The India Briefing

Economies of scale: cooperation, competition, and complexity between India and China

This month, we take a look at the complex relationship between India and China, both economically and politically.

Please find below our latest thoughts on India:

- India and China are the two most populous nations and are expected to rank #2 and #3 in the world’s list of largest economies by 2028. As two Asian economic powerhouses, their interactions carry heavy influence over regional stability and global trade dynamics.

- The relationship is complex, with many linkages hidden from public view, although these are becoming more prominent in headlines, especially as Chinese Foreign Minister Wang Yi paid a pivotal visit to India this month.

- Even more headline-grabbing is news that Indian Prime Minister Narendra Modi plans to join the Shanghai Cooperation Organisation (SCO) meetings in Tianjin at month end, marking his first visit to China in seven years.

- A clear catalyst is Donald Trump’s decision to put 50% tariffs on Indian exports to the US. Businesses are pushing for India to reopen to Chinese investment, which could help offset the tariff impact.

- Despite long-standing political friction, which has lingered for decades due to historical skirmishes along their shared border, economic engagement between China and India has grown substantially and amounts to USD 128 billion.1

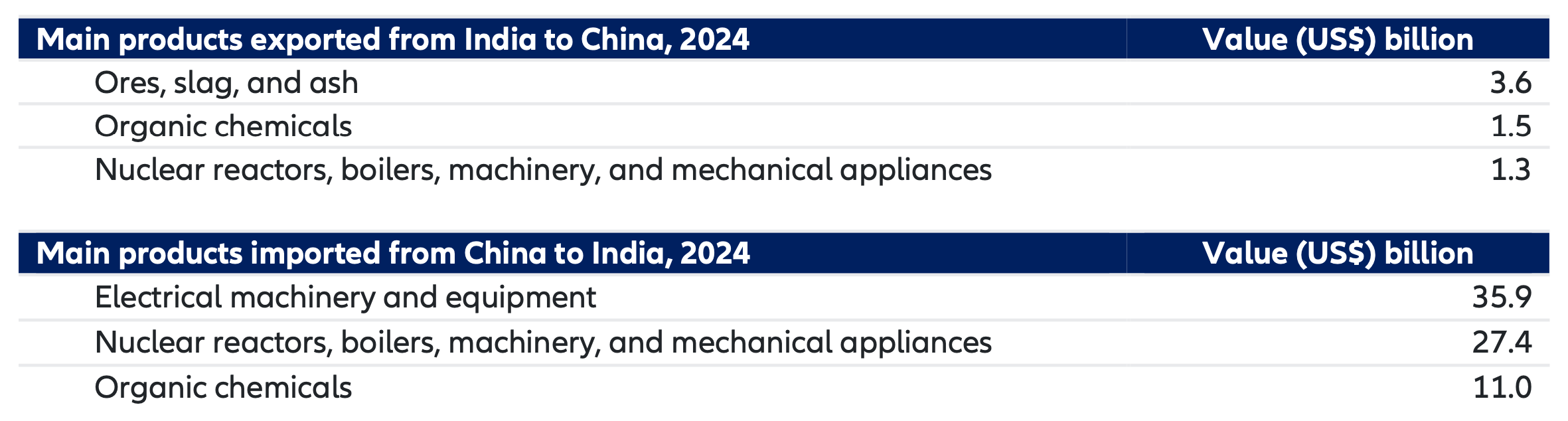

- While the list is long, India primarily imports Chinese electronics, machinery, and chemicals, whose value far exceeds India’s exports to China, which centre around raw materials like iron ore and cotton, as well as some agricultural products.

Chart 1: Exports between India and China

Source: Dezan Shira and Associates, China Briefing, as of 20 June 2025.

- To put numbers behind this, over 80% of notebooks/tablets in India and almost 90% of flat panel displays and antibiotics come from China. In the solar supply chain, approximately 90% of solar cells and panels in India are of Chinese origin.2

- That India’s supply chain relies so heavily on Chinese imports for strategic sectors like electronics (EMS), renewables, and active pharmaceutical ingredients (APIs) is a known vulnerability.

- There are over 100 Chinese companies operating in India today vs. around 50 Indian companies with offices in China.

- What’s more, Chinese investment extends into India’s tech and startup industries, representing a significant funding channel even in the face of tightened rules on foreign direct investment (FDI) from neighbouring countries as a result of 2020 border clashes.

- This economic asymmetry has raised concerns in New Delhi about India’s dependence on China across critical development areas..

- In response, India has banned over 300 Chinese apps over recent years, citing national security and data privacy concerns. While most of these apps were focused on “sketchy” ventures like betting, lending, and even dating, the ban also included social media heavyweights TikTok and WeChat.

- Meanwhile, China has also pushed back on the relationship. For example, Chinese battery giant CATL reportedly ordered its engineers to exit Foxconn’s Chennai plant in a move that disrupted India’s electric vehicle (EV) and electronics supply chains. Foxconn has also recalled Chinese engineers from another factory in India. Technology transfers seem set to remain an area of contention.

- With “Make in India” remaining a top policy priority and investment into EMS and other manufacturing areas representing thousands of new job opportunities for locals, India is openly looking to decouple from the Chinese supply chain.

- The complication is that while India can handle assembly, the components are still made in China, with little alternative for cost-effective intermediate goods sourced either domestically or from other trading partners.

- On the political front, the climate between India and China seems to be warming as the two nations align to counterbalance US influence, especially on trade and energy dependencies. Apart from prominent meetings among key statesmen, more diplomatic measures are being taken between the two nations.

- For instance, a softening in India’s stance towards China seems evident in the decision to resume issuing visas to Chinese tourists from July. Further evidence comes in the form of air travel, where direct India–China flights are scheduled to resume in September after a five-year hiatus.

- Partial troop withdrawals in disputed border areas and a revival in cross-border trade organisations have also helped create a more encouraging backdrop for economic cooperation between the two nations.

- Overall, decoupling between India and China is economically and politically sensitive. India is likely to strike a balance between leveraging Chinese hardware for availability and affordability while building digital and technological capabilities around these inputs for more strategic autonomy.

- While a full normalisation of economic and political relations is unlikely, nonetheless India has much to gain from restoring a better functioning relationship with China. Indeed, over time, this would allow India to achieve one of its key objectives, building a much greater degree of self-sufficiency.

1 Reuters, India trade deficit with China widens to record $99.2 bln amid dumping concerns, 16 April 2025.

2 The Economic Times, The dragon’s shadow still looms over Make in India, as of 21 July 2025.