The India Briefing

Brains and borders – how India is affected by new H1B visa rules

This month, we take a look at the India market’s performance relative to regional markets YTD, along with analysis of the new H1B visa announcement out of the US.

Please find below our latest thoughts on India:

- Asia Pacific markets are up more than 20% YTD in USD terms, despite headwinds in the form of global trade uncertainties, geopolitical flare-ups, and a general selling trend among foreign investors in the region.1

- China has been a particularly strong contributor, with macro data stabilising under a more “pro-growth” policy stance and the equity market delivering vibrant returns.

- Against this backdrop, India has been a notable laggard, not only in a regional context but also globally. YTD, the MSCI India Index is down about 1%.1

- Weakness in the early part of the year was particularly pronounced and largely self-inflicted in an effort to rein in unsecured lending and create a more sustainable growth path. This was exacerbated by an unseasonal heatwave and heavy monsoon rainfall.

- More recently, the imposition of 50% tariffs on exports to the US jolted markets and contradicted what many had assumed to be India’s favourable position in the eyes of the US administration.

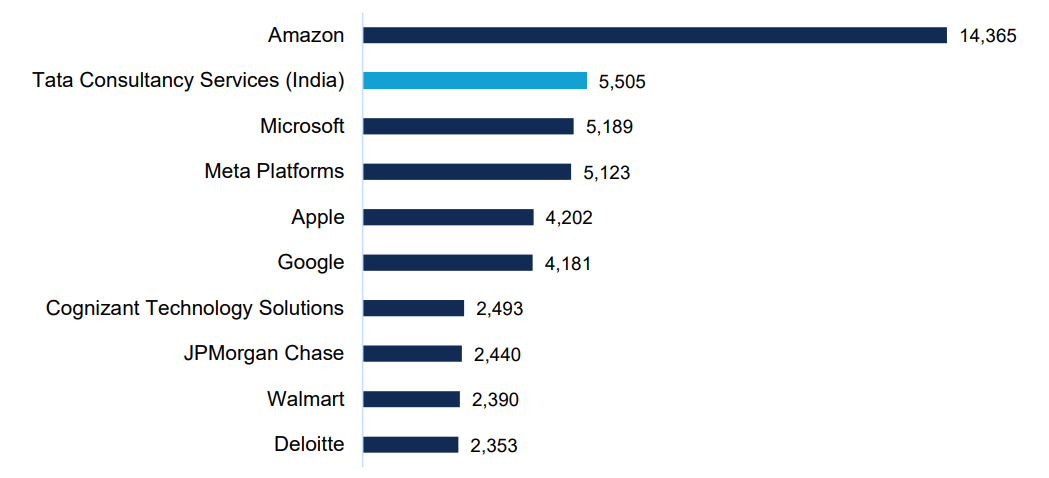

Figure 1: Top 10 H1B visa sponsoring companies in FY 2025

Source: CNBC, U.S. Citizen and Immigration Services, as of 30 June 2025.

- In turn, roughly USD 35 billion in remittances is transferred from the US to India every year, much of which is derived from tech sector employees.2

- While Indians (by country of birth) receive the most H1B visas, in reality, nine out of the top 10 H1B visa sponsors are US companies.2

- Although many large tech firms had already cut back substantially on H1B visa dependencies since Trump’s first term and the impact should be manageable for most companies, this announcement has created further uncertainty in the business environment.

- What has been notable, however, is that India’s domestic situation has had a far more meaningful impact on equity market performance this year than these exogenous factors.

- It took just five days, for example, for Indian equities to rebound after the August tariff announcement. Overall, the market is up nearly 5% since the end of March.1

- Nevertheless, foreign equity flows have exited India to the tune of USD 15 billion since the start of the year. Global emerging markets funds are also lightly positioned in the India equity market, underweight by around 100 basis points, on average, representing the largest underweight observed in 20 years.3,4

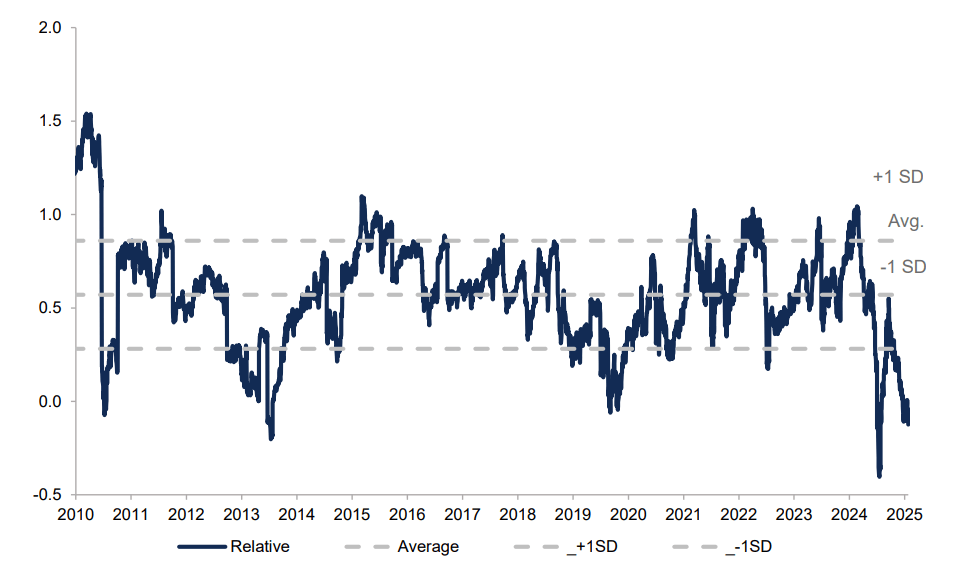

- With these developments, market valuations are now trading at more attractive levels, and India is more than one standard deviation cheap relative to MSCI World, its lowest relative level in the past 15 years.

Figure 2: MSCI India – P/B ratio relative to World P/B

Source: Bloomberg, Allianz Global Investors, 31 August 2025. The average valuation is calculated over the period of past 15 years, or since data became available.

- The market does not seem to be giving credit to the many policy initiatives that have been introduced in New Delhi this year.

- These include three consecutive interest rate cuts, a liquidity-boosting reduction in the cash reserve ratio that banks must set aside with the Reserve Bank of India (RBI), and a major overhaul and simplification of the Goods and Services Tax (GST) framework aimed at stimulating consumption.

- The multiplier effect of these measures should, in our view, far outweigh the penalties imposed by US tariff policies which, while punitive, generally affect a handful of smaller-cap auto ancillary, chemical, and textile exporters among listed constituents in equity indices.

- We expect these measures should, with some lag, lead to improved domestic demand and better corporate profitability, especially as the full impact of the GST cuts is digested.

- As such, backed by appealing valuations, light foreign investor positioning, and lower corporate earnings expectations, our view is that the India equity market has an increasingly favourable risk/reward profile.

- Though Indian equities have been a laggard so far this year, we see current market levels as an opportunity to build exposure.

1 IDS GMBH, Allianz Global Investors, as of 23 September 2025.

2 CNBC, U.S. Citizen and Immigration Services, as of 30 June 2025.

3 2025 HSBC, Asia Equity Insights Quarterly, as of 24 September 2025.

4 Citibank, India Strategy - Consumption/Tariffs/Earnings/Valuations, as of 18 September 2025