Sustainability

Defending the defensible: is the defence sector sustainable?

Ukraine’s legitimate right to defend itself against Russian armed forces demonstrates the importance of an effective and well-funded military. Recent events have sparked questions about the role of defence companies in sustainable investment portfolios and the long-standing exclusions applied to these investments. Is there room for a more nuanced view of the sector, particularly as it evolves and defence spending rises?

Key takeaways

- War in Europe has drawn attention to the relevance of the aerospace & defence (A&D) sector in portfolios, where typically these stocks have been totally or partially excluded

- Allianz Global Investors’ approach is to exclude controversial weapons across all portfolios, but an additional restriction of a 10% threshold of investee revenues generated from weapons, military equipment and services is applied to sustainable portfolios

- With perceptions of defence changing in the light of recent events, and spending set to rise, some investors are asking whether a more nuanced approach to the sector is possible

- Engagement with defence companies could form part of an alternative approach, but may not be a definitive answer

The Ukraine war has brought a significant focus on the aerospace and defence (A&D) sector and contributed to record outperformance by the sector this year.1 In February 2022 – the month in which Russian forces renewed Ukraine hostilities – the EU Commission published its Final Report on Social Taxonomy, which sets out to define what constitutes a “social investment”. This document notably omitted a previous description of the defence industry as “socially harmful”.

Typically, defence stocks have been subject to whole or partial exclusion from portfolios for investors with sustainability preferences. Now as the war in Ukraine continues there are questions around the positioning of the sector. Meanwhile heightened concerns over national and regional security and the “legitimate” use of military equipment are sparking a review of the use of exclusions and whether other approaches could be appropriate.

Excluding defence stocks

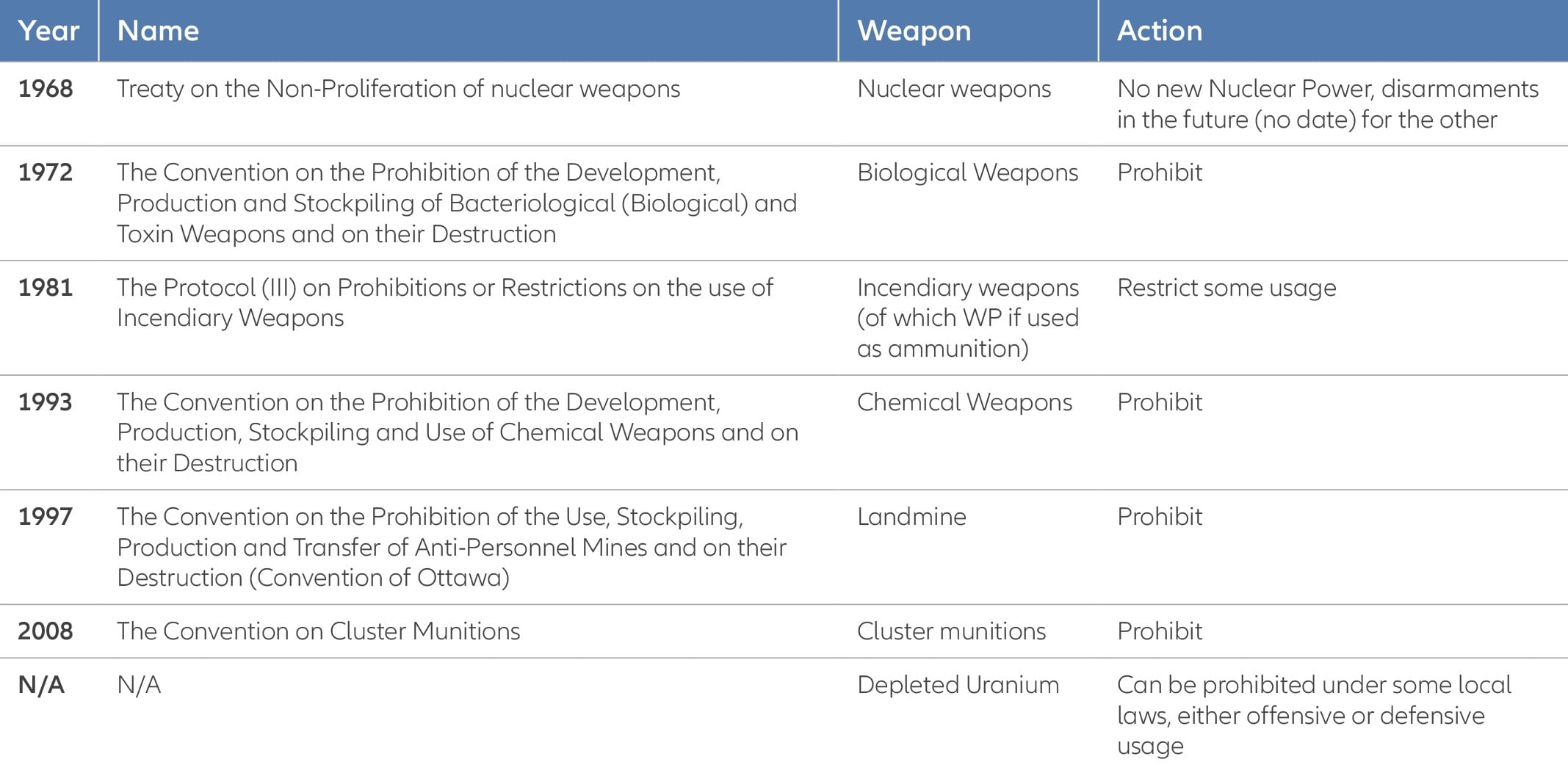

The primary reason for excluding A&D companies is that their involvement in so-called controversial weapons makes them inconsistent with sustainable portfolios. Although there is no single definition of this term – and views on what constitutes “controversial” vary – such weapons are broadly forbidden via national or international laws. Moreover, exclusions exist for specific groups of weapons:

- Most European countries forbid investments in companies that produce landmines, cluster munitions, and chemical or biological weapons.

- However, some investors extend this ban to include companies involved in nuclear weapons, depleted uranium weapons, and white phosphorus – given the challenges of controlling the impact of these weapons, especially on civilians, whatever their intended use.

- The final area of exclusions covers companies that produce military equipment and services. This term can be relatively broad but covers weapons, arms, military supplies and equipment that may be used for military purposes.

Did you know?

- Exclusions on armaments are not a new development: In 1096, Pope Urban II banned the use of crossbows against Christians, and the Second Lateran Council extended this ban to archers in 1139.

- Today, some weapons deemed “controversial” are either fully or partially forbidden under international agreements or local laws, although the latter can vary by country. In addition to local and international laws, there can be further investment constraints relating to specific investor distribution standards or local regulations.

Our approach to exclusions

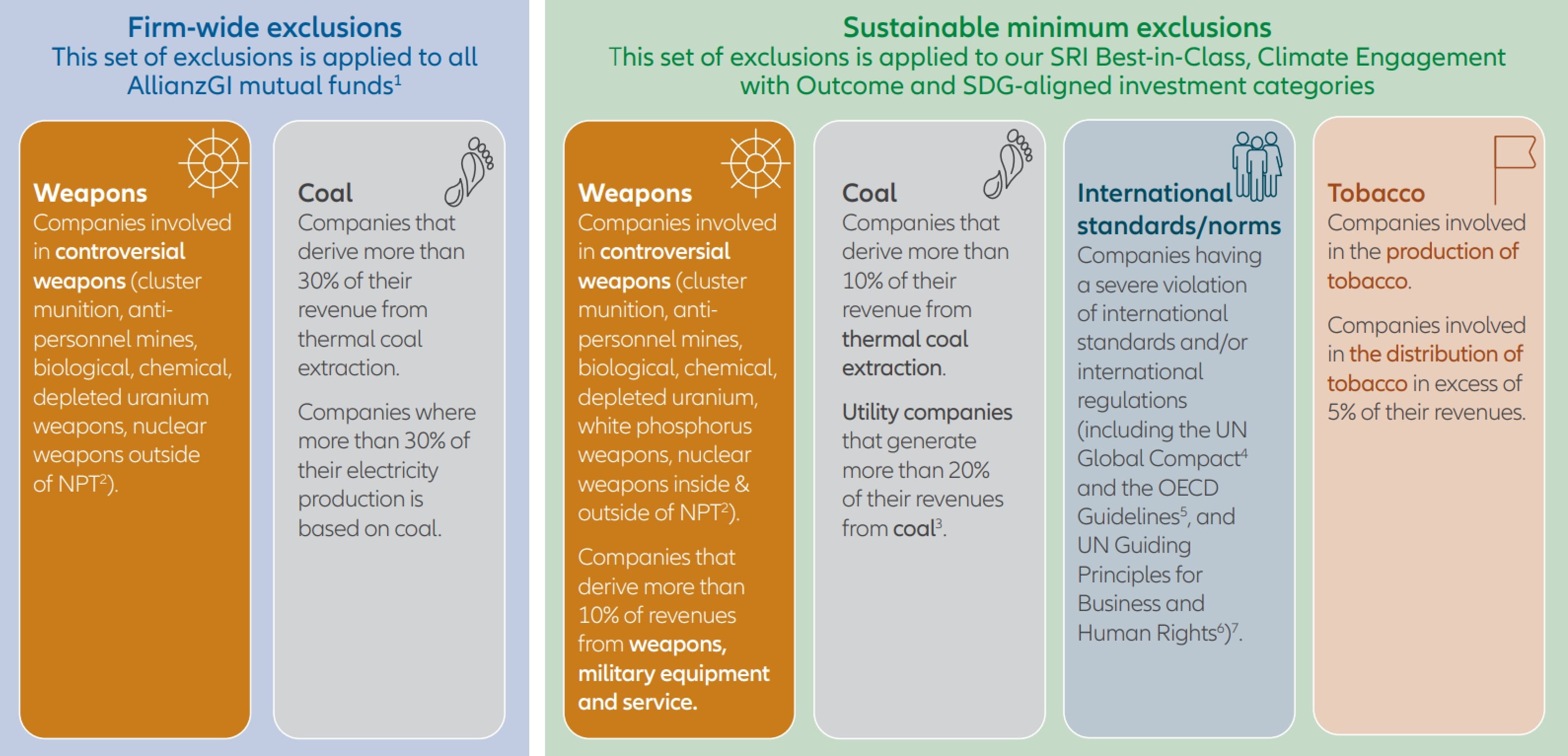

The AllianzGI exclusions policy includes firm-wide exclusions and additional exclusions for sustainable-labelled funds. The firm-wide exclusions centre on long-standing international protocols and agreements and its application covers development, production, use, maintenance, offering for sale, distribution, import/export, storage and transportation of the types of weapons listed on the left within Exhibit 1. For sustainable-labelled funds there is an additional exclusions threshold for some weapons and a threshold for some military equipment, also shown in Exhibit 1.

Exhibit 1: Allianz Global Investors – exclusions overview

Source: Allianz Global Investors, 2022. This is for illustrative purposes only.

Exclusions apply to direct investments. Specific revenue thresholds apply, for further details visit https://regulatory.allianzgi.com/en/esg. Sustainable minimum exclusions: for sovereign issuers, an insufficient Freedom House Index score is considered unless otherwise stated in the individual investment restrictions. 1. Applicable as of December 2021, where AllianzGI is acting as the management company. For institutional funds and mandates, it is subject to the consent of the respective clients. 2. Non-Proliferation Treaty, for further details visit Treaty on the Non-Proliferation of Nuclear Weapons (NPT) – UNODA 3. Please note firm-wide exclusion coal criteria on power generation (exclude companies where more than 30% of their electricity production is based on coal) will be additionally applied for sustainable funds as criteria are not the same. 4. More information can be found at https://www.unglobalcompact.org. 5. More information can be found at https://www.oecd.org/ corporate/mne//. 6. More information can be found at GuidingPrinciplesBusinessHR_EN.pdf (ohchr.org) 7. For certain cases, flagged issuers shall be on a watch list. These companies will appear on this watch list when there is our belief that engagement may lead to improvements or when the company is assessed to take remedial actions. Companies on the watch list remain investible unless we believe that our engagement or the remedial actions of the company does not lead to the desired remedy of the severe controversy.

There are other reasons why weapons may be excluded, even if they are not explicitly banned under international agreements. Examples of such exclusions include countryspecific commitments to nuclear disarmament; white phosphorus which has lawful and unlawful uses; and depleted uranium weapons for which no international agreement exists.

Our final exclusion addresses companies generating more than 10% of revenues from weapons and military equipment and services. By excluding these companies, we aim to avoid the active financing of military acts of aggression and conflict. International law recognises the right for a state to defend itself, but there is no legal consensus on the concept of “legitimate war”. In addition, by setting a threshold of 10% of revenues, we aim to avoid excluding companies whose core business is not military in nature.

Did you know?

- The theory of just war from the Latin “bellum justum”, has existed since ancient times.7 However, the description by Greek historian Appian of the means used by the Romans to be able to claim that they were on the “just” side of the Third Punic War show that in 149 BCE just wars were already difficult to define.

Military equipment is the main reason for companies being excluded – see Exhibit 2. The application of our 10% revenues threshold ensures that we minimise exposure to military equipment through other sectors outside of industrials – as shown in Exhibit 3.

Exhibit 2: AllianzGI exclusions applied to the A&D sector* by weapon type

*Based on the Bloomberg Industry Classification System.

Source: Allianz Global Investors internal data

Exhibit 3: AllianzGI’s 10% threshold minimises investor exposure to weapons

*Bloomberg Industry Classification System.

Source: Allianz Global Investors internal data

Geopolitical instability and security concerns will boost defence spending

How investors think about defence will likely change as definitions of geopolitical conflict and war evolve. The need to increase financial resources to national security has risen up the agenda for governments, following the onset of war after a long period of peace in Europe. The EU Commission’s change of approach to defence in its report on social taxonomy is another factor for European investors.

How defence budgets are spent is also evolving. For example, prior to the Ukraine crisis, the UK had decided to redirect spend from defence personnel to focus more on cybersecurity and aerospace, while in the midst of the conflict, Germany pledged to invest EUR 100 billion to modernise its military.

Defence budgets are expected to rise steadily in the coming years following a long period of underfunding, particularly in Europe. While total defence expenditure for European countries continued to rise for a sixth year running – reaching EUR 198 billion in 2020 – this figure was equivalent to only 1.5% of the GDP of the 26 European Defence Agency (EDA) member states.2 By comparison, US defence expenditure dwarfs that of every other EDA member3 as highlighted in Exhibit 4.

As conflict and defence evolve, the question is whether investments in the sector can influence the direction of capital towards a more resilient defence infrastructure, and away from more controversial activities.

However, the rise in military expenditure among European countries shown in Exhibit 5 might spark new controversies by supporting innovative technologies, such as drones and autonomous weapons, which raise new ethical questions about their use and impact. But these questions may take years to resolve, and a new international agreement could be required.

Exhibit 4: Top 10 countries by defence spending shows their changing focus

Source: Information from Stockholm International Peace Research Institute (SIPRI), https://www.sipri.org/

Exhibit 5: Expected change in defence spending for selected European countries

Source: Allianz Global Investors internal research

Did you know?

- Despite an annual military budget target of 2% of GDP agreed by NATO alliance members in 2006, only eight out of the 30 member nations are believed to be reaching this target.4

At AllianzGI, our current exclusions policy implicitly avoids controversies related to new defence systems (due to our 10% threshold). New weapons are costly to develop, and significant barriers to entry exist in the A&D sector. Companies developing new and potentially controversial weapons would likely fall within our existing exclusions.

Military transformed: the focus of future defence spending

- The increase in defence spending will help prepare European armies for the possibility of high-intensity warfare. Spending will need to be directed to develop current capacity, replenish stockpiles, modernise old Soviet era equipment for eastern countries and develop air and missile defence systems. Air forces will need to be modernised and expanded, and new warships launched. For instance, France is already working on its new aircraft carrier.

- The EU Commission established a Defence Joint Procurement Task Force to rapidly fill the gap in military equipment for EU countries by group ordering of critical equipment.

Our analysis of publicly listed companies involved in the development of weapons that typically raise such ethical concerns suggests that these activities would exceed our 10% revenues threshold.

The role of engagement in A&D

As a potential alternative to excluding companies from portfolios, active investors have the option to exert their influence through engagement. The challenge is that military companies and industries typically exist because of a Sovereign state’s interest to ensure, at least partially, the independence of its armed forces.

Furthermore, there are significant development costs and exports are often needed to make these projects economic. This adds a layer of complexity to how and with which companies the necessary engagement can be achieved. Exports are most likely to go to regions aligned with the interests of the location of the company, which means engagement is not always possible.

Despite these challenges, there is a role for engagement. It can be used to encourage improved disclosures on the types of A&D activities undertaken and evidence of governance over the supply chain of military equipment, including formal assessments or audits of internal processes and related disclosures. This focus is important in a sector that can be exposed to bribery, corruption, and high political influence.

The future of defence

Looking to the future, an important question to ask is: are the weapons used by an aggressor and a defender viewed in the same way? This analysis of investing in the A&D sector highlights that there is no clear distinction between “good” and “bad” weapons or those with a positive or negative impact. Ultimately, funding defensive weapons means funding offensive weapons and vice versa.

Our approach seeks to avoid using assets invested in sustainable strategies to finance products and services related to conflict. Through both a specific 10% revenues threshold and active engagement, our aim is to align with the UN Sustainable Development Goal 16 that upholds peace, justice and strong institutions, and seeks to “significantly reduce all forms of violence and related death rates everywhere”. As the discussion around conflict and defence continues to evolve, we are committed to playing an active role in this debate.

Appendix 1: International Agreements on related weapons

Source: UN5, Allianz Global Investors Research

1) FT.com, Defence stocks beat global market on expectations of higher spending, April 2022

2) https://eda.europa.eu/news-and-events/news/2021/12/06/eda-finds-record-european-defence-spending-in-2020-with-slump-in-collaborative-expenditure

3) Forbes, Where NATO defense expenditure stands in 2022, June 2022

4) https://www.forces.net/news/world/nato-which-countries-pay-their-share-defence

5) https://treaties.un.org/