Navigating Rates

Reset Roadmap

Four ideas for considering resetting bond allocations after recent market turmoil

2022 will be remembered as a year of regime change in bond markets. Advanced economies entered a phase of higher inflation shocks not seen since the 1970s1 as policy and markets have become beholden to rising prices. Year-to-date, the number of public debt markets providing shelter for investors is close to

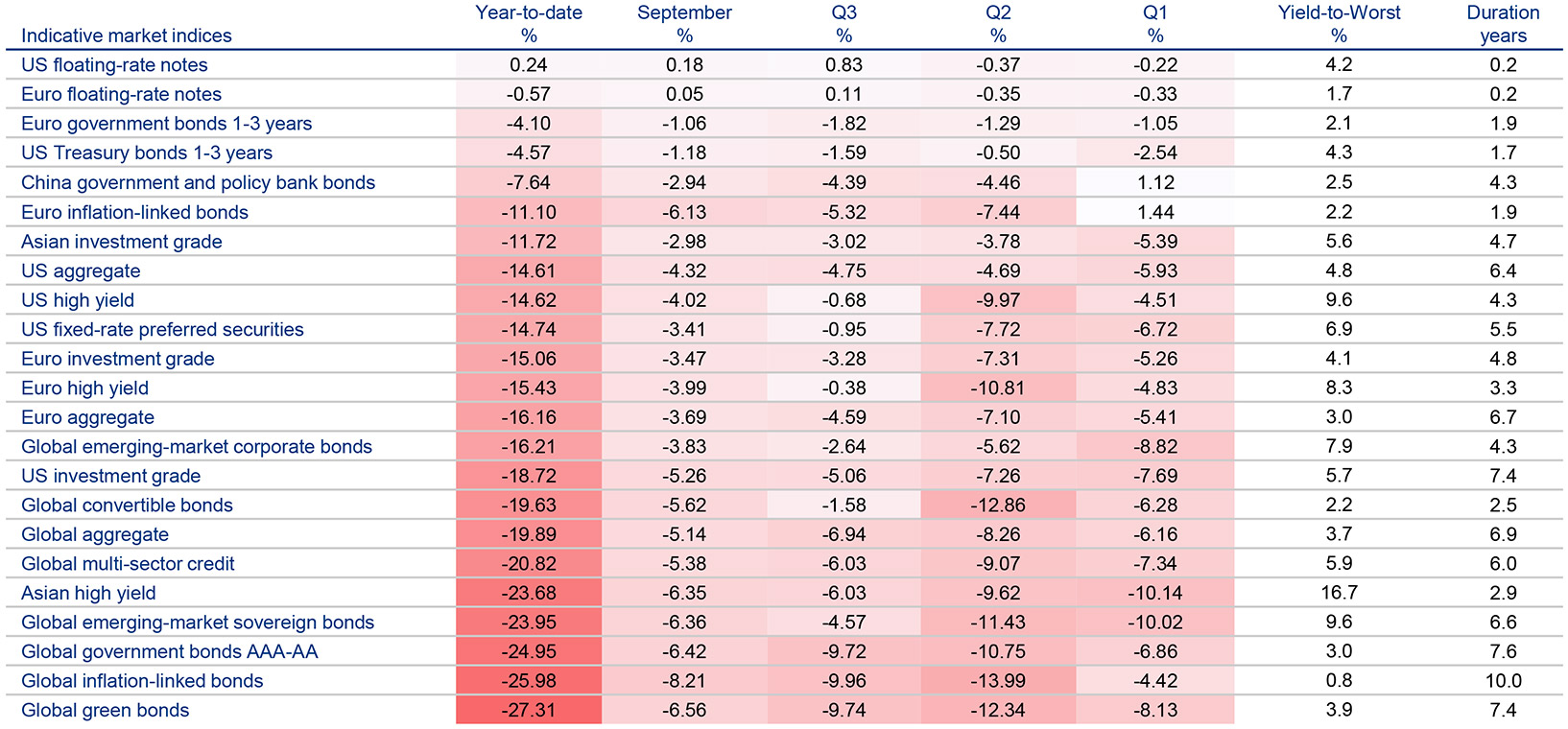

Exhibit 1: year-to-date, there have been few places for investors to hide in public debt markets

Source: Bloomberg. ICE BofA and JP Morgan indices; Allianz Global Investors. Data as at 30 September 2022. Index returns in USD (unhedged) except for Euro indices. Yield-to-worst adjusts down the yield-to-maturity for corporate bonds which can be “called away” (redeemed optionally at predetermined times before their maturity date). Effective duration also takes into account the effect of these “call options”. Past performance does not predict future returns. See the disclosure at the end of the document for the underlying index proxies. Investors cannot invest directly in an index. A rating provides no indicator of future performance and is not constant over time. Index returns are presented as net returns, which reflect both price performance and income from dividend payments, if any, but do not reflect fees, brokerage commissions or other expenses of investing.

Explore the four sections below for ideas for resetting bond allocations

Theme 1: a way to protect portfolios against market volatility

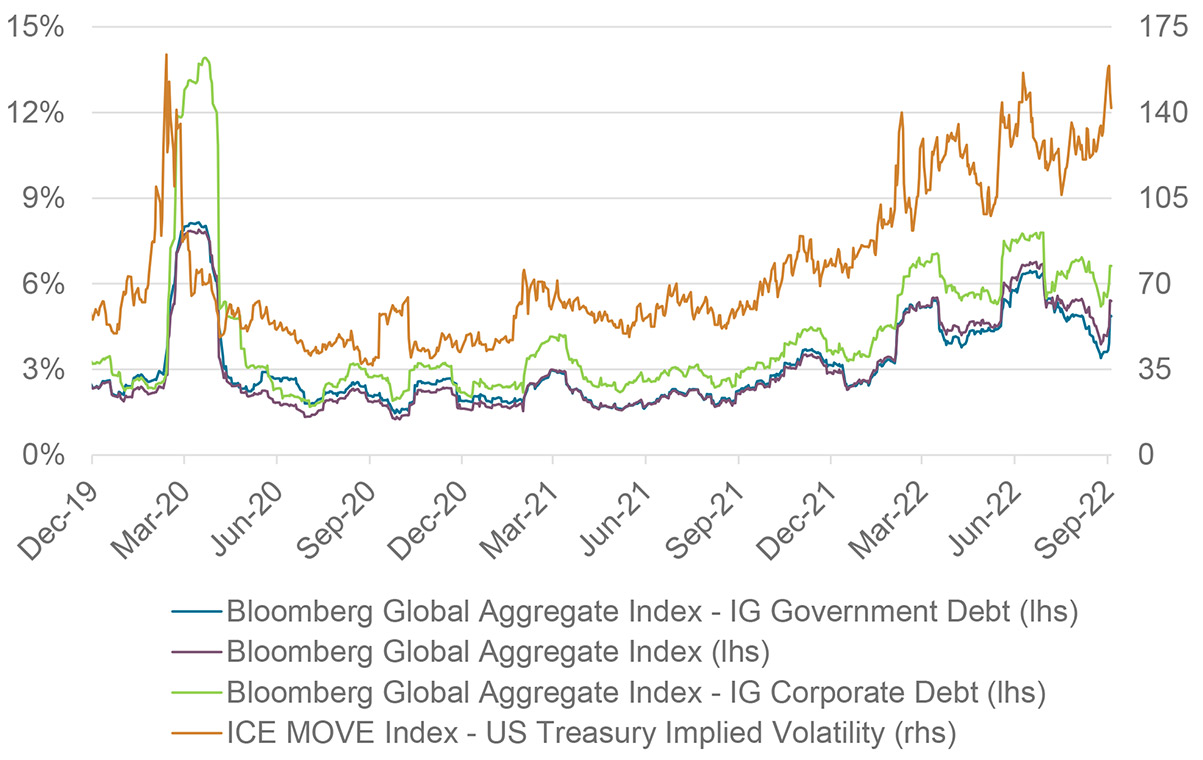

Realised and implied bond volatility are high and highly unstable

Measures of expected and realised bond volatility have come down from their recent peaks, but are still high.

Source: Bloomberg and ICE BofA indices. Allianz Global Investors. Data as at 30 September 2022. Index returns in USD (hedged). Realised volatility (30 days trailing) is annualised. IG= bonds rated Investment Grade. lhs=left-hand-side axis. rhs=right-hand-side axis. The rhs axis represents the value of the MOVE. which is a yield curve-weighted index of the normalised implied volatility on 1-month Treasury options on the 2. 5. 10 and 30-year contracts over the next 30 days. A higher MOVE value means higher option prices. Past performance does not predict future returns. See the disclosure at the end of the document for the underlying index proxies and important risk considerations. Investors cannot invest directly in an index. Index returns are presented as net returns, which reflect both price performance and income from dividend payments, if any, but do not reflect fees, brokerage commissions or other expenses of investing.

Where to Focus

- Strategies combining cash bonds with futures and options that help guard against rate and spread volatility could be considered. There can be associated cash outlay and performance costs.

- Floating-rate notes could help offer protection from rising rates. Keep in mind that floater yields tend to be lower than fixed-rate corporate bond yields.

Theme 2: navigating out-of-sync policies and economies

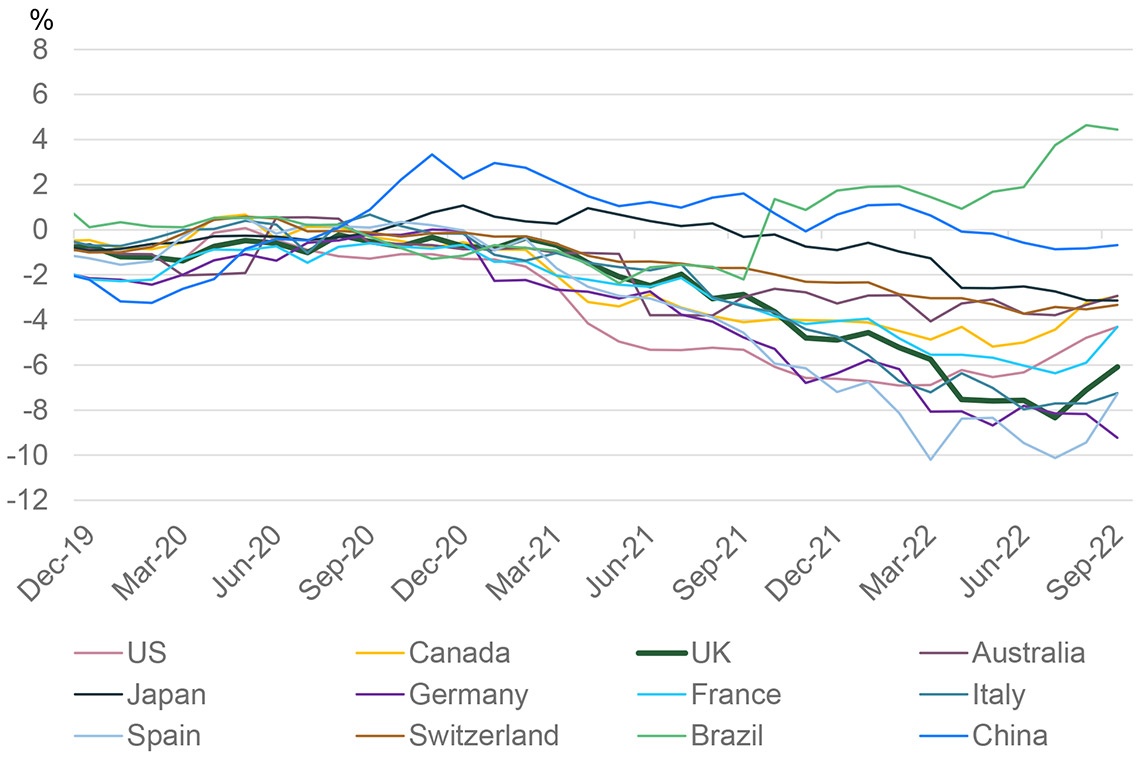

The divergence is feeding through to government bond markets

Local currency government bond yields adjusted for inflation suggest that economies and policies may be shifting in how and when they might exit the current inflation-led regime.

Source: Bloomberg. Allianz Global Investors. Yield data as at 30 September 2022. Latest available official inflation data for the month of August 2022. Month-end 1-year government bond yields (local currency) adjusted for monthly headline consumer price inflation (year-on-year, not seasonally adjusted). Past performance does not predict future returns.

Where to Focus

- The shift to an inflation-led regime may favour flexible bond strategies that could benefit from pricing discrepancies across global markets but also bring varying degrees of risks.

- It makes sense to consider allocating incrementally to those rates markets that could potentially benefit from flight to safety.

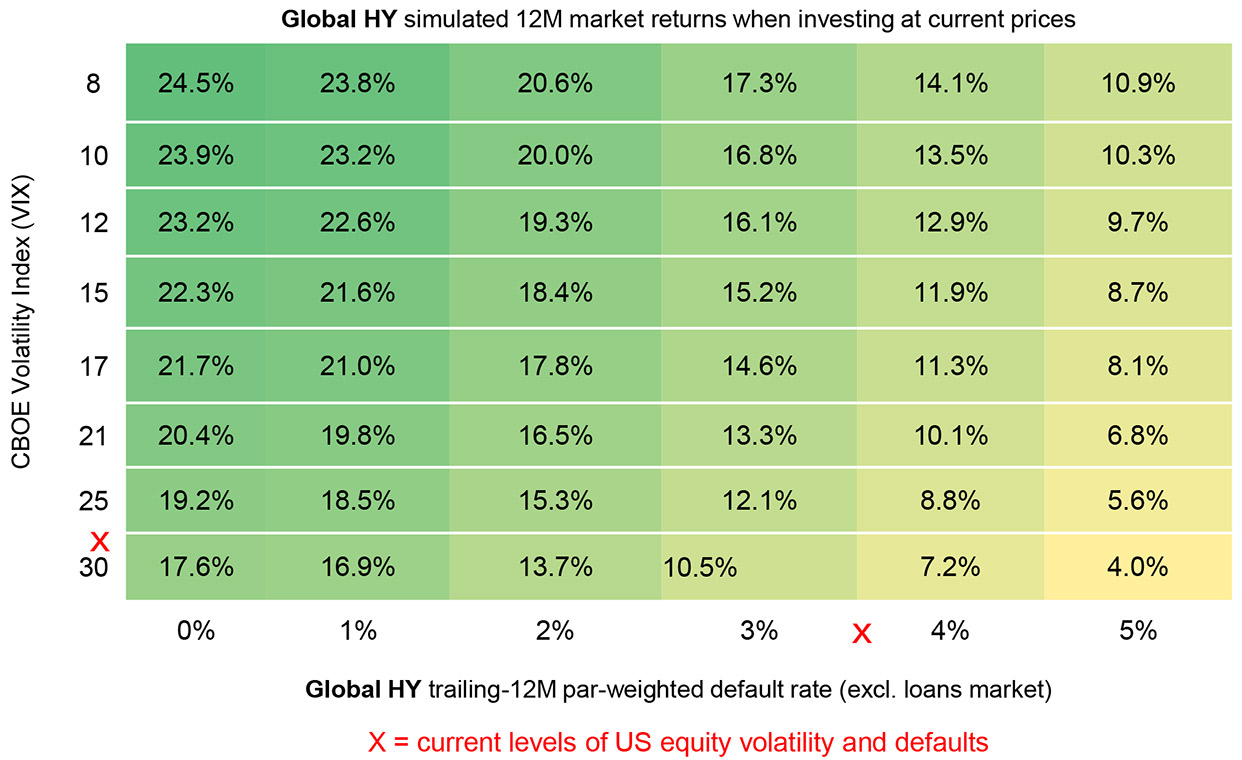

Source: Bloomberg. ICE. Allianz Global Investors. Data as at 30 September 2022. Global HY=ICE BofA Global High Yield Index. EM HC Sov=JP Morgan Emerging Market Bond Index (EMBI) Global Diversified. Past performance does not predict future returns. See the disclosure at the end of the document for the underlying index proxies, important risk considerations and simulation methodologies.

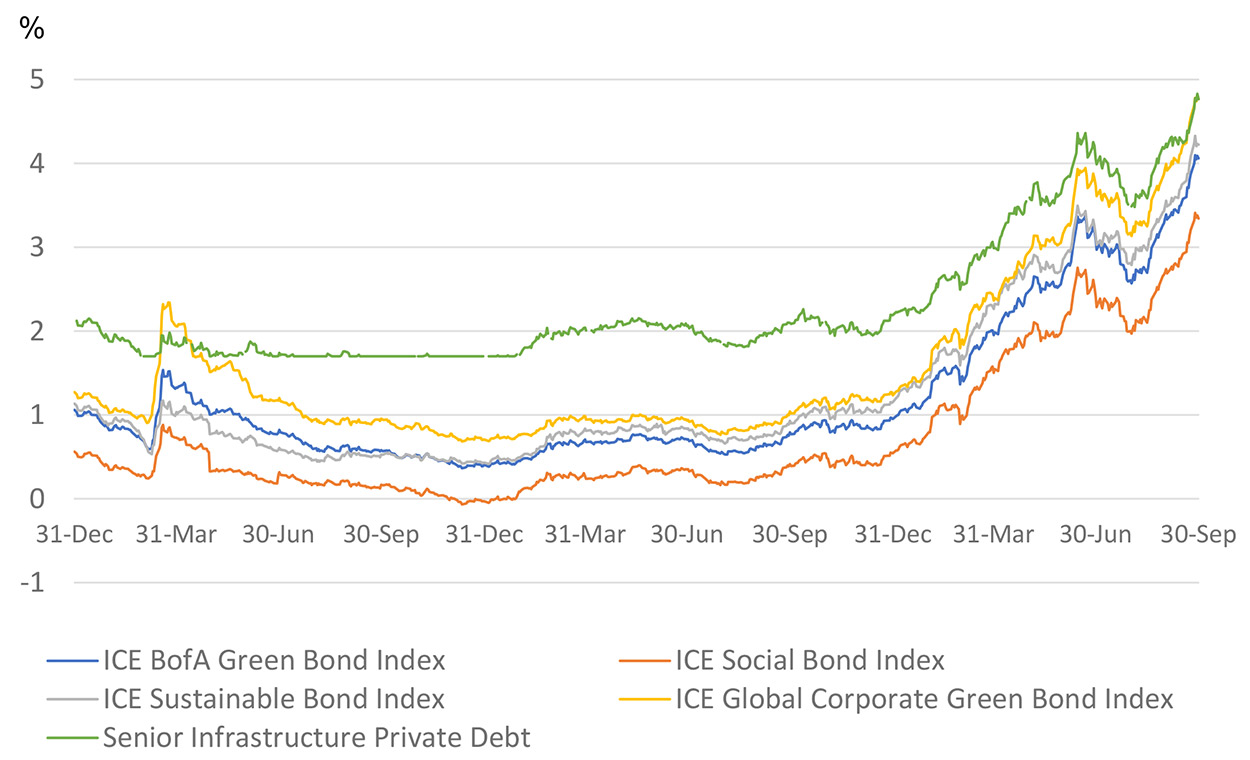

Source: Bloomberg, Allianz Global Investors. The yields for the ICE BofA indices represent the weighted average of the yields of the constituent bonds denominated in their local currency. The yield for investment-grade infrastructure private debt is an approximation, composed of the EUR 15-year mid-swap as a reference rate (with a floor at zero when it goes negative) + 170 basis points. Past performance does not predict future returns. See the disclosure at the end of the document for the underlying index proxies and important risk considerations. Investors cannot invest directly in an index.

Theme 3: a way to capture the value rebound in high-income assets

Once core rates and inflation stabilise, we believe high-income assets should follow soon afterAt current yields, high-yield corporates and emerging-market sovereigns could offer a good income cushion and upside.

Where to Focus

Theme 4: a way to benefit from the sustainable investing push

The energy crisis is boosting demand and yield for green and social financingYields offered by sustainability-labelled bonds have reset to more competitive levels.

Where to Focus

Disclosures indices

US aggregate (represented by the Bloomberg US Aggregate Bond Index): The Bloomberg US Aggregate Bond Index tracks the investment-grade. USD-denominated. fixed-rate taxable bond market. The index includes treasuries. government-related and corporate securities. fixed-rate agency MBS. ABS and CMBS (agency and non-agency); US investment grade (Bloomberg US Corporate Bond Index): The Bloomberg US Corporate Bond Index tracks the investment-grade. fixed-rate. taxable corporate bond market. It includes USDdenominated securities publicly issued by US and non-US issuers; US High Yield (ICE BofA US High Yield Index): The ICE BofA US High Yield Index tracks USD-denominated below investment-grade corporate debt publicly issued in the US domestic market; US floating-rate notes (Bloomberg US Floating Rate Notes Index): The Bloomberg US Floating Rate Notes Index tracks USD-denominated. investment-grade. floating-rate notes across corporate and government-related sectors; US fixed-rate preferred securities (ICE BofA Fixed Rate Preferred Securities Index); The ICE BofA Fixed Rate Preferred Securities Index tracks fixed-rate. USD-denominated. investment-grade exchange-traded preferred securities ($25 par) with outstanding market values of at least USD100 million issued in the US domestic market; Euro aggregate (Bloomberg Euro Aggregate Bond Index): The Bloomberg Euro Aggregate Bond Index tracks the investment-grade. EUR-denominated. fixed-rate bond market. including treasuries. government-related. corporate ad securitized issues; Euro investment grade (ICE BofA Euro Corporate Index): the ICE BofA Euro Corporate Index tracks EUR-denominated investment-grade corporate debt publicly issued in the euro domestic or eurobond markets; Euro high yield (ICE BofA Euro High Yield Index): The ICE BofA Euro High Yield Index tracks EUR-denominated below investment-grade corporate debt publicly issued in the euro domestic or eurobond markets; Euro floating-rate notes (Bloomberg Euro Floating Rate Notes Index): The Bloomberg Euro Floating Rate Notes Index tracks EUR-denominated. investment-grade floating-rate notes across corporate and government-related sectors; Asian investment grade (JP Morgan Asia Credit Index – Investment Grade): The JP Morgan Asia Credit Index – Investment Grade tracks fixed-rate. USD-denominated investment-grade bonds issued by Asia sovereigns. quasi-sovereigns. banks and corporates; Asian high yield (JP Morgan Asia Credit Index – Non-Investment Grade): The JP Morgan Asia Credit Index – Non-Investment Grade tracks fixed-rate. USD-denominated below investment-grade bonds issued by Asia sovereigns. quasi-sovereigns. banks and corporates; China government & policy bank bonds (Bloomberg China Treasury and Policy Bank 1-10 Year Index): The Bloomberg China Treasury and Policy Bank 1-10 Year Index tracks CNY-denominated bonds issued by the Ministry of Finance of the People’s Republic of China (PRC). and debt issued by Chinese policy banks (PRC government agencies which are not guaranteed by the government). that are listed on the China Interbank Bond Market (CIBM); Global emerging market sovereign debt (JP Morgan Emerging Market Bond Index (EMBI) Global Diversified): The JP Morgan EMBI Global Diversified Index tracks liquid. USD-denominated emerging market fixed- and floating-rate debt instruments issued by sovereign and quasi-sovereign entities; Global government bonds AAA-AA (Bloomberg Global Government AAA-AA Capped Index): The Bloomberg Global Government AAA-AA Capped Index tracks local currency bonds with a minimum AA rating issued by governments of developed countries worldwide; Global inflation-linked bonds (Bloomberg Global Inflation-Linked Index): The Bloomberg Global Inflation-Linked Index tracks investment-grade. government inflation-linked debt from 12 different developed market countries; Global green bonds (Bloomberg MSCI Global Green Bond Index): The Bloomberg MSCI Global Green Bond Index tracks the global market for fixed income securities issued to fund projects with direct environmental benefits. An independent research driven methodology is used to evaluate index-eligible green bonds to ensure they adhere to established Green Bond Principles and to classify bonds by their environmental use of proceeds; Global convertible bonds (ICE BofA Global 300 Convertibles Index): The ICE BofA Global 300 Convertibles Index includes 300 convertible securities and is considered generally representative of the global convertible market; Global emerging market corporate debt (JP Morgan Corporate Emerging Market Bond Index (CEMBI) Broad Diversified): The JP Morgan CEMBI Broad Diversified Index tracks the performance of USD-denominated bonds issued by emerging market corporate entities; Global aggregate (Bloomberg Global Aggregate Bond Index): The Bloomberg Global Aggregate Bond Index tracks the performance of the global investment-grade. fixed-rate bond markets and includes government. government-related and corporate bonds. asset-backed. mortgage-backed and commercial mortgage-backed securities from both developed and emerging markets issuers; Euro inflation-linked bonds (Bloomberg Euro Government Inflation-Linked Bond All Maturities Index): The Bloomberg Euro Government Inflation-Linked Bond All Maturities Index tracks the performance of EUR-denominated investment-grade inflation-linked bonds issued by governments of the euro area across the whole yield curve.

Disclosures indices continued & simulated performance

Global multi-sector credit (Bloomberg Global Multiverse Credit Index): The Bloomberg Global Multiverse Credit Index provides a broad-based measure of the global corporate bond market.. representing the union of the Global Aggregate Index and the Global High Yield Index and captures investment grade and high yield securities in all eligible currencies. Euro government bonds 1-3 years (Bloomberg Euro-Aggregate Treasury 1-3 Year): The Bloomberg Euro-Aggregate Treasury 1-3 Year Index measures the performance of the euro area government bond market and includes only bonds issued in euros or legacy euro currencies with a maturity between 1 and up to (but not including) 3 years. US Treasury bonds 1-3 years (JP Morgan Government Bond Index United States 1-3 Year Select Maturity): The JP Morgan Government Bond Index United States 1-3 Year Select Maturity Index tracks the performance of eligible fixed-rate. USD-denominated treasury bonds issued by the US Government with time to maturity between 1 and 3 years. The ICE BofA US Bond Market Option Volatility Estimate Index (MOVE) measures US bond market yield volatility by tracking a basket of over-the-counter options on US Treasury notes and bonds. The basket is comprised of at-the-money one-month options on the current 2-year. 5-year. 10-year and 30-year Treasuries. The Index value is equal to the average of the implied normal yield volatility of the four options. where the 10-year option is given a 40% weight and the other basket components each hold a 20% share. The ICE BofA Global High Yield Index tracks the performance of USD. CAD. GBP and EUR denominated below investment grade corporate debt publicly issued in the major domestic or eurobond markets. The ICE BofA Green Bond Index tracks the performance of investment grade-rated securities issued for qualified green purposes. Qualifying bonds must have a clearly designated use of proceeds that is solely applied toward projects or activities that promote climate change mitigation or adaptation or other environmental sustainability purposes as outlined by the ICMA Green Bond Principles. The index includes debt of sovereign. quasi-government and corporate issuers. but excludes securitized and collateralized securities. The ICE BofA Global Corporate Green Bond Index is a subset of the ICE BofA Global Corporate Index that tracks the performance of securities issued for qualified green purposes as outlined by the ICMA Green Bond Principles. The ICE BofA Social Bond Index tracks the performance of investment grade-rated securities issued for qualified social purposes. Qualifying bonds must have a clearly designated use of proceeds that is solely applied toward projects or activities that directly aims to address or mitigate a specific social issue and/or seeks to achieve positive social outcomes as outlined by the ICMA Social Bond Principles. The index includes debt of sovereign. quasi-government and corporate issuers. but excludes securitized and collateralized securities. The ICE BofA Sustainable Bond Index tracks the performance of securities issued for qualified sustainable purposes. Qualifying bonds must have a clearly designated use of proceeds that is solely applied toward projects or activities that promote a combination of climate change mitigation. adaptation or other environmental sustainability purposes. and that directly aims to address and mitigate a specific social issue and/or seeks to achieve positive social outcomes as outlined by the ICMA Sustainability Bond Guidelines. The index includes debt of sovereign. quasi-government and corporate issuers. but excludes securitized and collateralized securities.

Simulated performance data have many inherent limitations, only some of which are described as follows:(i) They are designed with the benefit of hindsight, based on historical data, and do not reflect the impact that certain economic and market factors might have had on the decision-making process, if a client’s portfolio had actually been managed. No simulated performance can completely account for the impact of financial risk in actual performance.(ii) They do not reflect actual transactions and cannot accurately account for the ability to withstand losses.(iii) The information is based, in part, on hypothetical assumptions made for modelling purposes that may not be realised in the actual management of portfolios. No representation or warranty is made as to the reasonableness of the assumptions made or that all assumptions used in achieving the returns have been stated or fully considered. Assumption changes may have a material impact on the model returns presented. Investors should not assume that they will experience a performance similar to the simulated performance shown. Material differences between simulated performance results and actual results subsequently achieved by any investment strategy are possible.

Exhibit 4. Simulation methodology for global high-yield corporate bonds: To calculate returns. we first take the current effective yield of the ICE BofA Global High Yield Index. Highyield spreads are a function of expected default rates with an assumed 35% recovery rate. plus an illiquidity premium that is correlated to the VIX. We compute what spreads should be under the default and VIX scenarios in the table. We then look at the change in spread from the current level for the Index and multiply this by the duration of the Index. This impact is added to/subtracted from the Index’s effective yield. Finally. we take the default rate less the 35% recovery rate. and then deduct that number from the return calculation to give us the expected Index returns. Note that we make no assumptions on changes in interest rates.

Simulation methodology for emerging-market external sovereign bonds: Index returns for emerging-market external sovereign bonds are composed of moves in US Treasury yield. moves in emerging-market credit spreads. and the carry from being long the Index over the holding period. We look at the change in yield and spread. multiplied by the duration of the Index. and add/subtract this figure to/from the yield of the Index to calculate the expected Index returns.

Important risk considerations

This presentation describes certain product capabilities of Allianz Global Investors U.S. LLC (“AllianzGI US”). These strategies involve selling and buying derivatives including futures and swaps and may not be suitable for every investor. No assurance can be given that any particular investment objective will be achieved. Among the risks specific to these strategies that AllianzGI US wishes to call to the attention of prospective investors are the following:

The use of derivatives involves risks different from, and possibly greater than, the risks associated with investing directly in the investments underlying the derivatives. Derivatives can be more volatile and involve significant risk and can disproportionately increase losses and reduce opportunities for gains.

Derivative transactions may produce effects similar to leverage and expose an account to related risks. Consequently, an adverse change in the relative price level can result in a loss of capital that is more exaggerated than would have resulted from an investment that did not involve the use of leverage inherent in the derivative contract.

For each strategy, the collateral requirement may vary depending on the use of an active or passive underlying portfolio, and on the extent to which the strategy uses derivatives. For each strategy, securities from the passive or active underlying portfolio may be pledged as collateral in order to implement the derivative positions. The collateral rules are based on the greater of Reg T rules (standard collateral rules defined by the CBOE and the SEC) and requirements of counterparties. When collateral is used to implement derivative positions, it is possible that a decline in market value of the positions could force the portfolio to cover any shortfall by liquidating noncash assets. The timing of such liquidation may be adverse.

The account may be required to sell investments at times it would not otherwise choose to do so in order to settle derivatives. Such sales may result in losses on such investments and will, in addition, involve transaction costs.

Options on indices may not correlate perfectly with the underlying investments and may not act as expected. Such transactions may not achieve their objectives and may result in (or add to) losses to the account.

Strategies described herein are dependent on the smooth functioning of the markets for the particular instruments being purchased or sold. If such markets do not operate as expected, the strategies described herein could be adversely affected.

Swap agreements involve the risk that the party with whom a client has entered into the swap will default on its obligation to pay the client and the risk that the client will not be able to meet its obligations to pay the other party to the agreement. Collateral for swaps is determined by each counterparty under ISDA agreements.

Past performance does not predict future returns. Performance may be volatile.

Disclaimer

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Investing in fixed income instruments may expose investors to various risks, including but not limited to creditworthiness, interest rate, liquidity and restricted flexibility risks. Changes to the economic environment and market conditions may affect these risks, resulting in an adverse effect to the value of the investment. During periods of rising nominal interest rates, the values of fixed income instruments (including short positions with respect to fixed income instruments) are generally expected to decline. Conversely, during periods of declining interest rates, the values of these instruments are generally expected to rise. Liquidity risk may possibly delay or prevent account withdrawals or redemptions. The volatility of fund unit/share prices may be increased or even strongly increased. Past performance does not predict future returns. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. This is for information only and not to be construed as a solicitation or an invitation to make an offer, to conclude a contract, or to buy or sell any securities. The products or securities described herein may not be available for sale in all jurisdictions or to certain categories of investors. This is for distribution only as permitted by applicable law and in particular not available to residents and/or nationals of the USA. The investment opportunities described herein do not take into account the specific investment objectives, financial situation, knowledge, experience or specific needs of any particular person and are not guaranteed. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable at the time of publication.

Disclaimer

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).

2451961