The India Briefing

India Equities pullback - A healthy correction

This month, we look into valuations for the Indian equity markets given the recent market pull-back and share our views on the longer-term picture.

Please find below our latest thoughts on India:

- As the saying goes, “be careful what you wish for.” Throughout the whole of last year, many investors took a wait-and-see approach with regards to India equities, believing in the fundamental growth drivers for the market but anxious about the valuations.

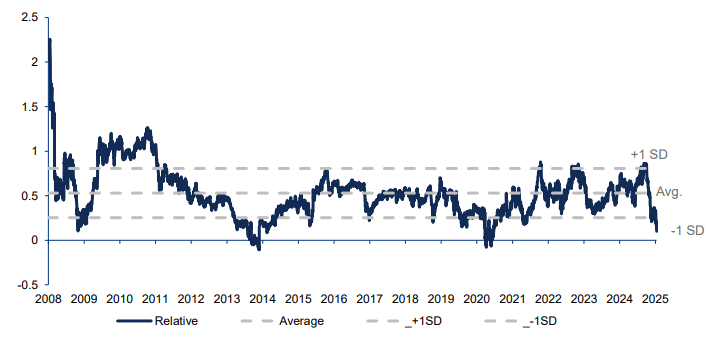

- Since the writing of our last India Briefing in late November, the MSCI India index has fallen by around 8%.1 Combined with the rally in other markets, this has resulted in a significant pullback in the valuations of Indian stocks relative to global equities (Figure 1).

Figure 1: MSCI India – P/B relative to MSCI World P/B

Source: Bloomberg, Allianz Global Investors, as of 13 January 2025. The average valuation is calculated over the period of past 15 years, or since data became available.

- We can point to a number of different triggers for the recent weakness in Indian equities – these include a lower GDP print, reports of urban consumption weakness, a slowdown in corporate earnings, Indian rupee (INR) depreciation, foreign institutional (FII) outflows, and risk-off sentiment stemming from the US presidential handover.

- Looking at the bigger picture, however, our view is that the recent slowdown in economic momentum is related to one-off events and is not symptomatic of negative structural trends.

- Let’s take these one at a time.

- First, financial conditions have tightened, and GDP growth has slowed; deliberate measures were undertaken to prevent economic overheating, especially in pockets like unsecured lending and microfinance.

- Post this policy-driven slowdown, however, there are broad expectations for an easing of liquidity and potential rate cuts over the next few quarters, initiated by Sanjay Malhotra, the new Reserve Bank of India (RBI) governor who took charge in December.

- Meanwhile, adverse weather conditions, including heavy rainfall and heatwaves across the country, restricted government spending, as did state elections concurrently conducted during this period.

- On the consumer front, data suggest that urban consumption, which had been steadfast for most of last year, slowed in recent months despite an improvement in inflation conditions.

- At a micro level, it seems that consumption actually remains robust – only that consumer preferences are driving the emergence of new winners. For example, categories like hotels, air travel, and new home sales have been strong and are experiencing wallet share gains at the expense of legacy brands.

- Overall, we think that India will sustain GDP growth exceeding 6% annually for many years. Minor fluctuations (0.5%–1%) in GDP growth reflect natural adjustments in a dynamic and growing economy.

- As such, we believe the worst will soon be behind us with regards to earnings, too. Moving forward, governmentled capital expenditure, which has been a key drag on earnings, is expected to reverse and contribute positively.

- In the September quarter, negative earnings-per-share (EPS) revisions at -4.5% accounted for only one-third of the market correction of more than 15% since the peak in September, indicating that the market reaction may have been overdone.2

- As we look at contributing factors globally, the Indian rupee (INR) has depreciated recently after years of relative stability. This is largely a function of the US dollar (USD) appreciating against most other currencies, not just INR. It also has links to FII outflows from the equity market amidst risk-off posturing.

- In our view, India’s robust fundamentals should support the INR over the longer term. The country has forex reserves of more than USD 600 billion.3 A further buffer is India having one of the lowest external debt-to-GDP ratios amongst its emerging markets peers at ~19%.4

- Donald Trump’s return to the White House has clearly created an environment where investors globally are braced for uncertainty. However, in the case of US-India relations, our view is that India could, in fact, benefit from Trump’s trade policies.

- India’s large IT services exports to the US, valued at USD 101 billion, stand to benefit from potential US corporate tax cuts.5 In addition, Trump’s first term boosted the ‘China+1’ strategy and diversification of supply chains, enhancing India’s position as a neutral and reliable business hub. This has created opportunities in diverse areas including auto components, electronics manufacturing, and solar modules.

- Looking ahead, we see a number of other continued structural tailwinds for India equities. These include positive demographics and productivity gains, political stability, and a favourable market structure featuring a large universe of liquid stocks that have low correlations with one another and with other asset classes.

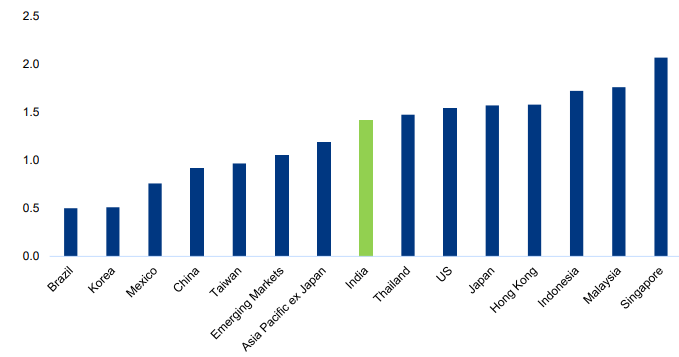

- Encouragingly, India equities now look more reasonably valued – with a price-to-earnings growth (PEG) ratio sitting roughly in the middle of the pack relative to other equity assets (Figure 2). The margin of safety for buying India equity has become more attractive.

Figure 2: Price-to-earnings growth (PEG) by market and region

Source: Goldman Sachs, using MSCI index unless stated otherwise, as of 21 January 2025. US = S&P 500. PEG defined as EPS growth (2025-2026) divided by 12-month forward PE.

- Overall, we view the recent market pullback as a healthy correction. We have been using this as an opportunity to buy some of our favoured stocks at valuations that we expect should form the basis for attractive longer-term returns.

1 IDS, Allianz Global Investors, as of 22 January 2025.

2 Allianz Global Investors, as of 31 December 2024.

3 Macquarie, as of 12 January 2024.

4 Reserve Bank of India, as of 30 June 2024, published 30 September 2024.

5 Citibank, Macro and Market Implications from Trump 2.0, as of 6 November 2024.