Summary

If trade tensions continue, the US and China could lock each other out and create their own tech ecosystems, forcing the rest of the world to choose one over the other. With the global economy already becoming less synchronised, investors will need to use greater skill and agility to navigate the markets successfully.

Key takeaways

|

One of President Donald Trump’s policy priorities has been to implement wide-ranging trade reforms – with a particular focus on China. In an attempt to pressure China into changing perceived unfair trade practices, the US has levied USD 50 billion in tariffs on imported goods – from auto parts to medical devices – and proposed another USD 200 billion. China, in turn, has retaliated with its own dollar-for-dollar counter-tariffs on airplanes, automobiles, farm products and more.

Yet while the increasing trade tensions between the US and the rest of the world are understandably worrying the markets, we believe the more important story is the potential for a “tech cold war”.

The Trump administration has made it clear that it views China as a strategic technological competitor, and it may be aiming to stop China’s access to cutting-edge US technologies completely. This could transform the economic and investment landscape – lowering profit margins, inhibiting innovation and disrupting everything from mega-cap tech firms to small-scale suppliers.

In times like these, an active investment strategy based on fundamental research can help investors select where to put their money to work, rather than passively accept market returns.

Opening salvos in a tech cold war

To the Trump administration, one of China’s most unfair trade practices is its alleged theft of US patents and intellectual property over multiple years. This is not a new view: other US administrations and intelligence agencies have drawn similar conclusions and attempted to secure their technology from theft and hacking. In addition to using tariffs to combat this problem, the US is also implementing export controls, pursuing indictments and proposing sanctions.

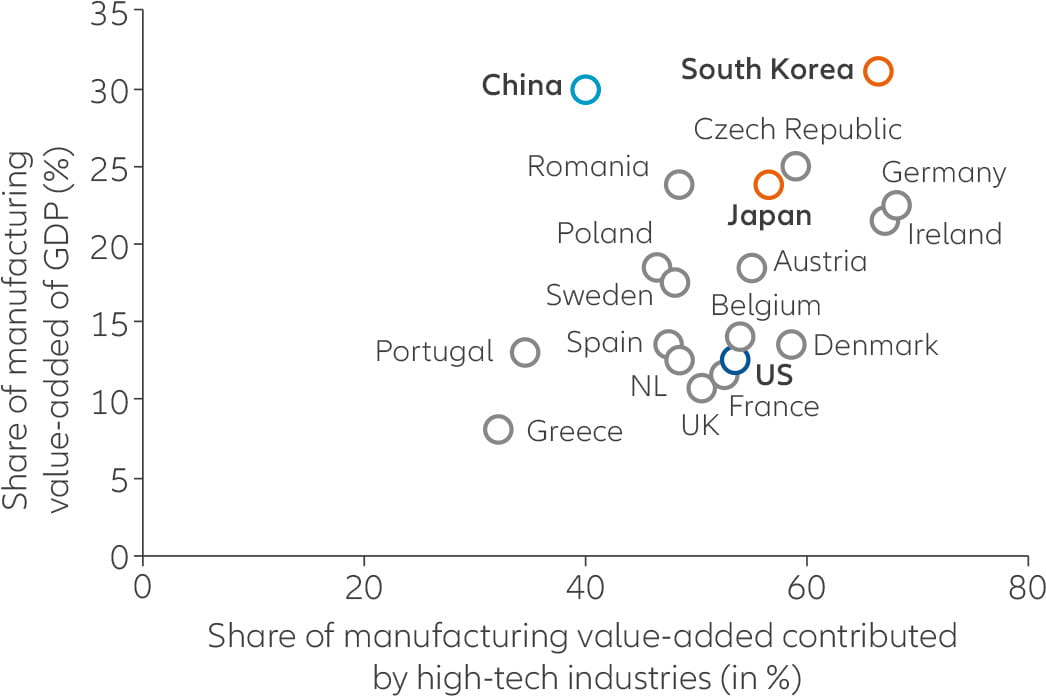

Another issue that makes the US nervous is China’s strategy for competing with the US and other developed nations in advanced manufacturing – its so-called “Made in China 2025” programme. By shifting China’s industrial capabilities into high-tech areas such as aerospace and robotics – and away from apparel, consumer electronics and other lower-value products – China hopes to avoid the “middle-income trap” to which so many emerging economies have succumbed.

China’s economy is increasingly dependent on high-tech industries

Importance of high-tech industries vs dependence on manufacturing

Source: Allianz Global Investors Economics & Strategy; European Chamber, China Manufacturing 2025. Data as at March 2017.

Casualties on both sides

In a tech cold war, the US and China could lock each other out of access to one another’s supply chains and develop their own discrete tech ecosystems – forcing the rest of the world to choose one over the other.

This would disrupt many of the world's most important supply chains, which are often long and complicated and can frequently cross back and forth between multiple countries and regions. Taking out even one link could cause cascading effects both up and down the line, impacting investors in unforeseen ways.

The prospect of serious supply-chain disruption would likely force countries around the world to make delicate and difficult decisions. The US high-tech ecosystem may be favoured by Europe because of the existing ties between the two regions – security, trade and existing infrastructure all play a role. Yet Japan, South Korea and Taiwan may struggle harder with their choices. China could win out over the longer term, thanks to its growth potential and access to peripheral Asia-Pacific markets.

If a tech cold war persists, it could be so damaging to the existing world order that it prevents a return to globalisation – even if today’s populist, anti-globalisation mood eventually dissipates. Perhaps most significantly, a tech cold war could revive the "us versus them" environment that existed during the US-Russia cold war, particularly amid fears over US-China cyberspace conflicts and China’s growing military presence in the South China Sea.

How China could retaliate

Although China has already implemented counter-tariffs, it has so far held off on further significant actions – possibly in the hopes that Mr Trump will be a one-term president. But if China decides to retaliate further, it could take multiple approaches:

- Devaluing the renminbi, which is sitting close to an important 7:1 level with the US dollar.

- Selling its USD 3 trillion in US Treasury holdings, though completely divesting would be very difficult.

- Reducing the amount of rare earth elements China makes available to the global tech supply chain. REEs are crucial to the manufacturing of batteries, mobile phones, fibre optics and more – and China controls 95% of the world’s REE supply, according to the US Geological Survey.

- Increasing its retaliatory tariffs on US goods; this could have spillover effects, including on German car companies that produce autos in the US.

- Targeting American brands in China – from smartphone manufacturers to car companies to fast-food chains.

Economic and investment implications

The global economy is already becoming less synchronised and more divergent – and investors need to use greater skill and agility to navigate the markets successfully. A tech cold war would only exacerbate this shift.

- Global growth could suffer from worker displacement and less innovation.

- If high-tech advances are no longer shared and economies of scale no longer globalised, growth could shrink even more.

- If forced to choose between two competing eco-systems, the Asian economies that form the bedrock of the global manufacturing system could be hurt disproportionately.

- It would be extremely difficult for the US to moving offshore manufacturing and assembly to onshore US locations – or to re-offshore them to other countries. Both moves could result in lower profit margins and higher prices for US companies, which in turn could lower demand for their goods and services.

- The tech sector is the largest single component of major US and Asian indices; any disruptions could push down valuations and earnings.

In times like these, a passive, index-based approach may not be the best way to manage risk and capture opportunities. Because index weightings can lag market movements, index investors could be forced to hold companies that are losing out in a high-tech reshuffling while missing out on the firms that are positioned well for the future.

Focusing on a limited number of issuers, sectors (such as the technology sectors), industries or geographic regions increases risk and volatility. Investing involves risk. There is no guarantee that active management will outperform the broader market. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the date is not guaranteed an no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

676329

About the author

ECB likely to stay the course, despite uncertainties

Summary

As the European Central Bank continues the very gradual normalisation of its monetary policy, we expect it will soon announce the wrap-up of its bond-buying programme. But this won’t signal the end of its accommodation: the central bank has multiple tools at its disposal to carry out its duties.

Key takeaways

|