Interpreting China

How understanding China’s “new formula” is critical to investors

How understanding China’s “new formula” is critical to investors. The complementarity aspects of three recent Chinese initiatives are instrumental in understanding how China’s role in the world is changing.

Key takeaways

- The complementarity aspects of three Chinese initiatives in China – BRI + China Standards 2035 + Made in China 2025 – are instrumental in understanding how China’s role in the world is changing.

- China Standards 2035 is a project that aims for China to take the lead with global technical standards, while Made in China 2025: in an industrial policy China aimed at expanding rapidly its high-tech sectors and advanced manufacturing base.

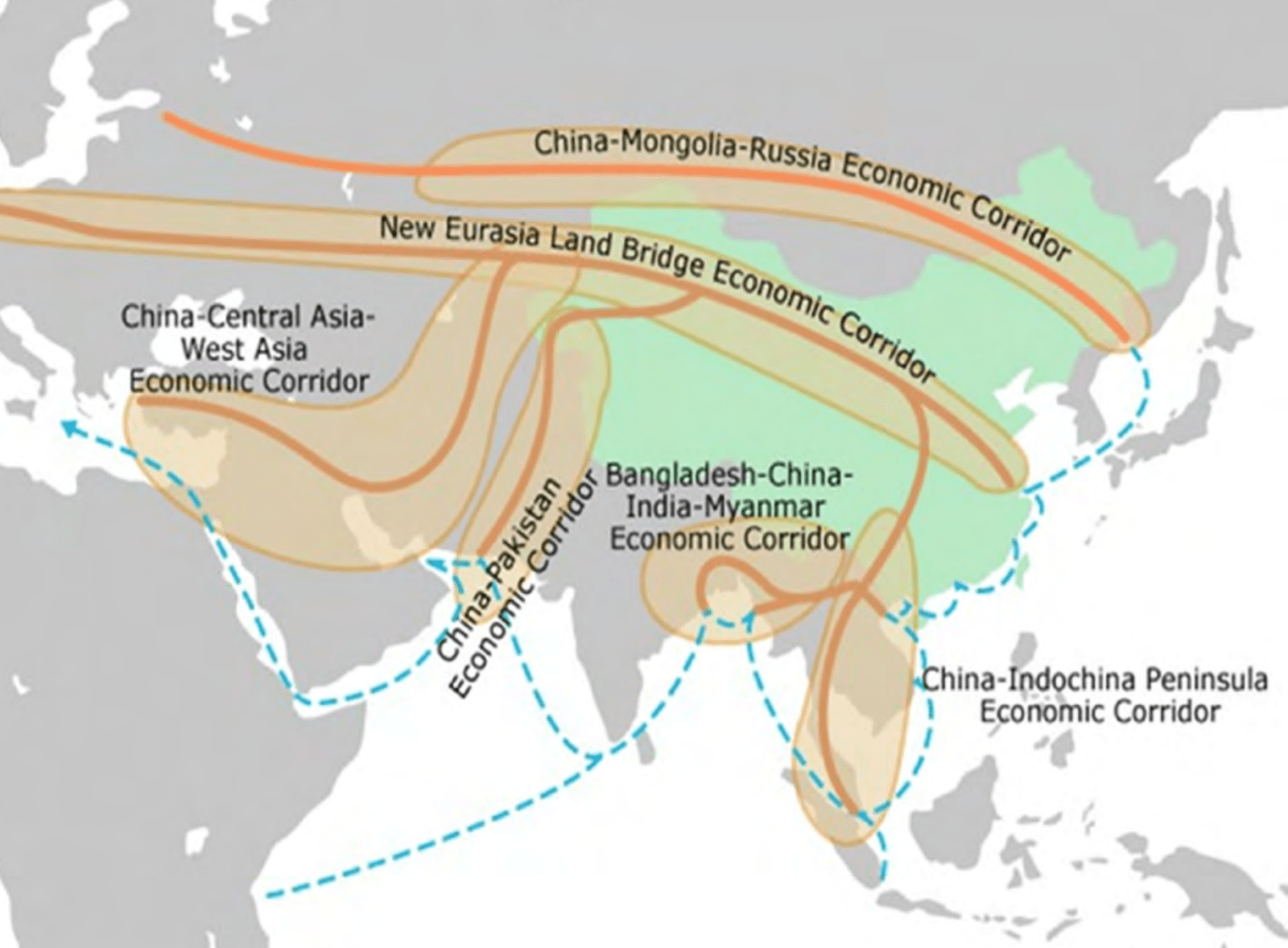

- The BRI (Belt and Road Initiative) is also growing China’s influence on the “Global South”, with 151 countries participating in the initiative, covering 75% of the world’s population and over 50% of world’s GDP.

- The implications of this new phase of development and the combination of the 3 strategies will be profound. It is critical for investors to follow their development and understand what reaction they impulse at the geopolitical level.

An initiative to take leadership in global standard setting bodies might not grab the headlines in the same way as landmark development strategies such as the “Belt and Road”, but China’s “Standards 2035” project speaks strongly of the country’s ambitions both in the economic and technical spheres, as well as the geopolitical. Indeed, influencing international standards – and the norms and procedures that are based on them – in a particular domain can potentially have a powerful effect in driving domestic innovation and technological leadership. Within the framework of the “Digital Silkroad”, China has initiated major infrastructure projects such as, for example, building cable networks connecting Asia and Europe overland. Growing Chinese leadership in international standard-setting bodies tells us something about the way the Chinese economy is currently developing, but also about what the broader effects of this may be in the medium-term, with respect to tech ecosystems, trading blocks, and geopolitics.

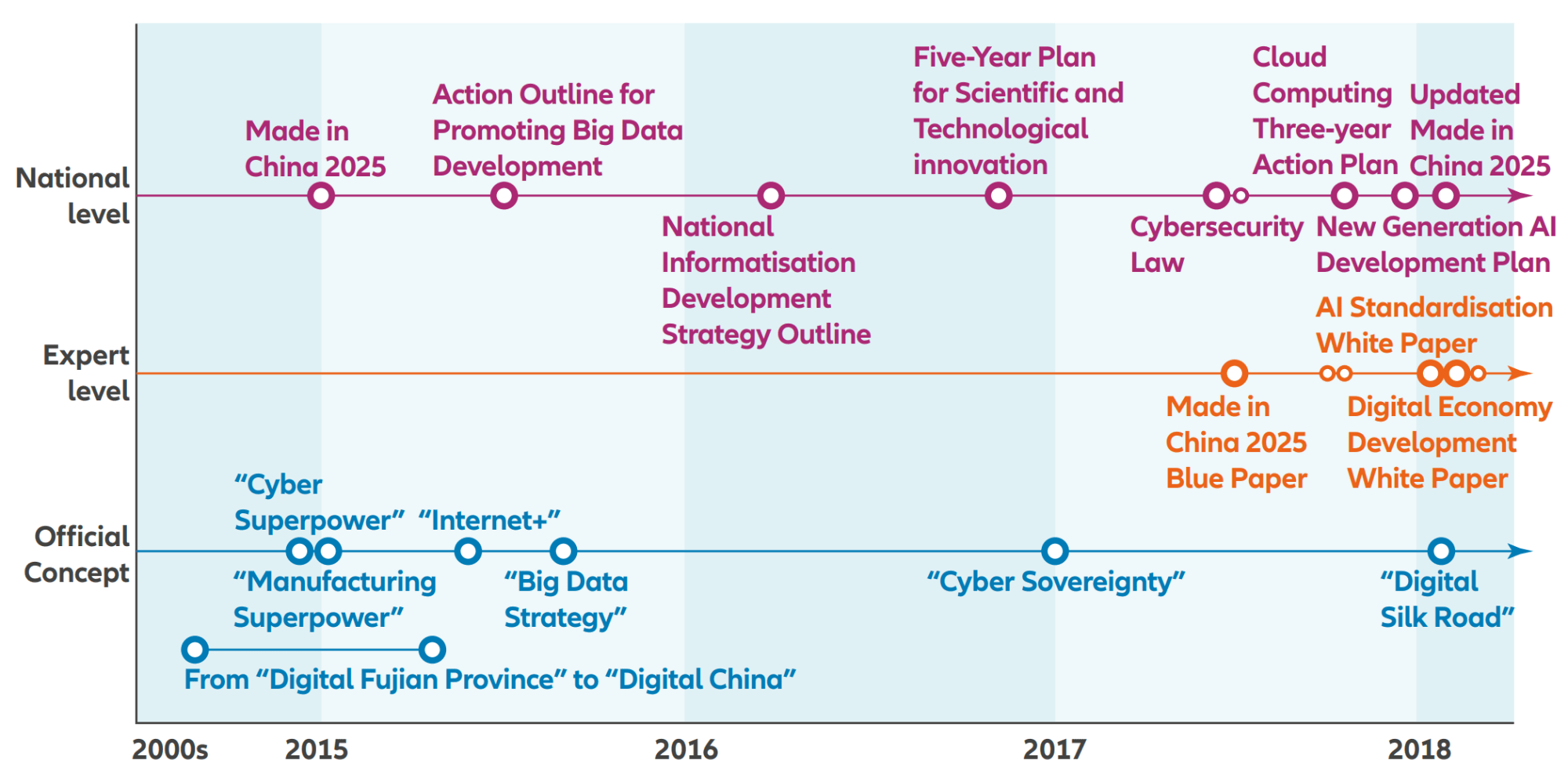

Exhibit 1: The making of China’s digital ambitions

Overview of key policy initiatives

Source: MERICS. MPOC_No.7_ChinasDigitalRise_web_final_2.pdf (merics.org)

In terms of the trajectory of the Chinese economy, the move from a low-cost economy mass producing cheap goods for the west, to one based on innovation and technological leadership has been observable now for some time. Indeed, the “Made in China 2025” strategic plan, first issued in 2015, explicitly aims to upgrade China’s manufacturing capabilities to move from labourintensive to technology-intensive production across areas such as aerospace, biotech, IT, pharmaceuticals, and robotics. Yet what is now becoming apparent is how the broader effects of growing Chinese technological leadership may play out as the country begins to set the agenda across a growing range of fields.

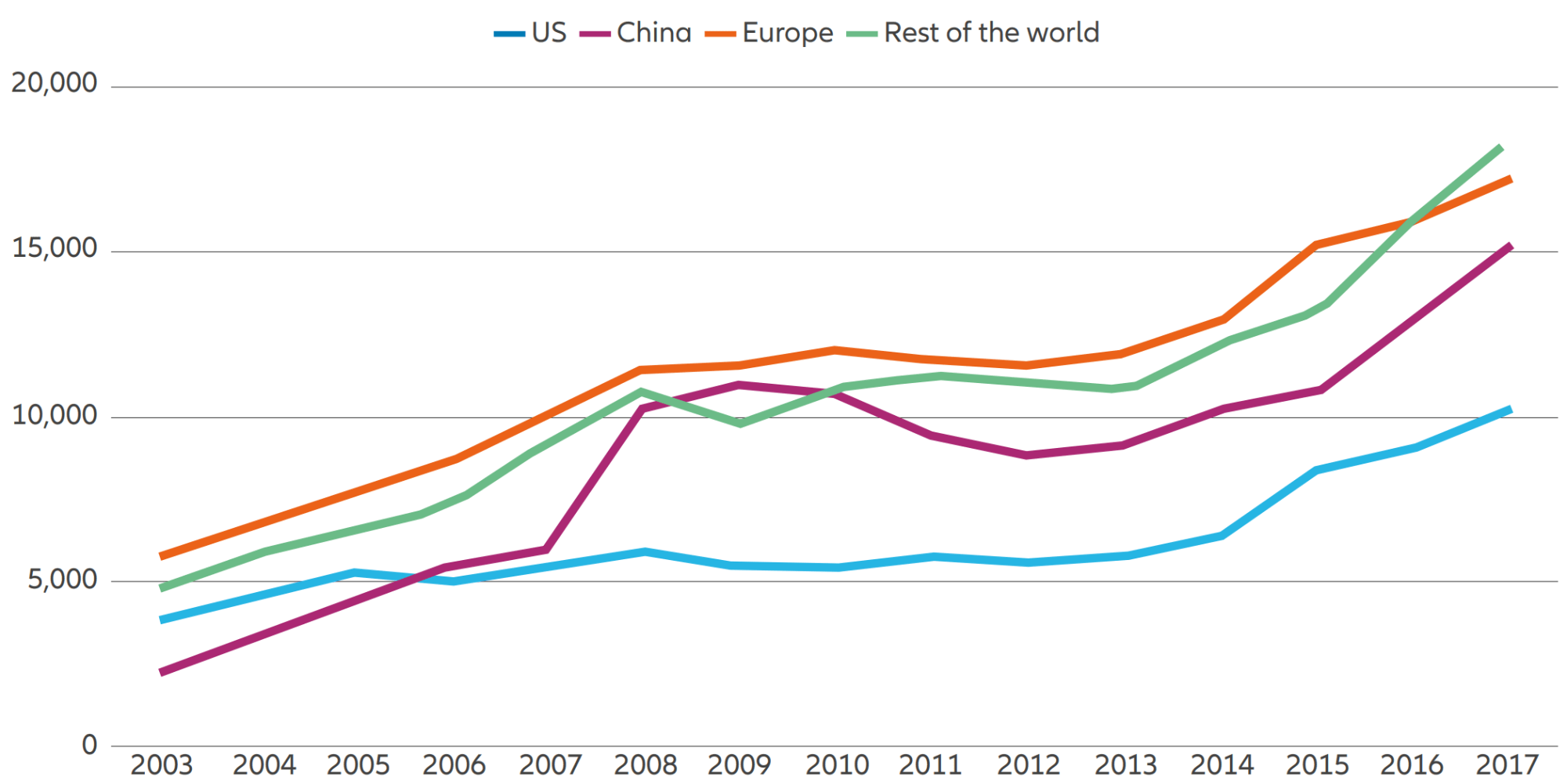

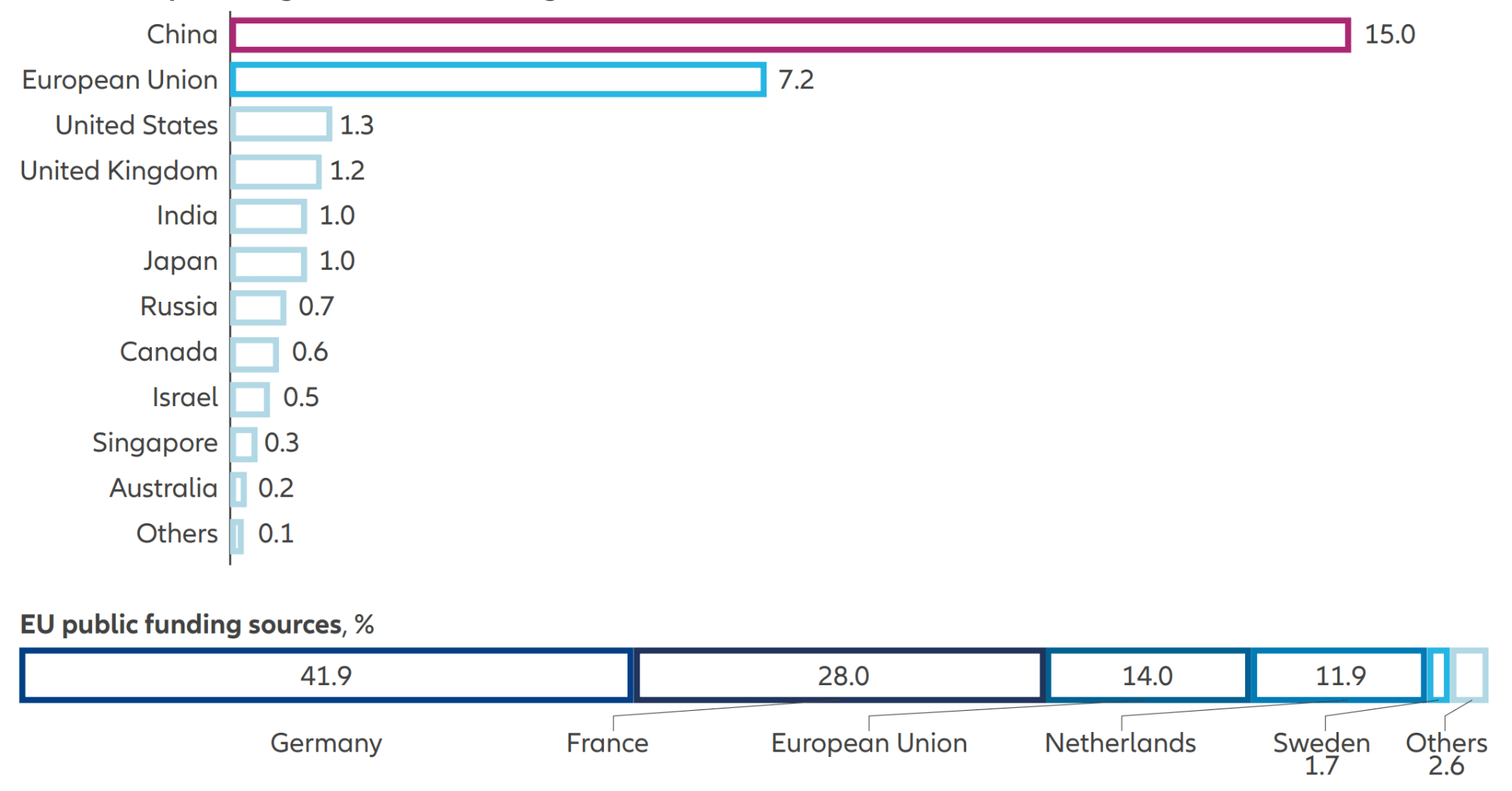

In fact, in areas such as AI, China is catching up, as it rapidly benefits from being the largest single-country internet base in the world. This means a massive amount of data – essential for machine learning – a strong digital native culture, and a very strong focus on winning the next technology race. And with respect to quantum computing, China has also made very rapid progress, building very powerful computers able to resolve complex problems. Here, China leads both the US and EU on public funding.1

Exhibit 2: China’s AI research is rapidly catching up

Annually published AI papers by Elsevier, by region (2003 - 2017)

Source: Shoham, Yoav et al. (2019). “Artificial Intelligence Index 2018 – Annual Report”. AI Index. http://cdn.aiindex.org/2018/AI Index 2018 AnnualReport.pdf. Accessed: March 13, 2019. MPOC_No.7_ChinasDigitalRise_web_final_2.pdf (merics.org)

Exhibit 3: China and the European Union lead significantly on public funding for quantum computing

Announced planned governmental funding,2 USD billions

Source: Quantum computing use cases - what you need to know | McKinsey

Note: Figures mahy not sum to 100% because of rounding.

Of course, China and the USA remain the world’s two primary powers and friction between them is structural and here to stay, particularly as China evolves to become a stronger global player (China Phase 3). How these frictions traditionally play out is familiar to us and often takes the form of disputes around trade and industrial competition. Yet what we may see in the coming years runs deeper and goes beyond merely trade and competition over markets. As China further develops its own tech infrastructure in areas such as AI and 6G communications, we will see a bifurcation, or decoupling, away from the USA and European economies which use different infrastructure and standards.

In the event of such a bifurcation, or even if the effect is less pronounced but we nevertheless end up with completing “tech hemispheres” across a range of practice areas, many emerging economies will need to decide where their future lies. And given China’s involvement in many of those economies via the BRI initiative, which involves financial and technical support, it is not hard to envisage a future where China takes many of the world’s emerging economic powerhouses from the “global south” with it.

However, on the other hand, a further effect of growing Chinese technological leadership will be that western companies and governments will need to find new ways of working and cooperating with Chinese businesses. For instance, Chinese firms are already establishing themselves as leaders across a range of areas that will be significant in the coming years and decades – such as 6G, EVS, and connected mobility – and securing crucial patents here. Indeed, the growing proliferation of new standards in areas such the internet of things (IoT) and digital twinning, as well as the development of protocols for the electronic authentication of metrics such as carbon emissions – something which will be critical for both lawmakers and consumers – means that interoperability and portability will be crucial, in the shape of a meta-platform (i.e., a platform of platforms), and corporates and other stakeholders will thus need to find new ways of cooperating.

China’s “Standards 2035” project is thus indicative of how China is emerging as a tech leader and an innovator in a range of areas. But it also shows how the effects of this leadership are likely to spill over and influence the broader geopolitical and economic spheres. Indeed, competition over standards and the potential emergence of competing tech hemispheres speaks of the Digital Darwinism where competing companies seek to quickly leverage emerging technologies to gain a significant and perhaps dominant advantage in their respective sectors. What is certain is that China’s nascent leadership – and ability to set the agenda – across growing number of future-critical fields will have profound effects for investors and market participants of all types as we move into a new and exciting phase of its development.

Exhibit 4: The One Belt One Road Initiative

1 Quantum computing use cases—what you need to know | McKinsey

2 Total historic announced funding; timelines for investment of funding vary per country.