AllianzGI will be strengthening its voting policies around pay, gender diversity and climate

- 2023 voting record revealed concerns around independent director elections and overboarding, with pay an ongoing standout concern in the US.

- For 2024 AllianzGI will be strengthening its voting policies around pay, gender diversity and climate.

- Capitalisation and remuneration areas of concern in the UK.

February 28, 2024. Allianz Global Investors (AllianzGI), one of the world’s leading active investment managers, today published its annual analysis of how it voted at AGMs around the globe, based on its participation in 9,137 (2022: 10,205) shareholder meetings and voting on close to 100,000 (95,512) shareholder and management proposals.

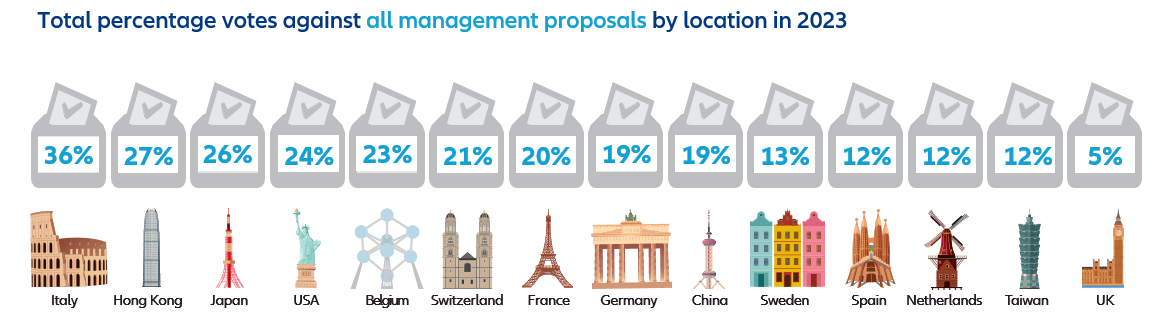

AllianzGI voted against, withheld or abstained from at least one agenda item at 71% (2022: 69%) of all meetings globally. It opposed 18% of capital-related proposals, 24% of director elections and 41% of remuneration-related proposals globally reflecting high expectations on governance standards.

Sustainability and governance advancements for 2024

Looking at voting for the year ahead, AllianzGI intends to continue to strengthen its voting guidelines with respect to sustainability aspects in three main ways;

- Pay : Currently, AllianzGI votes against European large-cap companies that do not include ESG key performance indicators into their remuneration policies. For 2024, this requirement is expanded beyond Europe and as of 2025 to smaller companies.

- Gender diversity : AllianzGI will set stricter board gender diversity targets for certain countries, raising the threshold to 40% for large UK, Italian and French companies and will also expect at least one female board member for all Asian-listed companies. AllianzGI’s commitment to gender diversity was the main motivation in co-founding the 30% Club Investor Group Germany 20231, and in co-chairing this initiative in France and Germany.

- Climate : 2023 revealed a decreasing number of “Say on Climate” resolutions. As AllianzGI places high importance on companies’ climate transition strategies, the voting policy has been updated to increasingly hold directors accountable if a company does not have a credible net-zero strategy in place. Going forward, AllianzGI will base its decision on its proprietary Net-Zero Alignment Share Methodology2 which provides a concrete means of comparing companies’ progress consistently across sectors and markets.

Continuing from a successful start in 2023, AllianzGI will once again pre-announce selected votes during the 2024 AGM season. Preannouncing voting intentions reflects AllianzGI’s willingness to be public with views on matters it considers important and where it is felt that confidential engagement is unlikely to yield the desired outcomes.

Voting in 2023

Remuneration / Say on Pay

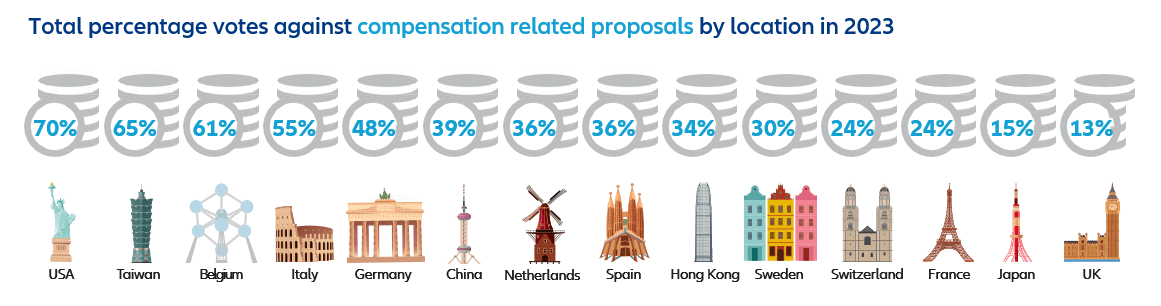

AllianzGI notes continued concern over remuneration in Europe, with the most ‘votes against’ recorded in Germany (48%), Italy (55%) and Belgium (61%). Concerns over transparency are highlighted, particularly in Germany and Italy, in relation to clearly disclosing the link between performance and pay-out. Where there has been progress is in the vast majority of European large caps that are now including ESG KPI’s in their remuneration policies, something AllianzGI have been advocating for several years now.

At 70%, AllianzGI’s rate of opposition to pay-related proposals continued to be high in the US in 2023, despite showing a slight reduction from 2022. AllianzGI continues to note that many US companies operate pay systems that reward short term market movement rather than reflecting management out-performance.

Shareholder resolutions

Last year saw a record number of shareholder resolutions, but lower average levels of support ‒ dropping to about 22% from a peak of 33% in 2021.

AllianzGI voted on 629 proposals in the US, including 60 on corporate governance, 62 on compensation, 211 on various social themes and the remainder on environmental resolutions or a blend of areas. In the US, AllianzGI supported 86% of all climate-related shareholder resolutions, 100% of human-rights related resolutions and 91% of resolutions with respect to greater transparency on political contributions and lobbying.

Matt Christensen, Global Head of Sustainable and Impact Investing at AllianzGI comments, "A number of market studies show shareholder support for key ESG resolutions in the USA fell in 2023. Going against that trend, AllianzGI showed its ongoing commitment to key ESG resolutions, in line with European investors’ stronger sustainability convictions. We intend to continue to utilize our proxy voting power to help shape a more sustainable future for companies and societies where we have equity ownership positions."

Say on Climate resolutions

AllianzGI has seen a significant decline in Say on Climate resolutions in 2023, having voted only on around 30 compared to roughly 50 in 2022. In Europe most Say on Climate resolutions are still tabled by companies in France and the UK, with Australia the most prominent country outside of Europe to do so.

Antje Stobbe, Head of Stewardship at AllianzGI, comments on the key takeaways this year stating, "We observed issues with how companies are dealing with low vote-turnouts on Say on Climate and with their responses to investor concerns more broadly. Additionally, amendments to company climate plans after they have been submitted to a shareholder vote is another emerging issue we have seen. We generally expect a company to be responsive to investor concerns and to state how they will be addressed. In 2023 we voted against directors if this was not the case."

Promoting high-quality boards

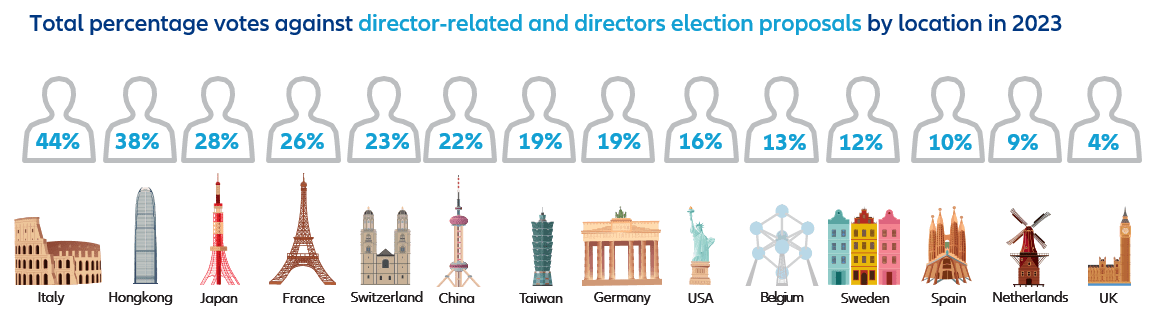

AllianzGI places high importance on the quality of boards as good governance goes hand-in-hand with better financial performance and high sustainability standards. In 2023 AllianzGI continued to vote against almost a quarter (24%) of all directors standing for election, while also voting against several companies where we deemed the board of directors and/or board committees to be insufficiently independent (2022: 25%), either because directors had a long tenure or where they were representatives of major shareholders.

Antje Stobbe, comments, "We continue to strengthen our expectations with respect to independence and ask boards to implement an independent Chair of the Audit and the Remuneration Committee as of 2024. Overboarding is a major ongoing concern in many markets. As demands on non-executive directors increase in times of economic uncertainty and geopolitical risk, we voiced our concerns and typically voted against when full-time executives take on more than one non-executive role, or when non-executive directors take on too many appointments in public and private companies."

Country specific highlights

Capitalisation joins remuneration as the major areas of concern in the UK

Overall, AllianzGI voted against only 5% of all resolutions in 2023 (4% in 2022) as corporate governance standards continue to be high in the UK market. AllianzGI monitors a number of corporate governance reforms in the UK as it believes sound standards of shareholder protection are an important ingredient to support investor confidence in the market.

AllianzGI voted against 13% of all remuneration-related proposals which has seen a significant drop from the 20% dissent seen in 2022. In general, executive remuneration structures & disclosures are well-formed in the UK. AllianzGI notes that more companies proposed restricted share plans which were in line with expectations and saw high levels of support. While there were a much greater number of remuneration policies up for vote (135), in general changes were less contentious and AllianzGI supported a higher level overall (87%). AllianzGI also saw less dissent for remuneration reports implying that there have been improvements in the disclosure and implementation of compensation policies.

Despite recognition of the increased guidelines from the Pre-Emption Group, AllianzGI decided against revising its policy limits around the disapplication of pre-emptive rights. As issuers follow market practice limits, where companies have sought to remove pre-emption rights at these higher limits AllianzGI only partially supported these resolutions. The result was a significant increase in dissent on related resolutions from 1% in 2022 to 11% in 2023.

Source: AllianzGI proxy voting data.

Source: AllianzGI proxy voting data.

Source: AllianzGI proxy voting data.

For further information please contact

Susie Tillotson

P +44 203 246 7846 | M +44 7464 525628

Email: susie.tillotson@allianzgi.com

About Allianz Global Investors:

Allianz Global Investors is a leading active asset manager with over 600 investment professionals in over 20 offices worldwide and managing EUR 533 billion in assets. We invest for the long term and seek to generate value for clients every step of the way. We do this by being active – in how we partner with clients and anticipate their changing needs, and build solutions based on capabilities across public and private markets. Our focus on protecting and enhancing our clients’ assets leads naturally to a commitment to sustainability to drive positive change. Our goal is to elevate the investment experience for clients, whatever their location or objectives.

Data as at 31 December 2023

1 https://www.allianzgi.com/en/insights/sustainability-blog/the-power-of-difference

1 The Net-Zero Alignment methodology aims to assess the transition plan’s credibility and likely net zero compliant pathway of a company. The methodology is based on the Net Zero Investment Framework from IIGCC’s Paris Aligned Investment Initiative.