Summary

In the world of fixed income, Asia can offer more income potential and relative value than many other regions. This should be particularly helpful to investors today, given historically low interest rates and concerns over high valuations.

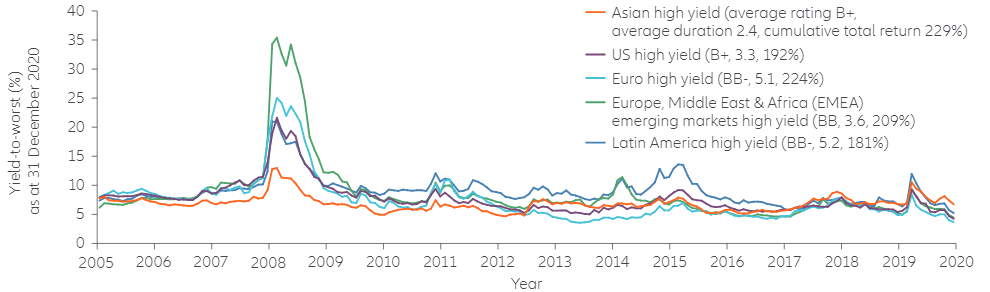

Although some fixed-income securities finished 2020 ahead of Asian high-yield bonds, the region still exhibited positive performance. Plus, this sector features what we believe is a very strong outlook. Among the many reasons why Asian high-yield bonds look enticing in today’s low-yield environment (see chart):

- The Asian high-yield market has the same average credit rating as its lower-yielding US counterpart. Yet the yield pick-up Asia offers over other regions is at multi-year highs. In fact, since 2005, the cumulative performance and resilience of Asian high-yield bonds (up 229%) has been better than other regions.

- Asian high-yield bonds have lower average duration than other regional markets – and lower durations generally involve less interest rate risk. This is particularly attractive today, when corporate bonds seem increasingly vulnerable to losses from sudden volatility in interest rate expectations.

Asia’s yield pick-up over other regions is at multi-year highs

Yield-to-worst of major high-yield market indices

Source: JP Morgan and ICE BofA indices; Allianz Global Investors. Cumulative total return values are based in USD or (for euro and EMEA emerging markets) hedged into USD. Yield-to-worst figures for euro high yield are hedged into USD. Yield-to-worst for corporate bond indices is the yield-to-maturity adjusted down for bonds which can be “called away” (redeemed optionally at predetermined times before their maturity date). Past performance is not indicative of future results. See the disclosure at the end of this document for important index information.

The strength of Asian high yield bonds comes despite factors that investors might consider negative for this asset class – including the ongoing Covid-19 pandemic and pockets of stress in China’s property market.

We expect the markets to further recognise the potential of this sector as investor attention shifts to higher-yielding and shorter-duration assets that offer relative value and greater protection from unexpected macroeconomic shocks. Indeed, foreign investors have steadily increased their holdings, buying about a quarter of all the newly issued Asian high yield bonds in 2020.

Given that one of the main reasons Asian high-yield bonds are attractive is their consistently strong coupon returns, which accrue over time, investors interested in this asset class should consider long-term allocations. Moreover, with a size of less than USD 300 billion, Asia’s USD high-yield market is relatively small and concentrated. To expand the opportunity set and add to risk diversification, it’s important to be active in looking for the right opportunities.

With more than 70% of developed-market government bonds in negative-yielding territory, and the average investment-grade corporate bond yield at a record low of less than 2%, we may be on the brink of a more strategic asset allocation shift to Asia and China. This shift has already accelerated in equities, and high-yield credit is well-placed to follow suit.

Learn more

For in-depth insights into the Asian high-yield bond opportunity, read the original paper: “Why Asian high yields may soon turn from laggard to leader”.

In the chart shown, Asian high yield is represented by JP Morgan Asia Credit Index - Non-Investment Grade; US high yield by ICE BofA US High Yield Index; euro high yield by ICE BofA Euro High Yield Index; EMEA high yield by ICE BofA High Yield EMEA EM Corporate Plus Index; Latin America high yield by ICE BofA High Yield Latin America EM Corporate Plus Index. For index definitions, visit: JP Morgan Index Suite and ICE BofA Indices. Investors cannot invest directly in an index.

1555147

China: the “sleeping giant” of the equity markets

Summary

Despite the coronavirus pandemic and ensuing global slowdown, 2020 was a watershed year for China in many ways. William Russell, Global Head of Product Specialists Equity, explains how China is delivering on its long-term strategy and what opportunities this can provide for investors.

Key takeaways

|