The India Briefing

The rise of the Indian consumer

This month, we look into the India consumer, with a particular focus on the travel and tourism industry, where we have good exposure in the Allianz India Equity Fund.

Please find below our latest thoughts on India:

- There have been signs of stabilisation in the Indian equity market of late. The Sensex has rallied by around 8% since the beginning of March (in USD terms).

- We see the recent correction as largely driven by policy-induced liquidity tightening and an unintended slowdown in government spending. This appears to have been a self-inflicted slowdown rather than a sign of structural weakness.

- Encouragingly, there is now a visible shift in policy focus towards reviving growth, with active steps being taken to ease liquidity conditions, including interest rate cuts and tax reductions.

- Looking ahead, a key structural growth driver for India will be the rising power of the domestic consumer. This is perhaps nowhere better illustrated than in the travel and tourism industry.

- In 2024, Indians travelled more than ever, thanks to a rising middle class and better infrastructure and connectivity.

- The interplay of rising consumption power and interest in experiences is driving innovation and penetration across travel and related sectors ranging from railways and airlines to online booking platforms, hotels, credit cards, social media, food and beverage, and other retailers.

- Businesses offering specialised packages or tailored travel themes seem particularly well placed to capture this trend. Travel categories like religious/spiritual travel, culinary travel, wellness travel, and adventure travel are all popular and growing segments that leverage India’s rich cultural and geographical diversity.

- The growth potential of religious tourism, in particular, is set to deliver outsized gains – with religious travel already constituting nearly 60% of all tourism in India. Estimates suggest that India’s spiritual tourism sector alone will generate over 100 million new jobs by 2030 and roughly USD 59 billion in value by 2028.1

- By way of example, look no further than the recent ‘Maha’ Kumbh Mela religious gathering. This 45-day festival drew approximately 400 million visitors (not just from India, but from around the world), representing what is believed to be the largest gathering of humankind in history.

- Estimates suggest that revenue from the festival for the city of Prayagraj in the northern state of Uttar Pradesh, where the religious gathering convened, totalled at least Rs 2 trillion (USD 24 billion).2

- The sheer logistics of developing sufficient infrastructure and managing a crowd of this size, not just in terms of safety, but also in the areas of sanitation and waste management, preservation of heritage sites, and control over the effects of environmental degradation, are impressive feats.

- India’s successful planning at this scale instils confidence in the infrastructure and security available to travellers. No doubt digital intervention using AI and predictive analytics improved the visitor experience.

- It is still early days in the domestic India travel journey, and we have barely scratched the surface of international travel. It could take many years for Indian tourists to equal the number of travellers from China, for example. We see a long runway for growth.

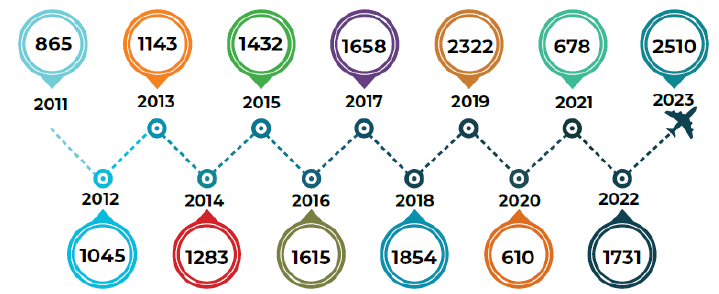

Chart 1: Year wise domestic tourist visits in millions

Source: Ministry of Tourism, 2024 India Tourism Data Compendium, as of 18 February 2025.

- More broadly in terms of discretionary spending, as Indians have become wealthier over recent years, sales of higher-end products and services have outpaced more essential spending.

- Simultaneously, consumer tastes are evolving quickly, with luxury, convenience, and digitisation dominating modern retail and e-commerce preferences. Raised awareness through digital content is an important driving force, as India has more “Gen Zers” than the entire population of the US.3

- In addition to travel and other experiences, younger Indians are progressively more willing to spend on premium products like electronics, jewellery, cosmetics, and branded apparel. High-end apartment sales have nearly doubled since the start of the Covid-19 pandemic.4

- This is driven by a combination of higher per capita incomes, a strong equity market over the last five years, significant growth in property prices (especially homes in prime locations), and a sharp appreciation in gold prices (Indian households own roughly 10% of the world’s physical gold stock).5

- This trajectory should be increasingly influential if we add in the recent tax cuts, which are expected to boost household disposable incomes by freeing up some Rs1 trillion (USD 11.6 billion) via tax reductions benefiting the middle class. What’s more, the 2025 Union Budget increased the tax-free income limit from Rs 700,000 (USD 8,161) to Rs 1,200,000 (USD 13,956), thereby putting more money in the pockets of the average Indian.6

- Bringing this back to investment opportunities, we are focused on discretionary consumption companies leveraging disruptive technologies, with margins normalising at higher levels after a lengthy investment cycle. The recent market soft patch has also brought valuations back to more attractive levels, in our view. Bon voyage!

1 KPMG, Sacred Journeys, as of August 2024.

2 Jeffries, A Slice of India: ‘Maha’ Kumbh Mela – an Event of a Lifetime, as of 16 January 2025.

3 ET BrandEquity, India is set to become the consumption capital of the world: Report, as of 22 March 2025.

4 CLSA, India premiumization, as of 4 March 2024.

5 Goldman Sachs, The rise of ‘Affluent India,’ as of 12 January 2024.

6 India Today, as of 20 February 2025.