Achieving Sustainability

Sustainable investing: “taking the temperature”

At the mid-point of 2025, we reflect on a seismic few months for sustainable investing – and consider what priorities might occupy the rest of the year. Spoiler: there’s another COP coming up.

It has been a seismic start to 2025. When we unveiled our themes for the year, we knew it could be a pivotal period for sustainable investing. But the speed with which agendas have developed and changed has taken everyone by surprise. The actions of the new US administration have trumped – so to speak – most other topics. Two questions we get most frequently from clients are: a) what does the latest US policy mean for sustainability, and b) what does it mean for your commitments as investors?

Clearly, the impact on the sustainability agenda in the US has been undeniable. So far, however, the impact across the rest of the world has been limited. Europe appears steadfast in its commitment to the transition to a more resilient economy, even as US policy forces pragmatism and a necessary reset of priorities. As it did during the first Donald Trump administration, Asia continues its quiet evolution on climate mitigation and adaptation plans.

Even so, the rolling back of the Inflation Reduction Act – President Biden’s flagship legislation to spur green investment – and geoeconomic tensions caused by US tariff policy will likely hurt local and global supply chains, whose efficiency and resilience is critical to the global transition. The probability of a delayed climate transition scenario – where global annual emissions do not fall until 20301 – appears to be rising.

We maintain our long-held conviction in the business and investment cases for ensuring economic resilience to climate, biodiversity and social changes. Read more about our commitments on these topics in our recently published Sustainable Investing and Stewardship Report.

Inflection point for defence

On defence, we anticipated a possible pivot this year towards higher NATO spending commitments and greater regulatory alignment on how to consider defence in investments. There is a recognition that Europe needs to step up its defence capabilities through its ReArm Europe plan,2 while the forthcoming NATO Summit will likely confirm a substantial rise in defence spending commitments.

The expected growth in defence spending will require a major expansion of private finance in the sector. This provides significant opportunities for innovation in defence finance structures and increased investor engagement with the industry. While we do not qualify any investments in defence as “sustainable investments”3, improving clarification on the sector can help broaden the investor base and drive concerted engagement for improved safeguards, for example around the weapons produced and the ultimate buyers. Our blog post, Defence: Your questions answered, provides more insights.

Defining what is sustainable

In our “Big moment of truth” theme, we suggested the time was right to seek some much-needed middle ground between regulators and investee companies on definitions of sustainable investments. This would help unlock capital. So, we welcome this year’s regulatory developments in Europe to provide guidance on what activities contribute to sustainable goals and by how much.

For example, the EU Omnibus is a major step to simplify and standardise sustainability reporting for companies, while updates from the European Securities and Markets Authority and Sustainable Finance Disclosure Regulation (SFDR) are critical in clarifying which investments can contribute to sustainability goals – and how and where. The growing alignment of European policy and guidance enhances the finance industry’s ability to transparently meet regulatory requirements and client preferences. This, in turn, maximises the effectiveness of our approach to data, research and stewardship.

Cementing transition finance

Going into 2025, we highlighted the rising relevance and resonance of transition investing. In January, BloombergNEF confirmed that annual global investment in energy transition technologies broke the USD 2 trillion mark in 2024.3 Furthermore, the use of the word “transition” in fund names is rising; we have seen the first transition-labelled funds under the new UK Sustainable Disclosure Regulation regime and we await the forthcoming guidance on transition funds under EU SFDR.

SFDR was not included in the EU Omnibus but it has close links with the Corporate Sustainability Reporting Directive and the EU Taxonomy, and cementing a transition product category within SFDR is therefore a critical addition to European regulation. Transition is increasingly being viewed as a core policy pillar in Europe’s drive for growth through innovation and as a way for the continent to protect its sovereignty. We will be publishing a white paper on private markets investments in the energy transition in the coming months.

Making the workforce work

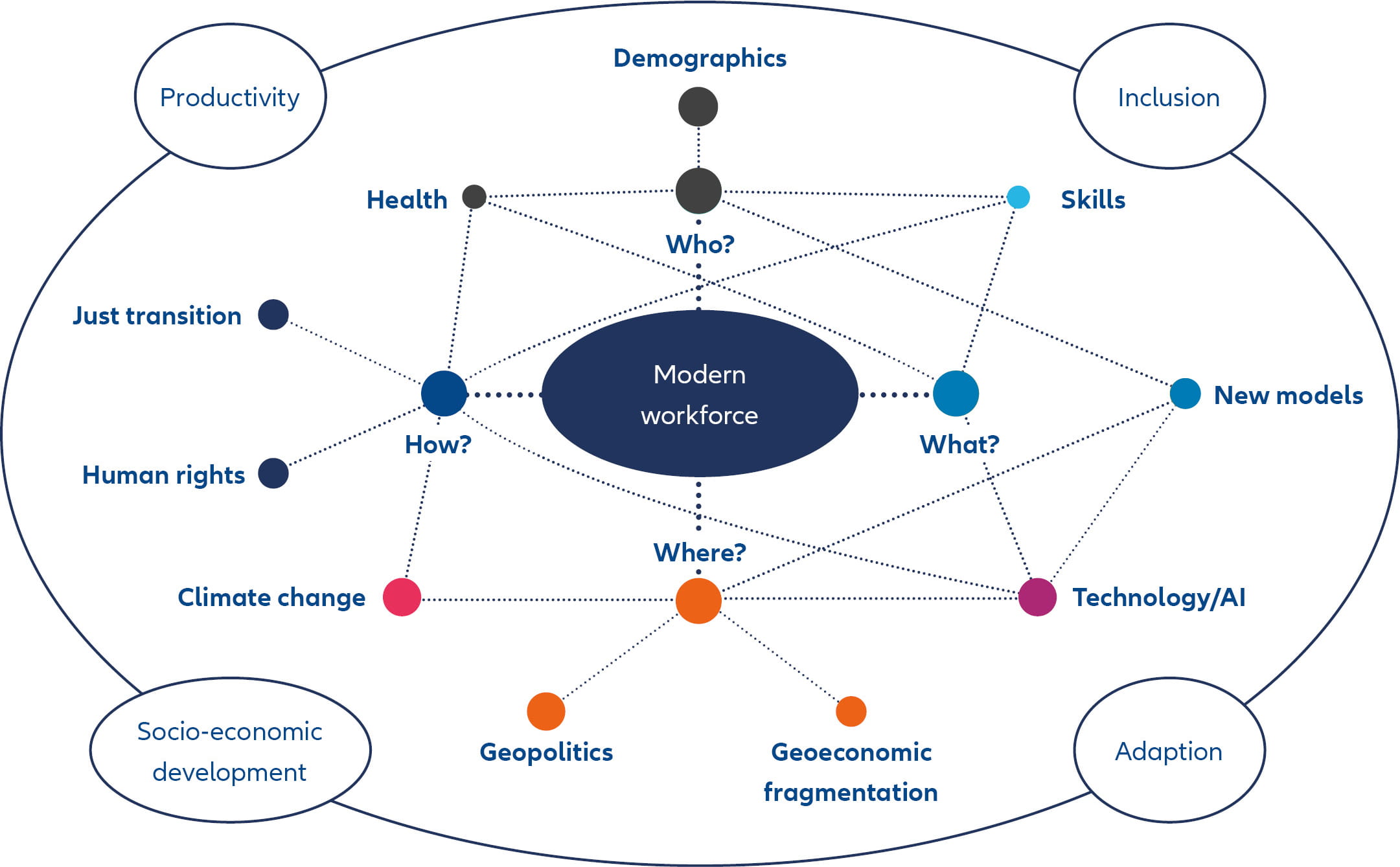

We have been positively surprised by the reception to our focus on the modern workforce, especially in Asia. Many factors affecting the global workforce will have significant economic implications in the coming decades, and any continued geoeconomic fragmentation will amplify the opportunities and risks. Our recent paper, “The modern workforce: are we ready for the shift?”, refines our assessment of key aspects that are material to our investments, such as who does the work, what work is done, where it is done and how it is done – this is a long-term trend but with rising near-term materiality. Exhibit 1 shows the many factors at play.

Exhibit 1 – Reshaping the modern workforce

Source: Allianz Global Investors, Sustainability Research 2025

Looking ahead

While the events of the first half of 2025 highlight the challenges of forecasting, we are focusing on the following areas for the rest of the year:

- NATO Summit – June’s summit will be notable for assessing not only the level of engagement that the US maintains with the rest of NATO on defence, but also the scale, timeframe and financing of increased defence spending commitments.

- Responsible AI – The increasing integration of artificial intelligence (AI) into daily lives – and the significance of technological risks as highlighted in the World Economic Forum Global Risks Report – is prompting more scrutiny on the governance of the sector. The technological opportunities are enormous, but AI-related shareholder proposals at the AGMs of major US tech firms cement the desire for guardrails. Expect further updates from us in the second half of 2025.

- Determining COP 30 – After COP 29, we asked whether COP is burnt out. The pressure will be on to demonstrate the value of this annual gathering. After the deadline postponement in February, how many countries will update their Nationally Determined Contributions – national climate action plans under the Paris Agreement – in time for COP 30? Will the US absence hinder or spur discussions?

- Slimming the waste line – Waste is endemic in the global economy. Whether it extends to overconsumption of cheap goods, pollution, social inequality from food waste, or the sourcing of critical minerals – addressing waste is a rising economic imperative. If tariff volatility persists, it could prompt a long-overdue rethink of waste and circularity.

Lastly, a recent highlight for us was our top 10 ranking in the latest ShareAction benchmark for our conviction and investment in sustainable and impact investing. Amid unprecedented change in the sector, we are especially pleased to gain this recognition for the guidance, insights and solutions we provide.

1 NGFS, Scenarios Portal, 2025

2 European Commission, Commission unveils the White Paper for European Defence and the ReArm Europe Plan/Readiness 2030, March 2025

3 Chapter Zero, Energy Transition Global Investment Exceeded $2 Trillion in 2024, February 2025

4 World Economic Forum, Global Risks Report 2025