempted from the reciprocal tariffs.

- We believe India stands to gain in this environment. Just as “China+1” strategies initiated under the first Trump presidency led to the emergence of new sectors in India like electronics manufacturing services (EMS), renewable equipment, and auto ancillaries, we see a strong likelihood that these industries will gather pace and that new categories will also emerge

- A good example from the EMS space is smartphones. During the first Trump administration, Apple expanded its production footprint in India. Fast forward to today and India now accounts for 20% of its final assembly of iPhones, showcasing the speed at which manufacturing has progressed in the seven years since President Trump announced his first tariffs in January 2018.2

- Trade flows both ways. Just last week, a large Indian air carrier announced its intentions to purchase US airplanes that have been rejected by Chinese airlines amid the tariff turmoil – helping to position India as a growing end market for goods and services of high value.3

- Much has been written about the outflows from Indian equities on the part of foreign investors – net outflows are approximately USD 15 billion this year.4

- What has been less mentioned is how foreign investors have been increasingly backing the Indian bond market with around USD 4 billion in net inflows year to date.4 In our view, this reflects India’s fiscal prudence and stable credit fundamentals – which should also be supportive for equity valuations.

- Evidence also suggests that private capital and qualified institutional placements (QIPs) have been favouring India. The Indian government has embarked on a series of reforms aimed at encouraging foreign inflows. For example, the 2025 Union Budget in February proposed new regulations allowing up to 100 percent foreign direct investment into the insurance sector.

- Finally, the price of gold has surged to over $3500 per troy ounce. This is welcome news for Indian households, who, as we wrote in the March India Briefing, own roughly 10% of the world’s physical gold stock.5

- Beyond this, India’s gems and jewellery sector is projected to reach USD 128 billion within the next five years, not just on the back of rising gold prices, but also boosted by demand for lab-grown diamonds (LGDs), for which India already produces 15% of the world’s supply.6

- But it’s not only about creating a stunning solitaire ring or exquisite stud earrings. Industrial applications of LGDs include semiconductors, aerospace, and optics – all areas where India has ambitions for growth.

- Amid the day to day gyrations of global capital markets, we continue to believe that India equities represent a compelling long-term investment opportunity. As the saying goes, “A diamond is forever.”

1 Allianz Global Investors, IDS, Bloomberg, total return data in USD, as of 23 April 2025.

2 The Wall Street Journal, Apple plans to source more iPhones from India as potential tariff fix, as of 22 April 2025.

3 Bloomberg, as of 22 April 2025.

4 Citibank, Asia Economics & Strategy Daily, as of 22 April 2025.

5 Goldman Sachs, The rise of ‘Affluent India,’ as of 12 January 2024.

6 The Economic Times, India’s gems and jewellery sector projected to reach $128 billion by 2029, as of 21 April 2025