9 things to know about China’s bond markets

Summary

China’s bond markets have historically been underutilised by many foreign investors, but things are changing. Steady reforms, an increasingly internationalised currency and attractive yields are resulting in increased inflows. Read these nine tips to understand the essentials of investing in China’s fixed-income marketplace.

-

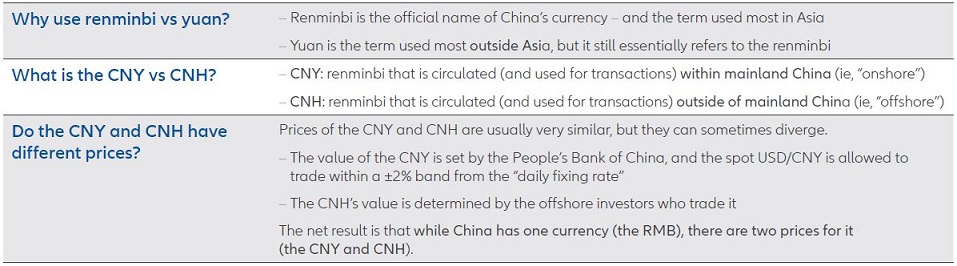

China’s fixed-income marketplace isn’t monolithic, but it is massive. The onshore RMB segment alone is bigger than those in France, Germany and the UK combined.

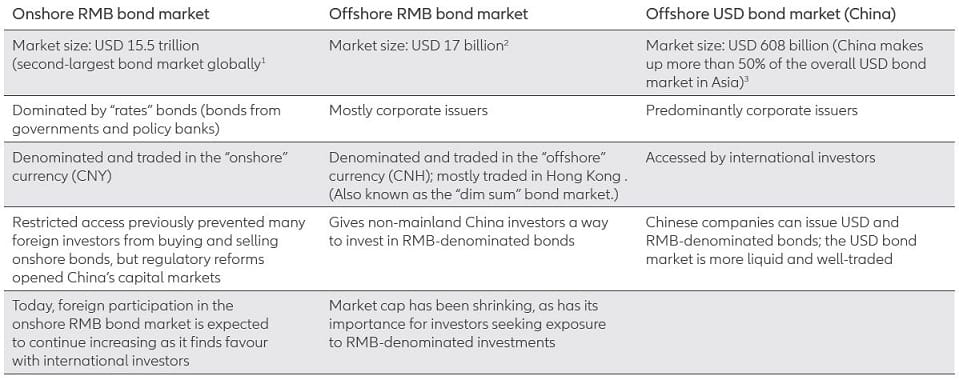

Three different investable markets for Chinese bonds

-

Outside of Asia, “yuan” is generally the term used to describe China’s currency. But “renminbi” (abbreviation: RMB) is the official legal name of China’s currency, and the term used the most in China and in Asia overall. Bond investors should be aware of the two kinds of renminbi used in financial transactions.

- In “onshore” China (sometimes called mainland China), transactions are done using the onshore traded renminbi (abbreviation: CNY). This is where “onshore RMB”/“onshore CNY” bonds get their name.

- In “offshore” regions (those outside of mainland China), transactions are done using the offshore traded renminbi (abbreviation: CNH). This is where “offshore RMB”/“offshore CNH” bonds get their name.

China’s regulators are intent upon making the onshore RMB currency (the CNY) a more “internationalised” one – similar to how the US dollar (USD) is used around the world to conduct transactions. That makes the onshore RMB bond market increasingly important.

Key renminbi facts for fixed-income investors

-

The total value of China’s onshore RMB bond market reached USD 15.5 trillion at the end of 2020, and many market participants are expecting the market to grow significantly in the coming years.

China’s onshore RMB bond market is also diverse, with three main segments of the market: money market instruments, “rates” and “credits”.

- Rates bonds form the largest segment of the onshore RMB market (55% as at 30 June 2020). This group broadly consists of central government bonds (CGBs), local government bonds (LGBs) and bonds from policy financial banks (PFBs, which are large financial institutions owned by the Chinese government).

- Credit bonds encompass issues from government-linked financing entities, state-owned enterprises (SOEs), financial institutions (such as banks and insurers) and privately owned (non-government) corporations. Credits make up about a quarter of the onshore RMB market.

- Money market instruments issued by banks and corporations make up the rest of the onshore RMB bond market.

Outstanding bonds by market

Source: Chinabond, Chinaclear, Wind, Standard Chartered Research. Data as at 30 June 2020.

-

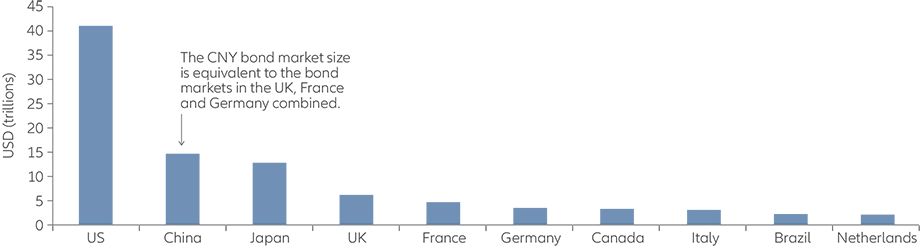

When investing in the onshore RMB bond market, it’s important to work with a partner who can help you assess the creditworthiness of an issuer. The credit quality of bonds issued by LGBs, SOEs and private companies can vary widely. Moreover, China’s onshore credit rating system differs from international rating conventions. For example, onshore bonds rated AA+ would typically be rated as “high yield” on an international scale.

Onshore RMB bonds’ breakdown by credit rating

Source: Wind, Standard Chartered Research. Data as at 30 June 2020.

-

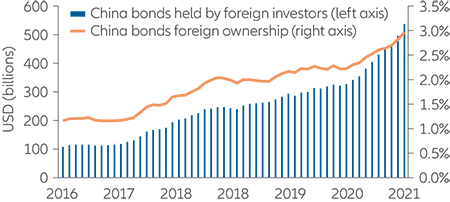

China has been making it easier for non-mainland China investors to access to its domestic capital markets. This has paved the way for Chinese bonds to be included in global benchmark indices – with the latest being the FTSE Russell WGBI in November 2021. China is also working to make the renminbi a more “internationalised” currency. Together, these factors should help international investors’ holdings of RMB bonds to rise over time.

But international investors still own less than 3% (about USD 540 billion) of the entire RMB bond market. This is significantly lower than the 10%-25% foreign bond ownership range observed in other emerging-market nations. It is also lower than China’s representation in major global bond indices. This indicates that foreign interest will likely keep growing in the coming years.

Foreign ownership of China bonds

Source: CEIC, WIND, Citi Research. Data as at 31 January 2021.

-

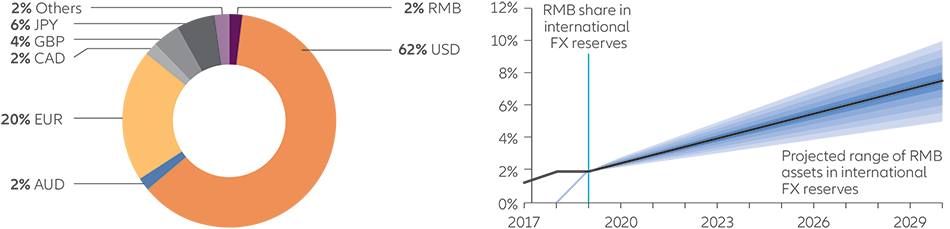

In recent years, governments and companies have grown increasingly comfortable using the renminbi to conduct international transactions. This can help these institutions eliminate currency risk, since one currency doesn’t need to be exchanged for the other – a process that can cause fluctuations in value.

Another factor making the renminbi attractive to international investors is the way China’s central bank – the People’s Bank of China, or PBoC – has resumed using conventional tools (such as adjusting the short-term interest rate) to enact its monetary policy. Compare this with the unconventional tools that other large central banks are using, such as the massive bond purchases known as “quantitative easing”. Some investors consider these tools to be less sustainable and possibly riskier. That makes the PBoC’s more conventional approach – and China’s renminbi – more attractive to many international investors.

As the international community turns to the renminbi, there should be a corresponding need for investors to seek investment assets denominated in renminbi. This may help lift the value of RMB bonds over time, which would likely benefit investors who already own these bonds.

Global central bank reserves (as at 2Q 2020) and projected growth of RMB usage in global reserves by 2030

Source for global central bank reserves: IMF, JP Morgan Asset Management. Data as at 31 October 2019. Source for projected growth of RMB: Morgan Stanley Research, Haver.

-

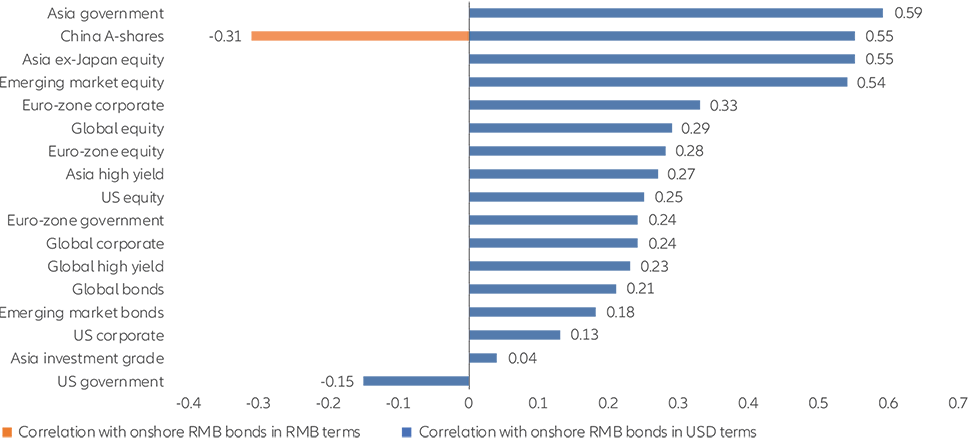

Onshore RMB bonds have exhibited low correlations to other asset classes. Case in point: onshore RMB bonds moved in the same direction as global bonds only 22% of the time. As a result, holding onshore RMB bonds in a global portfolio may improve overall diversification.

3-year return correlation of onshore RMB bonds vs other major asset classes

Source: Bloomberg. Data as at 31 December 2020.

-

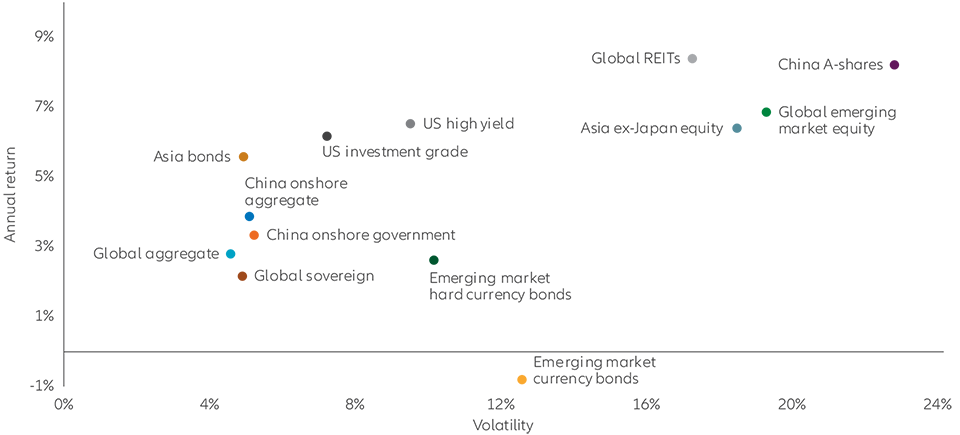

Over time, the returns of onshore RMB bonds have been steady. Moreover, their volatility has remained low, meaning there have been relatively few large swings either up or down. When these two metrics are taken together, they can be expressed as a “risk/return” profile. And as the accompanying chart shows, onshore RMB bonds have an attractive risk/return profile compared with other major asset classes. That can make onshore RMB bonds a helpful addition to a range of portfolios.

3-year risk/return profile (in USD)

Source: Bloomberg, Allianz Global Investors. Data as at 31 March 2021. Please see the disclosure at the end of this document for important index information.

-

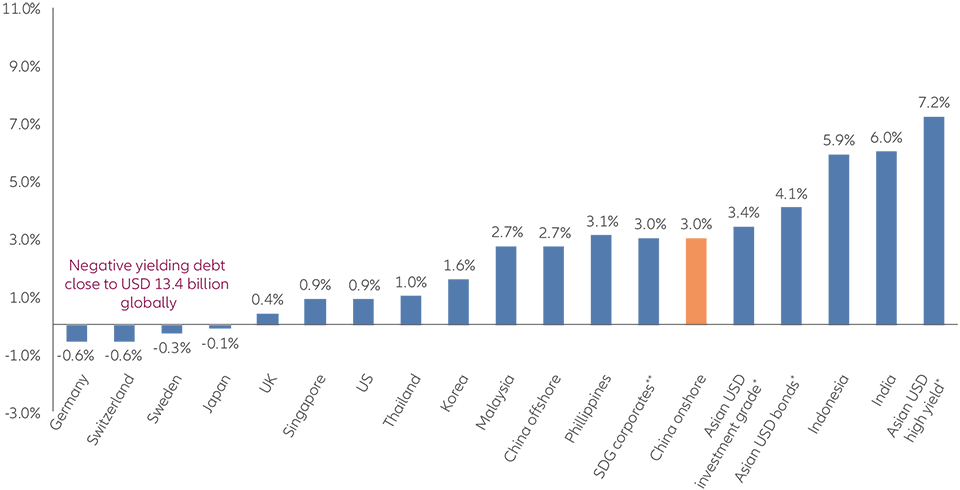

Interest rates in developed economies have been low or even negative for some time. This has contributed to low to negative yields for many types of bonds, as the accompanying chart shows. Moreover, given that the global economic environment continues to be somewhat weak, we expect interest rates to remain at the suppressed levels for some time. That makes it all the more important for investors to pursue sufficient sources of yield potential. Onshore RMB Chinese government bonds (CGBs) have a higher yield than most developed-market government bonds. Moreover, CGBs offer an average credit rating of A+. That means investing in CGBs can provide investors with solid credit quality and attractive additional yields.

5-year government bond nominal yields

Source: Bloomberg, Markit IBoxx, JP Morgan, Allianz Global Investors. Data as at 31 December 2021. *Based on JP Morgan Asia Credit Index. Refers to yield-to-maturity (YTM). **Based on Markit iBoxx SGD Corporate Bond Index. Refers to annual yield.

1. Source: Asian Bonds Online. Data as at 31 December 2020.

2. Source: FTSE Russell. Data as at 31 December 2020 (updated quarterly). FTSE Dim Sum Bond Index is an unmanaged index considered representative of the China offshore CNH bond universe.

3. Source: JP Morgan. Data as at 31 December 2020. JP Morgan Asia Credit Index (JACI) is an unmanaged index considered representative of the Chinese USD denominated bond universe.

Index information for Exhibit 8: Asia ex-Japan equity is represented by MSCI AC Asia ex. Japan Index; Asia bonds by J.P. Morgan JACI composite Total Return; China onshore government by Markit iBoxx ALBI China Onshore Government (USD Unhedged) TRI; China onshore aggregate by Bloomberg Barclays China Aggregate TR Index; China A-shares by MSCI China A Onshore Net Total Return Index USD; emerging-market hard-currency bonds by J.P. Morgan EMBI Plus Composite; emerging-market local-currency bonds by J.P. Morgan GBI-EM Global Diversified Composite Unhedged USD; US investment grade by ICE BofA US Corporate Index; US high yield by ICE BofA US High Yield Index; global sovereign by J.P. Morgan GBI Global Unhedged USD; global aggregate by Bloomberg Barclays Global Aggregate Total Return Index Value Unhedged USD; global equity by MSCI ACWI Index; global emerging-market equity by MSCI Emerging Markets Gross Total Return USD Index; global REITs by MSCI World Real Estate Total Return USD Index. Investors cannot invest directly in an index.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. Credit risk reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. Emerging markets may be more volatile, less liquid, less transparent, and subject to less oversight, and values may fluctuate with currency exchange rates. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication’s sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept >that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

1663660

10 things to know about China equities

Summary

Once largely out of reach to foreign investors, China’s equity markets have opened up as the country’s economy transforms. From Shenzhen and Hong Kong listings to the Nasdaq-like STAR board, Chinese companies are attracting significant investor capital. Here’s what you need to know.