The India Briefing

Benefiting from global trade dislocations

This month, we look into trade dislocations and the impact on electronics manufacturing (EMS) development in India, along with the continued market weakness, which we believe is largely self-inflicted and should show signs of reversal as policy adjustments take effect.

Please find below our latest thoughts on India:

- A notable development during the last month was the face-to-face meeting of India’s Prime Minister Narendra Modi and US President Donald Trump in Washington, DC. By most accounts, the Modi-Trump White House rendezvous was cordial and productive.

- India pre-emptively removed tariffs on Harley Davidson motorcycles and agreed to buy more US natural gas and F-35 fighter jets, without having to go through the motions of striking a deal.

- The US administration pledged support on security and deeper economic partnership in return.

- A feature of this recent engagement is that India bargained from a position of strength. Net goods exports to the US only account for approximately 2.2% of India’s GDP, suggesting that trade-related risks to India’s growth are largely manageable.1In fact, the risk of US tariffs on India are among the lowest across emerging markets, in our view.

- Beyond tariffs, global trade dislocations and broader geopolitical tailwinds are leading more US businesses to consider entering or adding capacity in India if not already there.

- But it is not only Americans scaling up production in India. Many well-established brands from Japan, Germany, Korea, China, and beyond are deepening their ties on the ground in India.

- ‘China+1’ strategies implemented under the first Trump presidency have paved the way for more diversified supply chains.

- Together with other supportive factors such as USD 16 billion in Indian government production-linked incentives, we expect momentum in new sectors such as electronic manufacturing services (EMS), renewable energy equipment, and auto ancillaries will continue to build.

- To put some numbers behind these trends, in FY24, electronics exports advanced to the 5th position in India’s total export basket, up from 9th place in FY21.2

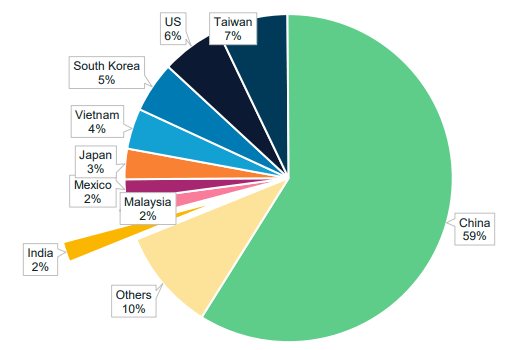

- We see a long runway for growth in these areas. For example, India only represents around 2% of the global EMS supply chain, whereas China holds the crown at 59% of world electronics manufacturing.2

Chart 1: Share of global electronics manufacturing

Source: Avendus Spark, Tectonic Shift: The Rapid Evolution of India's Electronics Industry, as of 22 October 2024

- In practical terms, labour in India is much cheaper than in China. Whereas the average manufacturing cost in China is USD 28.20 per day, the same work performed in India is billed at around USD 6.20. It is no surprise, therefore, that companies are increasingly looking to take advantage of this differential.2

- In addition to the cost-effectiveness of India’s talent pool, India’s workforce is well-skilled for technology and engineering roles and possesses solid English language capabilities.

- From an investor standpoint, new sector developments and innovative business models help reinforce India’s deep and liquid capital markets, which represent a broad and diverse landscape of stock-picking opportunities.

- In our view, India is set to experience a decade of continued growth and productivity gains, but its equity markets won’t move in a straight line, and there will be shorter-term dislocations like we are experiencing today.

- The recent India equity market correction, as we see it, was primarily due to self-driven tightening and regulation. This is already starting to reverse with recent policy initiatives.

- Currently, over 85% of the broad market index (BSE 500) is trading below its 200-day moving average, signaling a broad-based correction.3 This presents a wide funnel of high-quality stocks that have corrected, creating attractive entry points.

- With inflation easing and the recent budget maintaining fiscal prudence, it is increasingly likely that the Reserve Bank of India (RBI) will further ease liquidity and interest rates, which in time will support growth and market sentiment.

- The recent budget’s tax cuts were a positive surprise, benefiting over 50% of income tax filers, which is approximately 20 million people. The related psychological impacts on consumption can be powerful, and unexpected income gains have historically spurred discretionary spending.

1 Trading Economics, 2023 data, as of February 2025.

2 Avendus Spark, Tectonic Shift: The Rapid Evolution of India's Electronics Industry, as of 22 October 2024.

3 Bloomberg, Allianz Global Investors, as of 24 February 2025.