European Equity Markets Commentary

The principal issues that have kept us busy over recent months will continue to be decisive in the rest of 2023. The European economy remains characterized by inflation, rising interest rates and uncertainties regarding the geopolitical situation. In the words of the European Central Bank President, Christine Lagarde: “We are now entering the second phase (of inflationary developments) in which rising wages play an important role in inflation”. These developments set the stage for the further trajectory of central bank rates over the coming months, but also show the cost situation emerging for many companies.

2023 – what else awaits us?

Consumer spending and strong labour markets have driven inflation. While companies could easily raise their prices, and thus pass increased costs on to customers, corporate profit margins remained high. However, the game is now changing. Although labour markets remain resilient, high prices are leading to lower consumption, and there is now little leeway for further price increases. And the appetite for higher wages is also affecting profit margins.

Another issue currently faced by many corporates is “destocking”. The disruption of value chains during the Covid pandemic led to large stocks of raw materials and semi-finished products being built up in order to ensure production could keep going. It is now necessary to reduce these stocks back to the normal level, impacting the suppliers of such materials. And this process also extends to consumers, as they too also hoarded goods during this period. The consumption of these stored goods, materials, and products is now taking place, resulting in lower incoming orders and sales.

Current data confirm this trend. The so-called PMI (purchasing managers’ index) indicates that, in some European countries, incoming orders from companies are declining, especially those from abroad. Economic sentiment is also declining in other areas, such as services. While it is certainly premature to speak of a crisis, the lack of momentum from other regions is clear.

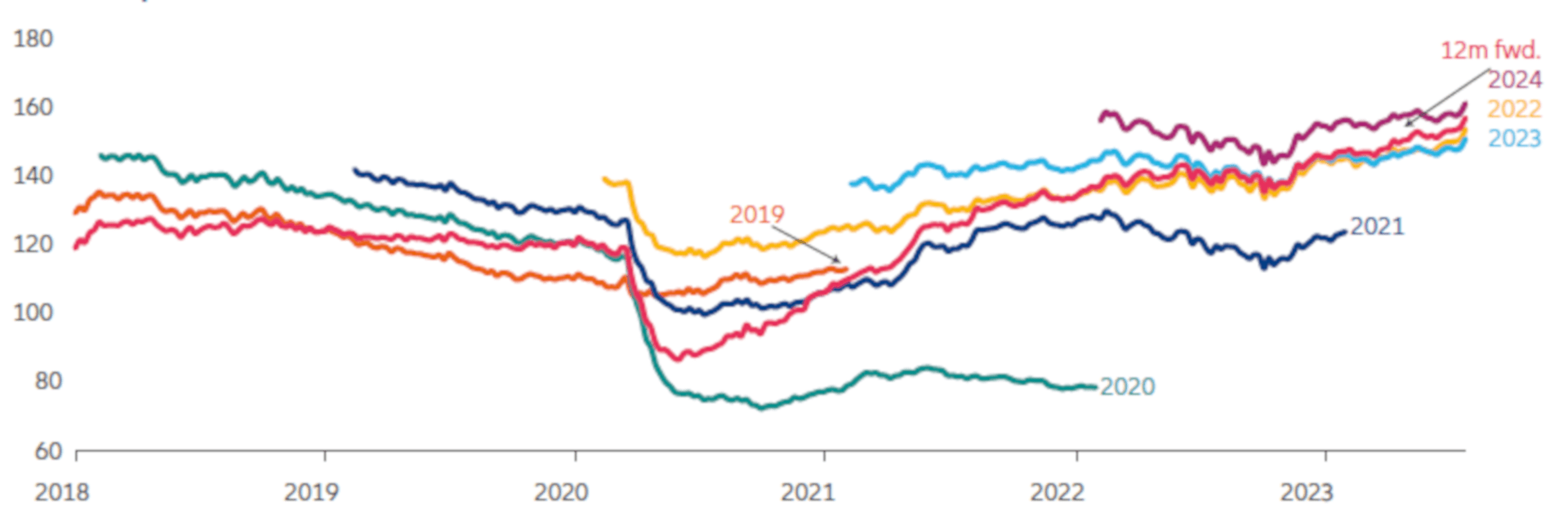

MSCI Europe consensus EPS

Sources: Refinitiv/Datastream, AllianzGI Economics & Strategy. As of 27 April 2023. Past performance and forecasts do not predict future returns.

The above chart shows MSCI Europe expected earnings, and we can see the course of profit expectations over time. A slight increase in earnings per share was expected for 2023 at the end of last year, but this is now flattening out.

Most markets were benign during the first half of 2023, driven by low valuations, hopes of stable economic development, and the possibility of interest rates falling again. These hopes are not being borne out, and the situation will likely be more difficult over the coming months. Businesses will feel the effects of higher costs, wages, and interest rates; however, as long as labour market are not significantly affected, we expect normalization in 2024 and a return of rising profits. Energy prices will fall, and destocking will come to an end, while inflation will fall to more reasonable levels. Indeed, inflation will be with us for some time to come and, with it, higher interest rates. However, any easing of the geopolitical situation will also give the markets new potential.