Diversity comes of age as an investment theme

Summary

The pandemic illustrated the fragility of diversity and inclusion, making it a critical sustainable investment topic. Investors and regulators alike are insisting that companies employ more diverse workforces from the top down. At the same time, investments are emerging that specifically target greater diversity – both within organisations and in wider society.

Key takeaways

|

The notion of fairness in the capitalist economy is gaining ground – including equal treatment of individuals, communities and individual diversity categories.1 Arguments in favour of encouraging diversity are nothing new, but the pandemic revealed the fragility of the prior decades' apparent progress. In this report, we briefly introduce diversity’s complex layers and identify the lessons learned during the pandemic regarding gender diversity – the most advanced diversity typology. Furthermore, we discuss how investors can integrate diversity into investment decisions and active asset management.

Understanding the breadth of diversity

While articles and reports refer extensively to diversity, equity and inclusion (DEI), it is often narrowly applied as a concept. There is a breadth and depth to diversity, both in terms of the range of different communities affected and the various issues that impact them. Without education and understanding, many people in the broader population may not be aware of how the issue of “difference” affects their behaviour towards, or perceptions of people and communities.

To explain DEI’s breadth, the term diversity is commonly linked to gender, gender identity, ethnicity, age, religion or sexual orientation. It also encompasses education, language, disability (mental or physical) and geography. Failure to support DEI takes many forms and is often unintentional, although it’s important to recognise that legal provisions exist, but sometimes prove a hindrance. Formal recognition of diversity types, and understanding of the causes of non-inclusion, can foster development of appropriate processes and strategies that embed greater inclusion.

Lessons from the last two years

Looking at how the Covid pandemic affected diversity progress brings the lack of gender diversity back into the spotlight as this period had a particularly adverse impact on women. A study from The Lancet covering the first 18 months of the pandemic up to September 2021 showed that 26% of women experienced “employment loss” versus just over one in five men.2 Similar findings of increased job losses for women came from a World Bank3 report. The added burden on women of caring for others resulted in the pandemic experience widening a persistent employment gap. According to the International Labour Organisation (ILO)4, the current global labour force participation rate for women is just under 47%, while for men it’s 72%. This difference of 25 percentage points extends in some regions of Africa, the Middle East and South Asia above 50 percentage points.

Beyond the employment gap is the salary gap. The unadjusted pay gap averages 20% globally, according to the ILO. Yet this understates how much less women are paid because it does not take into account a range of relevant factors such as type of occupation, education and experience that might give a truly accurate picture of the wage differential. Data for this “adjusted” pay gap is very limited.

The key question arising from the experience of women in the pandemic is: if progress on gender diversity was challenged, how much more difficult was it for other under-represented groups to advance? Answering this question fully requires broader and more granular data. But the issue leads to a more general point: it’s logical to assume that equality of access and opportunity for all groups could narrow the labour force’s current gaps in skills and employment.

The evolution of diversity as an investment theme

Investors now take a holistic view of sustainability concerns, expecting that issues such as diversity are embedded into the values of asset management firms. Increasingly, asset managers are using publications like sustainability or stewardship reports to disclose their own diversity data as well as how they have engaged with investee companies and cast proxy votes on this issue.

The social case for greater inclusion is clear and there is significant academic evidence aligning it to stronger financial performance.5 Consequently, many investors now regard limited gender diversity in investee companies as a risk and have raised their expectations on the extent to which diversity is integrated into investment decisions.

Corporate diversity data nearing critical mass

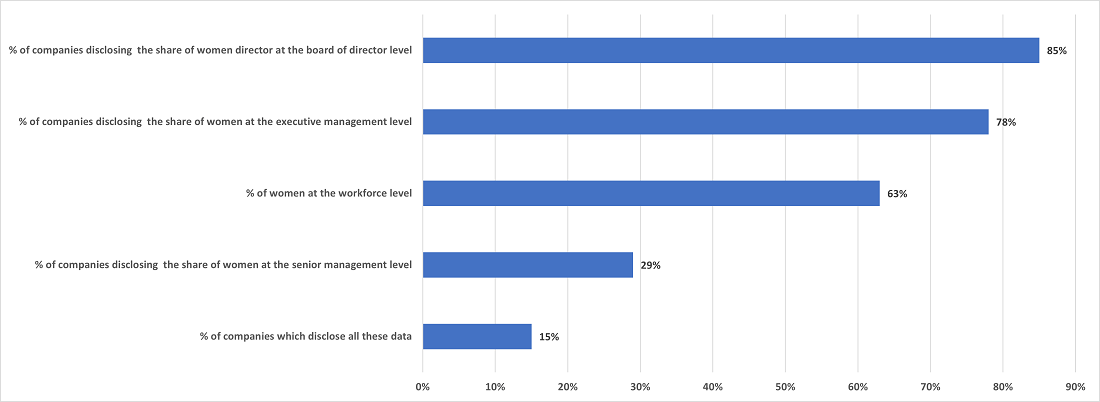

Data providers and investors are increasingly screening companies for diversity information, requiring greater disclosure. Regulators are likely to reinforce the requirement for greater disclosure (see later section). We expect required data to be aggregated at company and board levels at the very least, with periodic and consistent reporting. Companies failing to provide appropriate disclosures, strategic focus or meet certain thresholds may find themselves “screened” out or “voted against”. However, diversity is a complex topic and there are data access hurdles facing investors in certain geographies.

Engaging with companies on diversity issues is often necessary to overcome these obstacles and better understand an organisation’s diversity profile, strategic focus and governance of the topic. The information investors seek typically includes formal strategy statements, clear processes, board member responsibility, a link to compensation and, where required, pathways to strengthen a company’s position.

Driving positive change through active stewardship

Engagement takes place either bilaterally or in collaboration with other investors. Allianz Global Investors (AllianzGI) actively uses its proxy voting rights and usually votes against re-election of the chair of the nominations committee of large-capitalisation companies in developed markets if women make up less than 30% of the board.6 We also expect nationality and ethnic diversity to appropriately reflect a business’s geographic footprint and employee and customer profile. For example, AllianzGI would not support re-election of the chair of a large-cap listed US company’s nominations committee if there was not at least one board member from an under-represented ethnic group. This rule will also be implemented in the UK next year

Collaborative engagement is also a powerful tool. In 2021, AllianzGI joined the 30% Club Investor Group in France, which aims to increase female representation at leadership levels of large listed domestic companies.

The role of regulation

Regulation on diversity is evolving. A growing number of states in the US and the EU now insist on a minimum percentage of women at board level, and there is rising pressure to improve disclosure (see Exhibit 1). For example, the Securities and Exchange Commission7 is planning to publish amendments to disclosure regulation this year to improve transparency into the composition of the workforce, including diversity, aligning with Nasdaq rule changes related to board diversity and disclosure.8 The European Commission recently proposed9 a new directive updating the current text on equal pay, with new dispositions to improve pay transparency, including adjusted pay gaps.

Exhibit 1: gender diversity KPIs for MSCI ACWI index constituents (database of 2,753 companies)

Source: MSCI, as at 10 March 2022

Growing opportunities to invest for greater diversity

Away from screening for weak diversity “footprints”, there are increasing opportunities to invest in companies with a broad and positive diversity “handprint” – those companies that have a positive impact in society beyond their own footprint. For this reason, diversity lends itself to impact investing where a positive measurable benefit is targeted.

Emerging opportunities include social, sustainability and sustainability-linked bonds. These debt instruments can direct capital either to specific diversity projects or provide capital for a company that is committed to stated diversity goals. For instance, the Social Bond Principles specifically aim to address social issues related to diversity.10 For example, an emerging-markets telecoms operator has issued a sustainability bond to fund information and communication technology training for women, boosting their participation in the digital economy. In the US, Fannie Mae’s Sustainable Bond Framework makes home ownership and rental possible for millions of Americans, specifically including underserved communities.11

Many of the available instruments and sustainable investment offerings use the United Nations’ 17 Sustainable Development Goals (SDGs) as a framework. SDGs 5 and 10 specifically address gender diversity and reduced inequalities, but SDG 3 (Good health and Well-being), SDG 6 (Clean Water and Sanitation) and SDG 8 (Decent Work and Economic Growth) can have meaningful ancillary benefits for inclusion, especially in resource-constrained, lower-income economies. In 2019, the Global Impact Investing Network published its Gender Lens Investing Overview12, which provided a framework for investors which could similarly be adapted to improve other workplace diversity weaknesses

To conclude, the pandemic not only illustrated the fragility of diversity but also brought it to centre stage for the investment community. The momentum for investors to act as change agents for greater diversity in workforces, as well as wider society, is significant and still growing. In many ways, the present time will prove to be a coming of age for DEI.

1. Allianz Global Investors, Unlocking the “S” in Capitalism, February 2022 https://www.allianzgi.com/en/insights/outlook-and-commentary/unlocking-the-s-in-capitalism

2. L S Flor, J Friedman, C N Spencer, J Cagney, A Arrieta, M E Herbert et al, Quantifying the effects of the COVID-19 pandemic on gender equality on health, social, and economic indicators: a comprehensive review of data from March, 2020 to September 2021, The Lancet, March 2022 https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(22)00008-3/fulltext

3. World Economic Forum, Global Gender Gap Report, March 2021 https://www3.weforum.org/docs/WEF_GGGR_2021.pdf

4. International Labor Organization, The gender gap in employment: What’s holding women back? February 2022 https://www.ilo.org/infostories/en-GB/Stories/Employment/barriers-women#intro

5. An example is McKinsey, Delivering through diversity, January 2018, https://www.mckinsey.com/business-functions/people-and-organizational-performance/our-insights/delivering-through-diversity

6. Allianz Global Investors https://www.allianzgi.com/en/our-firm/esg/our-approach

7. US Securities and Exchange Commission, Prepared speech before the PRI “Climate and Global Financial Markets” Webinar, July 2021 https://www.sec.gov/news/speech/gensler-pri-2021-07-28

8. US Securities and Exchange Commission, Statement on Nasdaq’s Diversity Proposals – A Positive Step for Investors, August 2021 https://www.sec.gov/news/public-statement/statement-nasdaq-diversity-080621

9. EU Action for Equal Pay, Equal pay for equal work, March 2020 https://ec.europa.eu/info/policies/justice-and-fundamental-rights/gender-equality/equal-pay/eu-action-equal-pay_en#pay-transparency

10. International Capital Market Association, Voluntary Process Guidelines for Issuing Social Bonds, June 2021 https://www.icmagroup.org/assets/documents/Sustainable-finance/2021-updates/Social-Bond-Principles-June-2021-140621.pdf

11. Fannie Mae, Social Bond Framework, April 2022 https://capitalmarkets.fanniemae.com/media/20616/display

12. GIIN, Gender Lens Investing Overview, 2019 https://thegiin.org/gender-lens-investing-initiative

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).

2200925

Summary

Armed conflict, financial woes and inflation shocks have contributed to a tricky 2022 so far for emerging markets. But a broader, systemic crisis is not anticipated for emerging-market debt, and there might be reasons for optimism about a recovery.

Key takeaways

|