Embracing Disruption

Ageing water infrastructure – inaction not an option

Outdated water infrastructure poses enormous challenges for many European governments. In conjunction with unprecedented droughts, poor water supply and ageing water networks are having disastrous effects on Europe's crop yields, putting further pressure on already strained food commodity prices. Investments in companies that offer water-efficient and water-saving solutions along the entire water value chain can help addressing these problems.

Key takeaways:

- Recent droughts in Europe have focused attention on ageing and inadequate water infrastructure in Europe.

- Governments are preparing to make significant investment in water-related infrastructure and sewerage.

The unprecedentedly warm and dry weather experience by much of Europe this summer have brought the issues of water shortages and drought sharply into focus for many European governments and water utilities. Indeed, the problems go beyond just potential shortages in water itself. The knock-on effects for agriculture, the largest consumer of drinking water, are already leading to severe drops in seasonal harvests in some regions, putting further pressure on food commodity prices, already strained by recent geopolitical developments in Europe – for instance, the Italian famers’ association Confederazione Italiana Agricoltori suggests local corn and soybean production could be down around 50% this year, while the agricultural group Coldiretti reports declines in barley, rice and grain production, estimating the overall bill to agriculture caused by summer drought at around EUR 3 billion1.

Indeed, at the broader European level, recent findings from the European Union’s Joint Research Centre suggest that this year’s exceptionally hot and dry conditions had a serious impact on the yield forecast for EU summer crops, with shrinking reservoir levels requiring several countries to restrict irrigation or to abandon the irrigation of some fields altogether.2

Drought’s impact on clean energy supply

A further area of concern is the impact of drought on hydroelectric power production, especially in Italy, Switzerland Austria, and others that rely on this means on power generation to a greater extent than some of their northern neighbours. Hydroelectric capacity normally produces around one sixth of Italy’s total electricity needs, yet in the regions most affected by drought, supply this summer was down by around 50%3. The issue of water supply is thus also having a slowing impact on the green transition away from fossil fuels.

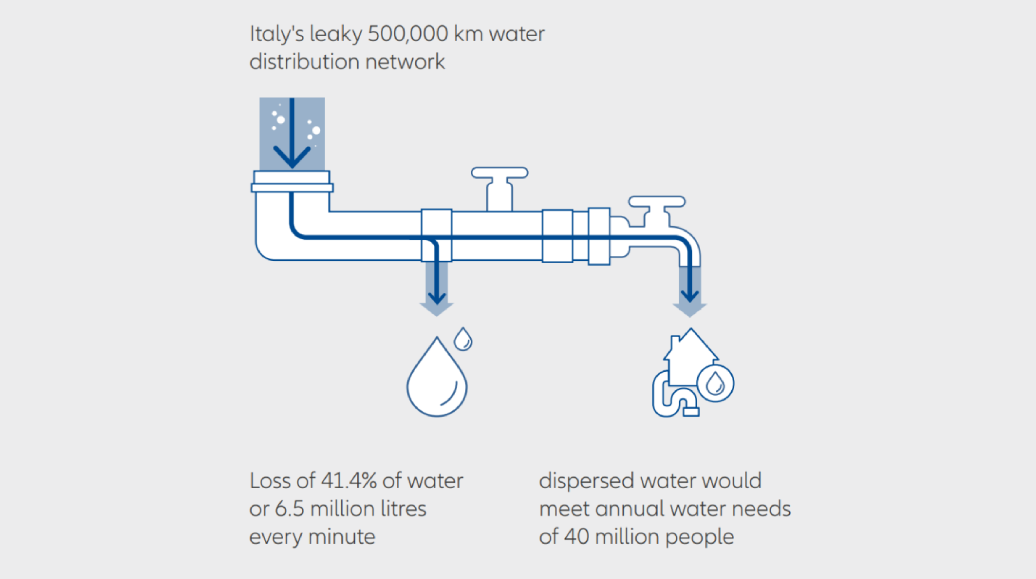

While the cause of current droughts in Europe is likely to be found in our changing climate, the issue of ageing and inadequate infrastructure is severely compounding the problem. For instance, in Italy it is estimated that, due to leaky pipes, around 40% of water is lost before reaching end users, representing 6.5 million litres lost every minute across the country’s 500,000 km distribution network.4

And the problem is not just restricted to Italy; in the UK, for example, London’s Victorian era network of pipes and sewage tunnels are estimated to leak around 25,000 litres of water a second,5 representing not just a huge level of waste, but also causing damp and related problems in many London homes.6

The problem of inadequate water-related infrastructure in the UK also reared its head across many of the country’s beaches this summer. Due to deficiencies in sewage treatment facilities, storms and flash flooding led to an unprecedented volume of raw sewage and wastewater being dumped into the sea.7 Cornwall, a favoured domestic holiday destination due to the picturesque coastline and relatively mild weather, alone saw 14 of its 80 bathing beaches off limits due to sewage at various points this year.8

Given that the infrastructure in many western industrial countries is very old, it will become more and more difficult to cope with future challenges. Much existing infrastructure was built more than 50 years ago, with some backbone facilities being even older. Global warming and fewer reservoirs are creating a severe challenge to the current system, and investments to fix the most pressing problems is necessary to deal with the challenges to come.

The costs of inaction

The social and financial costs of inaction on water infrastructure are clear, and many governments are now starting to act. In Italy, the Federation of Water Utilities estimates that EUR 3 billion is necessary for urgent maintenance work, compared to a current annual budget of EUR 50 million9 – the problem has thus become pertinent in the upcoming Italian general election, with the various parties setting out a range of proposals to address the issue. In the US, the recent USD 1.2 trillion infrastructure bill included USD 105 billion for water infrastructure projects. Although the entire plan has been withdrawn due to current high inflation levels, the pressing need in the US remains and will be picked up over the years to come. While in the UK regulators are considering penalties and other incentives to force water utilities to invest adequately in upgrading ageing pipes and further developing insufficient sewage processing capacity.10

These problems, and the associated investment that is required to rectify them, are creating opportunities for innovative, solutions-oriented companies whose products and services can help us do more with less water supply, as well as those that supply modern parts and equipment to enhance existing infrastructure. Indeed, given the sheer scale of current issues surrounding water supply and wastewater, many of these companies are well positioned for long-term growth, presenting opportunities for informed investors along the water value chain.

1) Bloomberg: Italy Declares State of Emergency on Impact from Drought, 5th July 2022

2) https://joint-research-centre.ec.europa.eu/jrc-news/summer-drought-keeps-its-grip-europe-2022-08-22_en

3) Bloomberg: Italy Declares State of Emergency on Impact from Drought, 5th July 2022

4) Washington Post: Romans mastered aqueducts. Now Italy is just trying to fix its leaky pipes July 30th, 2021

5) Ofwat Service Delivery Report, 2020-1, www.ofwat.gov.uk/publication/ service-and-delivery-2020-21 / https://www.water-technology.net/projects/thameswater

6) https://www.bbc.com/news/uk-england-london-44227168

7) https://www.ft.com/ontent/0140a61d-6c78-4f9a-8f8d-1a797f7475bb

8) https://edition.cnn.com/travel/article/uk-beaches-sewage-england/index.html

9) Smart Water magazine: Italy’s water network is like a sieve: 6.5 million liters are lost every minute 15th March 2019

10) https://www.ft.com/content/0140a61d-6c78-4f9a-8f8d-1a797f7475bb