10 things to know about China equities

Summary

Once largely out of reach to foreign investors, China’s equity markets have opened up as the country’s economy transforms. From Shenzhen and Hong Kong listings to the Nasdaq-like STAR board, Chinese companies are attracting significant investor capital. Here’s what you need to know.

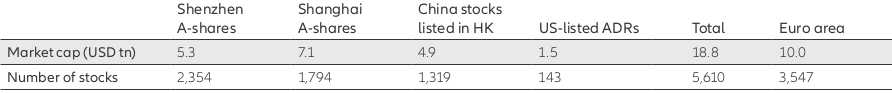

China’s capital markets have expanded significantly in recent years. The combined market capitalisation of the exchanges in Shanghai, Shenzhen and Hong Kong – plus US-listed American depositary receipts (ADRs) – is USD 18.8 trillion (see chart). This is significantly higher than the USD 10 trillion market cap of euro-area equities1. Access to such a large market provides attractive opportunities for investors to gain further exposure to China’s growth story.

Major stock exchanges for China equities vs euro area

Source: Shenzhen Stock Exchange, Shanghai Stock Exchange, Hong Kong Stock Exchange, Bloomberg, Allianz Global Investors. Data as at 31 December 2020. The total figures are for comparison only. The stocks included may be listed in more than one exchange. Offshore China stocks are defined based on companies with ultimate parent domiciled in China. Suspended stocks, investment funds and unit trusts are excluded.

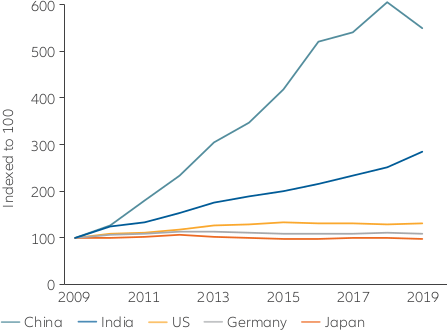

The outlook for China equities is underpinned by government investment in “new infrastructure” – foundational technologies such as artificial intelligence and electric vehicles. These are areas where China wants to reduce its reliance on foreign technologies and become a global leader – and Chinese companies have been benefiting. Case in point: the number of patent filings in China grew more than 450% between 2009 and 2019 (see chart), dwarfing the total number of annual patent filings by the world’s other top economies.

Annual patent filings of five largest economies

Source: World Intellectual Property Organization. Data as at December 2019.

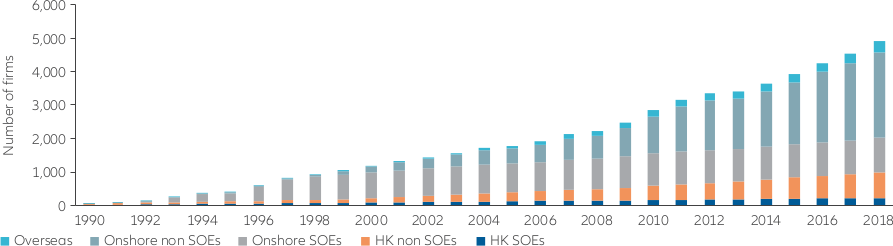

China’s state-owned enterprises once held outsized influence over the country’s economy, but significant reforms drove down their share of GDP from 50% to 30% over the last 15 years. In addition, non-strategic SOEs – such as local consumer or technology businesses – are now behaving more like profit-seeking entities. China is also the youngest market regionally, meaning Chinese companies have been part of the region’s major benchmark index for the shortest amount of time. It’s an indication that much of the investment activity that previously took place in private and venture-capital markets is increasingly accessible to investors in listed equity markets. As Chinese equity indices have changed over time (see chart), markets have become more dynamic and more reflective of where the economy is headed.

China’s equity market composition by company type and location

Source: Wind Data Service, Gavekal, Macrobond Financial. Data as at 31 December 2019.

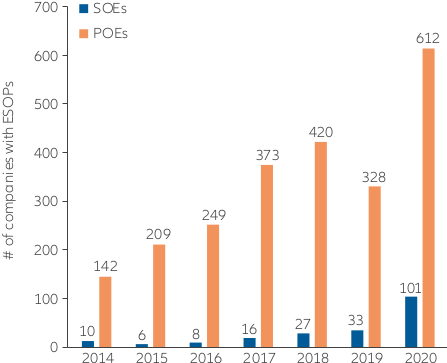

Some investors may have previously questioned China’s corporate governance standards, but things are changing. Use of international auditors and accounting standards is growing, with every listed Chinese company required to file quarterly reports and end its fiscal year on 31 December. Moreover, an increasing number of state-owned and privately owned enterprises offer employee stock ownership programmes (ESOPs; see chart). This helps turns employees into shareholders with an active stake in the company’s success.

Number of China A-share companies with ESOPs

Source: Wind. Data as at 30 November 2020.

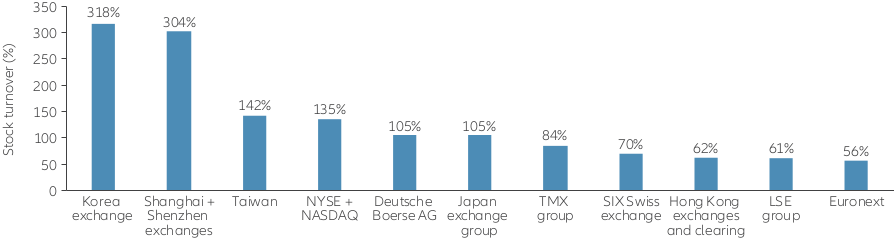

Domestic retail investors in China dominate the market for A-shares and account for more than 80% of daily turnover2. (Markets with high turnover ratios are generally easier to trade because they’re more liquid – meaning more investors are buying and selling.) With the investment culture in China focused more on momentum and short-term trading, the stock turnover ratio of China A-shares is among the highest in the world (see chart).

Stock turnover of China A-shares vs other major markets

Source: World Federation of Exchanges, Allianz Global Investors. Data as at 31 December 2020. Turnover is the total value of shares traded during the period divided by the average market capitalisation for the period.

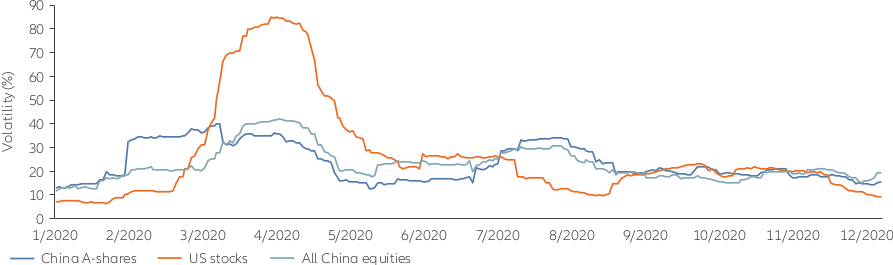

Volatility in China’s equity markets has sometimes been high – but perhaps surprisingly, during the peak of the pandemic crisis in 2020, China was less volatile than the US (see chart). There were only three days, for example, when China’s markets moved by more than 5% on a daily basis, compared with 10 days in the US. And while much of the current A-share trading activity is driven by retail investors, China’s equity markets overall are likely to become more influenced by institutional investors over time. This should help push volatility levels closer to those of the so-called more developed markets.

Rolling 30-day volatility in 2020 (US stocks vs China A-shares vs all China equities)

Number of days in 2020 with more than +/5% daily movement

Source: Refinitiv DataStream, Bloomberg, Allianz Global Investors. Data as at 31 December 2020. Volatility figures are annualized. US stocks are represented by the S&P 500; all China equities by MSCI China; China A-shares by MSCI China A Onshore. For index definitions, visit S&P Global and MSCI. Past performance is not indicative of future performance. Investors cannot invest directly in an index.

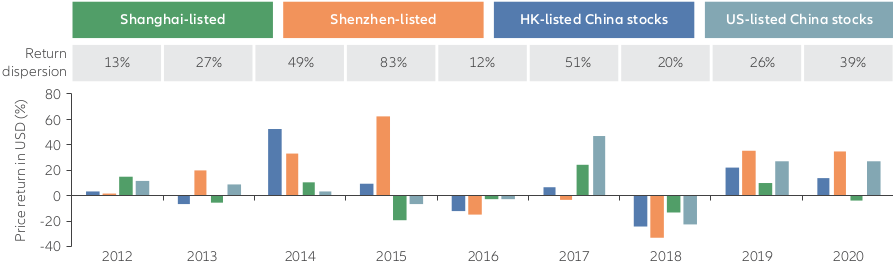

China has many stock exchanges and share classes – reflective of the depth and breadth of its economy – and they all have their own important characteristics. Even within China A-shares, the different listing venues offer varying exposures to sectors, market caps and SOEs. Regional macroeconomic differences can also affect shares: for example, US market performance influences US-listed Chinese ADRs. The net effect of these differences can be seen in the wide dispersion of performance by stock exchange (see chart). Investing across China’s exchanges can bring additional diversification benefits, but knowing the nuances of the marketplace is key.

Calendar-year return for different China equity markets

Source: Thomson Reuters Datastream, Allianz Global Investors. Data as at 31 December 2020. Shanghai-listed stocks are represented by Shanghai SE Composite Index; Shenzhen-listed stocks by Shenzhen SE Composite Index; Hong Kong-listed stocks by Hang Seng China Enterprises Index; and ADRs by S&P/BNY Mellon China ADR Index. For index definitions, visit: China Securities Index Co..; Hang Seng Indexes; and S&P Dow Jones. Past performance is not indicative of future performance. Investors cannot invest directly in an index.

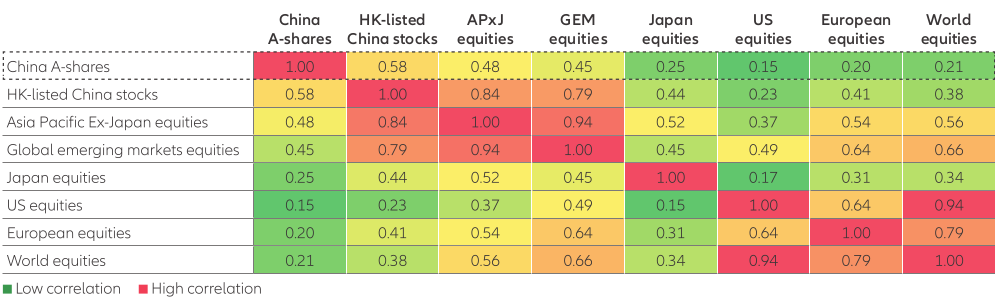

China A-shares have a correlation of 0.21 with global equities over the last 10 years (see chart). That means China A-shares move in the same direction as global equities only 21% of the time. Or looked at another way, almost 80% of the time they move in a different direction. (In comparison, US and global equities have a correlation of 0.943.) Holding A-shares in a global portfolio may help generate a better risk-return profile. This could be particularly beneficial during steep market drops like those seen during the Covid-19 pandemic, when some highly correlated asset classes fell in tandem.

Correlation of A-shares with major equity markets

Source: Bloomberg, Allianz Global Investors as at 31 December 2020. Correlation data is calculated based on historical return of respective MSCI indices for the past 10 years, using weekly USD return. China A-shares represented by MSCI China A Onshore Index; HK-listed China stocks by MSCI China Index; APxJ equities by MSCI AC Asia ex Japan Index; global emerging market equities by MSCI Emerging Markets Index; Japan equities by TOPIX Index; US equities by S&P 500 Index; European equities by MSCI Europe Index; world equities by MSCI World Index. For index definitions, visit: MSCI; Japan Exchange Group (TOPIX); S&P Global. Past performance is not indicative of future performance. Investors cannot invest directly in an index.

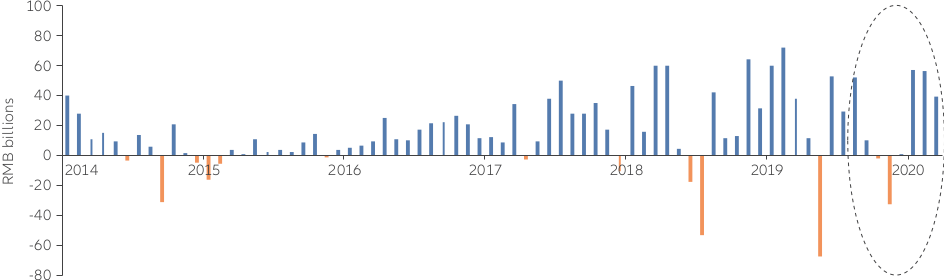

The Shanghai and Shenzhen Stock Connect schemes that launched a little over five years ago helped integrate Chinese equities into the global financial system by making it easy to invest across borders. For example, investors outside of mainland China can use the Hong Kong exchange to buy A-shares in Shanghai or Shenzhen (known as a “northbound” trade). In “southbound” trades, mainland China residents use the Shanghai or Shenzhen exchanges to buy Hong Kong-listed stocks. Since the Shanghai Stock Connect opened in November 2014, Chinese equities have enjoyed 62 months of “northbound” inflows with only 13 months of outflows (see chart). Notably, the ongoing inflows have occurred despite economic and political volatility, implying a fundamental shift towards greater global investment in China.

Monthly northbound buying via Stock Connect (RMB billions)

Source: Wind, Allianz Global Investors. Data as at January 2021.

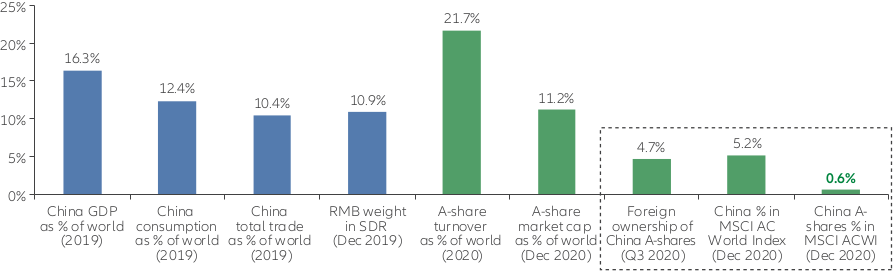

Some of the most prominent global stock indices – the benchmarks against which many investors measure their performance – have been adding Chinese stocks in increasing numbers. This reflects the growing importance of China to the global equity markets. It’s likely also a sign that more foreign investment will be flowing into the region in the future. But compared with China’s economic influence and market scale – it accounts for 16.9% of global economic output, among other factors – the country may still be under-represented on benchmark indices (see chart). Investors may want to consider allocating more to China than benchmarks do.

Key statistics on China and China equities

Source: FactSet, MSCI, Goldman Sachs Global Investment Research. Data as at 31 December 2020.

1. Source: European Central Bank as at 31 December 2019.

2. Source: SSE, Wind, Bloomberg, Goldman Sachs Global Investment Research as at December 2017.

3. Source: Bloomberg, Allianz Global Investors. Data as at 31 December 2020. Correlation data is calculated based on historical return of respective MSCI indices for the past 10 years, using weekly USD return. China A-shares represented by MSCI China A Onshore Index. GEM equities represented by MSCI Emerging Markets Index. US equities represented by S&P 500 Index. World equities represented by MSCI World Index. Investors cannot invest directly in an index.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Equities have tended to be volatile, and do not offer a fixed rate of return. Emerging markets may be more volatile, less liquid, less transparent, and subject to less oversight, and values may fluctuate with currency exchange rates. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication’s sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan

1532754

9 things to know about China’s bond markets

Summary

China’s bond markets have historically been underutilised by many foreign investors, but things are changing. Steady reforms, an increasingly internationalised currency and attractive yields are resulting in increased inflows. Read these nine tips to understand the essentials of investing in China’s fixed-income marketplace.