The India Briefing

The economics of risk and return

This month, we unpack some of the dynamics around India’s market resilience, as the return and risk profile of Indian equities implies that investors are being adequately compensated for the higher risk taken.

Please find below our latest thoughts on India:

- India’s equity market performance has been strong over the last three months, up more than 16% in USD terms since the end of February despite the volatile, tariff-infused ride in global markets.1

- This period also covers the escalation of tensions between India and Pakistan. From May 7 – 9, which saw the worst of what now appears to be a short-lived conflict, the MSCI India index saw a correction of less than 3%.1

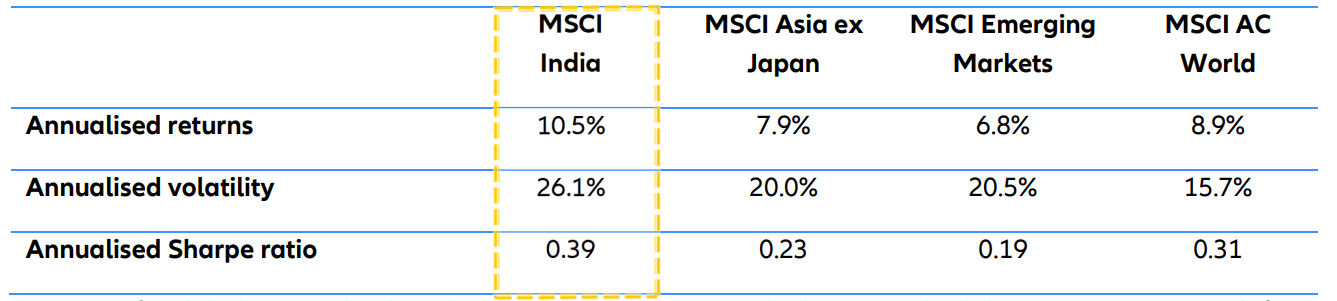

- This recent resilience is representative of a longer-term feature of the Indian market. Over the last 20 years, the MSCI India index has delivered annualised returns of 10.5% (see Chart 1), recovering quickly from setbacks such as the global financial crisis and Covid-19 pandemic.

- While volatility in Indian equities has registered above regional averages, it nonetheless still demonstrates a significantly higher Sharpe ratio (excess returns adjusted for volatility) than most other Asian, emerging, and even global markets.

Chart 1: 20-year risk and return metrics (in USD terms)

Source: BofA Global Research, Bloomberg as of 21 May 2025. Volatility = standard deviation % in USD. Risk-free rate = 1month US Treasury yield.

- In the case of India, there are several contributing factors to the equity market’s notable resilience in the face of global volatility and economic downturns.

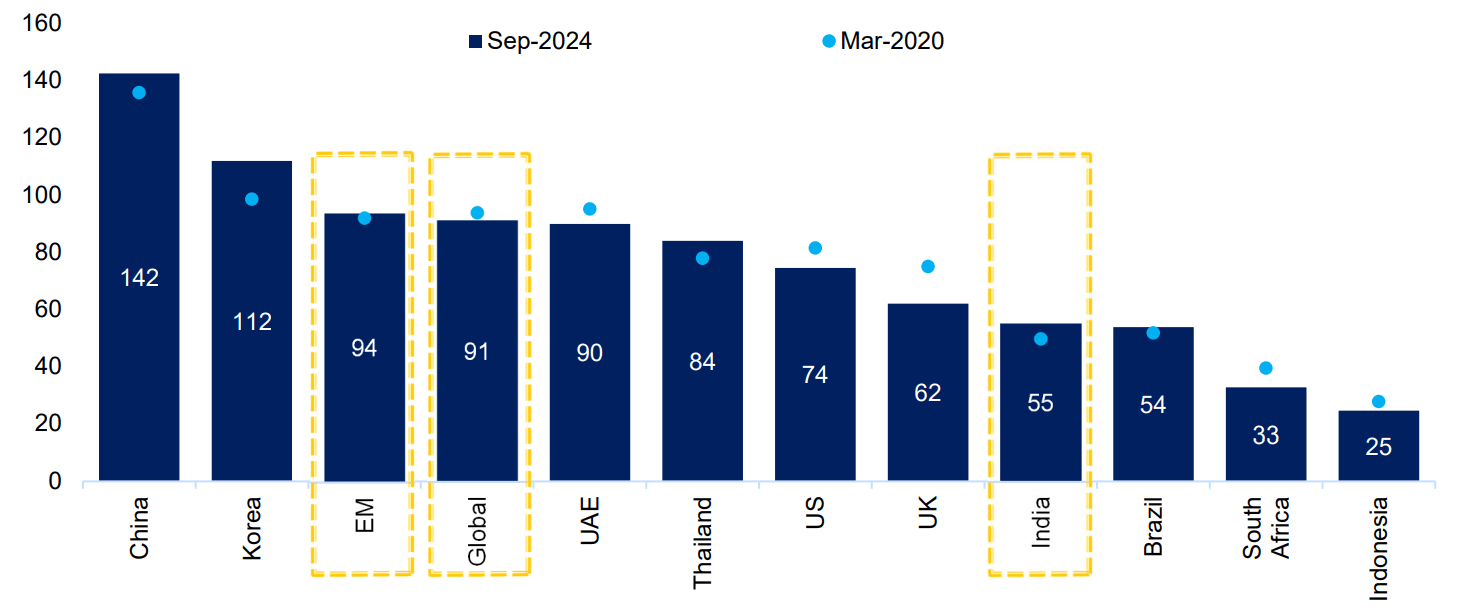

- A particular feature of the economy – especially in the context of recent debates on the US debt ceiling – is India’s low levels of leverage.

- At 55% of GDP, India’s non-financial corporate debt is well below the level of most developed economies and other countries with similarly large equity markets. India’s external debt is also one of the lowest among G20 economies.2

- While much of the rest of the world is grappling with significantly higher debt levels, especially since Covid-19, Indian government, household and corporate balance sheets are generally in good shape.

- Excessive borrowing is broadly frowned upon in Indian society. This aversion to debt is cultural, stemming from a desire to limit interest payments to spend more on critical needs like health care and education.

Chart 2: Non-financial corporate debt (as % of GDP)

Source: Citibank, as of 9 January 2025.

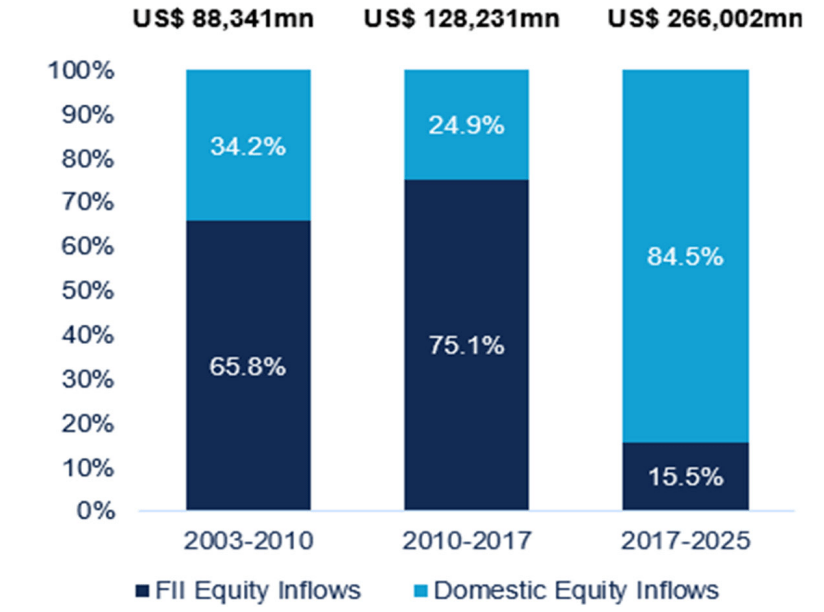

- A second reason for the resilience of Indian equities relates to the diversification benefits and increasing breadth and depth of the market’s shareholder base over time.

- In particular, a key change to the market structure over the last decade has been the growing influence of the domestic investor base, which has helped to smooth out volatile periods caused by asset allocation decisions of global investors.

- In fact, domestic Indian investors account for roughly 85% of inflows into equities over the last eight years, far outweighing the impact of foreign flows.3

Chart 3: Local savings > global participation

Source: Bank of America, Allianz Global Investors, as of 31 December 2024. FII = foreign institutional investors.

- Along with demographic trends and rising incomes, we see India as being on a long journey from a nation of depositors to one of investors.

- What’s more, Indian shares are spread across sectors and industries, representing a diverse investment pool, with no dominant sector like technology, banks, or commodities, which can be the case in other markets.

- Beyond the attractive features of the market composition, we believe India’s resilience is further supported by long-tailed structural dynamics such as digitisation, consumption growth, manufacturing resurgence, and formalisation of the economy.

1 Bloomberg, as of 28 May 2025.

2 Citibank, as of 9 January 2025.

3 Bank of America, Allianz Global Investors, as of 31 December 2024.