Active is: Anticipating what’s ahead

“Year of the Ox” symbolises China’s strong future

Summary

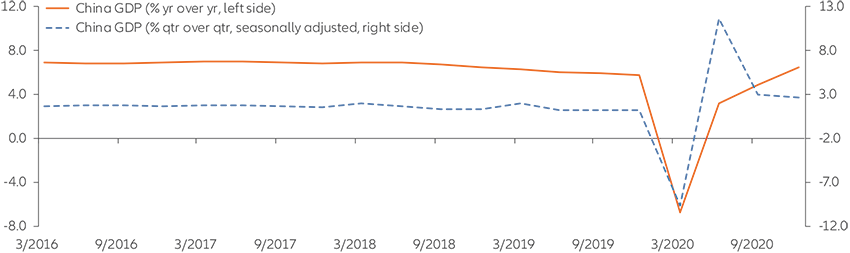

This lunar new year, China has much to celebrate – including resilient economic growth, widespread success at suppressing Covid-19 and a steady transformation into an advanced economy. That’s why the ox is a suitable symbol for a country that continues to do the hard work needed to maintain its trajectory.

Key takeaways

|

Summary

In the world of fixed income, Asia can offer more income potential and relative value than many other regions. This should be particularly helpful to investors today, given historically low interest rates and concerns over high valuations.

-

The MSCI China A Onshore Index is an unmanaged index that captures large- and mid-cap representation across China securities listed on the Shanghai and Shenzhen exchanges. The MSCI World Index is an unmanaged index considered representative of stocks of developed countries. The MSCI USA Index is an unmanaged index designed to measure the performance of the large- and mid-cap segments of the US market. The MSCI China H Index is an unmanaged index that captures large- and mid-cap representation across Chinese companies incorporated on the mainland and traded in Hong Kong. Investors cannot invest directly in an index.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Equities have tended to be volatile, and do not offer a fixed rate of return. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. Credit risk reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. Emerging markets may be more volatile, less liquid, less transparent, and subject to less oversight, and values may fluctuate with currency exchange rates. Environmental, social and governance (ESG) strategies consider factors beyond traditional financial information to select securities or eliminate exposure which could result in relative investment performance deviating from other strategies or broad market benchmarks. Currencies involve risks such as credit risk and interest rate fluctuations, and can be more sensitive to the effect of varied economic conditions of the underlying country. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

Will China keep the coronavirus at bay?

Covid-19 is the main risk for economic growth globally – and China is no exception. But China and Asia overall seem to be in a better position than their Western counterparts, given that the United States, the European Union and other major economies are still struggling to bring the coronavirus under control. If China’s economy keeps up its strong recovery, China’s equity and bond markets may look increasingly attractive.

Will China repair relationships with existing trading partners– and strengthen new ones?

China’s troubled relationship with the US has been a major geopolitical theme in recent years. US President Joe Biden may help reduce tensions, but some issues will undoubtedly remain. This is one reason why China has been steadily becoming more self-sufficient by strengthening its supply chains, building up its own advanced-manufacturing capabilities and forming new alliances.

For example, the new Regional Comprehensive Economic Partnership (RCEP) creates an economic bloc of Asia-Pacific nations that covers a third of the world’s population. The RCEP deal will apply to almost 30% of global trade and GDP – more than the EU’s trading bloc or the US-Mexico-Canada agreement.

The EU and China also recently announced their Comprehensive Investment Agreement (CAI) after seven years of negotiations. This should provide the EU with access to important new commercial opportunities in the manufacturing, automotive and financial services sectors, among others. For China, the CAI is a strategic breakthrough, helping it form new international partnerships amid the rise of protectionism and anti-China sentiment.

Will China keep up its successful economic transformation – or will it overreach?

China continues to make progress in developing innovative technologies that help the country compete in higher value-adding, advanced-manufacturing sectors such as robotics and aviation. Recently, China officially launched its “Dual Circulation Strategy”, which involves substituting imported goods (such as semiconductors) for domestic ones while expanding domestic demand. The goal is to further advance China’s per-capita GDP so the country can more quickly complete its transformation to an advanced economy.

These policies have been well-received by the financial markets overall, but others haven’t been. China’s regulators recently clamped down on some of the country’s best-known corporations, accusing them of monopolistic and anti-consumer behaviour. However, we don’t believe Beijing will take this too far for fear of putting Chinese companies at a competitive disadvantage.

Will China continue emphasising sustainability?

Slowly but surely, China is devoting more attention to the issues that are critical to the sustainability of its economy.

At the same time, China must do more to improve transparency so investors can understand more about how companies and policymakers are approaching important ESG issues. Until then, it’s vital for investors to find partners who can provide proprietary research into what’s really happening behind the scenes.