Summary

Listed US technology companies often continue to be run by their founders, who also retain large or majority shareholdings. This situation can lead to questions over their compensation policies. Regardless of the type of ownership, concerns are exacerbated when boards fail to read the expectations of shareholders, evidenced by poor outcomes at shareholder meetings, and this requires active investors to engage directly with the board.

Key takeaways

|

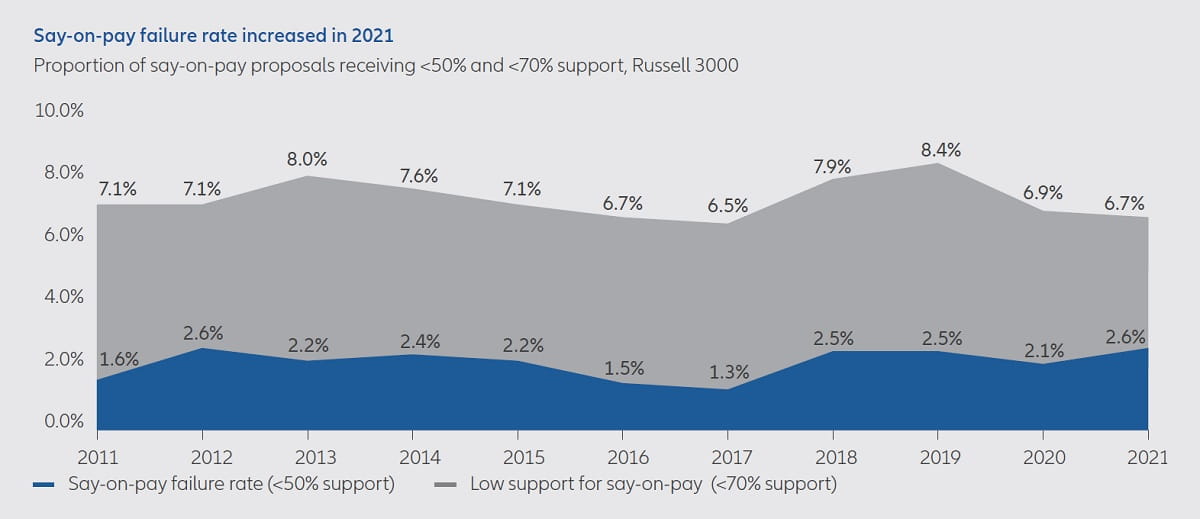

This year’s US AGM season threw up a growing number of cases where companies failed to win shareholder support for their advisory vote on pay. Research shows that 2.6% of AGM votes on pay went against management, up from 2.1% last year1.

And many of these expressions of dissent took place at technology company AGMs. We view these instances as red flags, which in some cases were followed by share price underperformance. This is not surprising; the board’s failure to read the expectations of their company’s largest shareholders could be indicative of broader governance blind spots.

Source: ISS Governance – 2021 Proxy season review, United States compensation

At Allianz Global Investors, our approach to questions around executive pay is shaped by our Global Corporate Governance Guidelines2. The fundamental premise is that the structure and level of executive pay should be designed to promote the long-term success of the company. This entails the board having a clear ongoing apprehension of the expectations of shareholders. The guidelines detail the issues we expect boards and compensation committees to consider, such as the use of share-based compensation to help align the interests of management and shareholders. We support long-term incentive plans that set demanding, multi-year targets and encourage outperformance.

From governance guidelines to practice

The public equity market in the US is more dominated by large institutional shareholders than other regions3. Interestingly, it also exhibits the least concentrated ownership among the OECD economies, with ownership of each company typically spread across a broader number of shareholders. This means that our policy can be readily applied to the US equity market.

However, in this context the technology sector is an outlier within the US; it has emerged in recent decades and many of its companies are still run by their founders. Among more recently established technology companies that have chosen to go public, the founders often retain ownership and voting control4. In this, the technology sector differs markedly from others, where founding entrepreneurs are no longer significant shareholders in companies with previously concentrated ownership (eg, multi-generational, family-controlled businesses).

Alignment in founder-run companies is not guaranteed

We recognise that founders can be an integral part of a company’s investment case. However, founder-run or controlled companies face a variety of corporate governance risks, ranging from skewed control and ownership structures to issues over the balance and composition of the board. One high-profile consequence can be that compensation and long-term incentive structures do not align management’s interests closely enough with those of minority shareholders.

Pay is not the only way to ensure an alignment of interests between management and shareholders. Another key factor is the board, which provides checks and balances to prevent abuse of power by the CEO and management and hold them accountable for performance. The effectiveness of the board is, therefore, another factor we consider when assessing executive compensation. For example, seeking to establish the robustness of the pay-setting process, we consider whether the board – and critically the compensation committee – has sufficient level of independence.

We apply our Global Corporate Governance Guidelines equivalently in all cases, seeking a clear alignment between management and shareholders, irrespective of the ownership structure. Ad-hoc research provided to us recently finds variations between sub-segments of the technology sector, with some founder CEOs receiving compensation in line with peers, while in other cases there are material differences. An important consideration for us as investors is the extent to which management performance is reflected in share price performance.

Our experience so far does not indicate any correlation between compensation structures and inadequate alignment of management and shareholder interests; there is no particular feature of pay in founder-managed companies which makes them more or less prone to poor alignment. There are instances of founder CEOs who choose to receive below-market pay, in some cases nil, suggesting that they see themselves primarily as shareholders in the company. In other cases, we observe that founders’ pay is in line with, or sometimes well above, market rates.

Hence, in situations where we have questions about the degree of alignment between management and shareholders, we may decide to engage with the board to gain a clearer understanding of the details of these compensation structures and how they reflect performance. The results of this engagement may be an overriding factor in determining whether we accept management’s voting recommendations on pay.

Engagement in pursuit of deeper insight

A well-designed executive compensation scheme should support the alignment of management, primarily with shareholders but also with key stakeholders5. In the case of companies run by the founding individual, there tends to be a substantial or controlling shareholding. Where we question the appropriateness of compensation levels or structures, we engage with the board to better understand the rationale and long-term strategy behind compensation schemes.

As an active asset manager, we are keen to differentiate between high and misaligned levels of compensation. We are comfortable supporting high levels of compensation where the company has performed well, and we consider its strategy to have positioned it positively for the long term. In our engagement, there are several areas we regularly explore to gain insights that will supplement our analysis of published corporate reports. These include:

- The rationale behind the compensation policy or specific Compensation Committee decisions.

- The alignment of executive compensation trends with those of the workforce, which can provide insights into the organisation and identify potential areas of internal friction.

- The board’s perspective on the company’s social profile. Does it have an inclusive approach to all stakeholders (eg, employees, customers, local external stakeholders)?

- Management responsiveness to shareholder and stakeholder views and feedback. How regular, extensive and meaningful is the outreach?

Engagement in pursuit of change

Should the answers to our questions highlight risk factors or areas for improvement, we would continue our dialogue to focus on these issues. Our policy clearly explains our favoured governance structures, especially in cases involving companies that have a large base of institutional investors and are run by professional managers with small shareholdings. We will engage with management teams to discuss how they could amend compensation structures to be more aligned with our guidelines. In discussing the design of long-term incentive schemes, we may encourage companies to6:

- Reduce reliance on share options – these can provide an asymmetrical and geared incentive versus long-term shareholdings or strategy. This means that although their value is linked with upward share price movement, their economic value grows at a faster rate than the corresponding share price growth. Additionally, while shareholders may experience loss, recipients of share options can only experience an upside.

- Extend performance stretch targets – high levels of compensation should not be delivered unless linked to outperformance against peers or expectations, not business-as-usual.

- Reduce or eliminate equity awards that are not subject to performance criteria or thresholds.

- Avoid judging performance over periods shorter than three years.

Conclusion: we will deepen our engagement with technology companies

We have identified technology as a particular segment of the US market where we believe there is scope for improved compensation structures and will continue to engage with several of our investee companies on this topic. We will use this engagement process to make clear our expectations and the basis on which we will vote in next year’s AGM season.

Sources:

1 ISS Governance – 2021 Proxy season review United States compensation

2 Available on www.allianzgi.com

3 OECD “Owners of the World’s Listed Companies”, available on www.oecd.org

4 CFA Institute “Dual-Class shares: the good, the bad, and the ugly” www.cfainstitute.org

5 Increasingly stakeholder considerations are also in play. For example, certain aspects of pay affect issues of inclusive capitalism, they include pay gaps across gender or ethnicity.

6 This is a partial list focused on typical shortcomings of long-term incentives. Please refer to our Global Corporate Governance Guidelines for a full outline of our expectations.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

1914640

Carbon offsets: debate to define role in net zero

Summary

Carbon offsets sparked fierce debate between policymakers and campaigners during COP26. Such discussion is vital to help fix some of the perceived flaws in a tool that will have a role to play in the net-zero drive.

Key takeaways

|