Sustainability | ~ 4 min read

Is climate on the ballot?

We anticipated climate tensions in a heavy election year, but the recent election cycle has thrown up some surprises. What are the implications for the climate agenda?

While the recent UK and French elections have shown overall support for the left, momentum has been drifting towards the policies of the far right across Europe. Two pertinent questions stand out in considering whether voters heading to the polls will impact sustainability targets.

First, does the political shift really change anything? Across the continent, the focus appears to be the cost of climate action by those on the right of the political divide and tactical action by the left. To generalise, right-wing parties view environmental policies as financially punitive, while the left wing is more oriented towards mitigating punitive future costs. Is it that simple? No, those pushing for a greener agenda face fiscal constraints, while the anti-green agenda favours alternative clean energy and carbon capture technologies.

Neither policy programme is as good nor bad as it may appear, but both undermine much-needed climate investment momentum. The unexpected scenario of a hung parliament in France may remove some tail risks, but the risk of further fiscal uncertainty will place further pressure on climate financing.

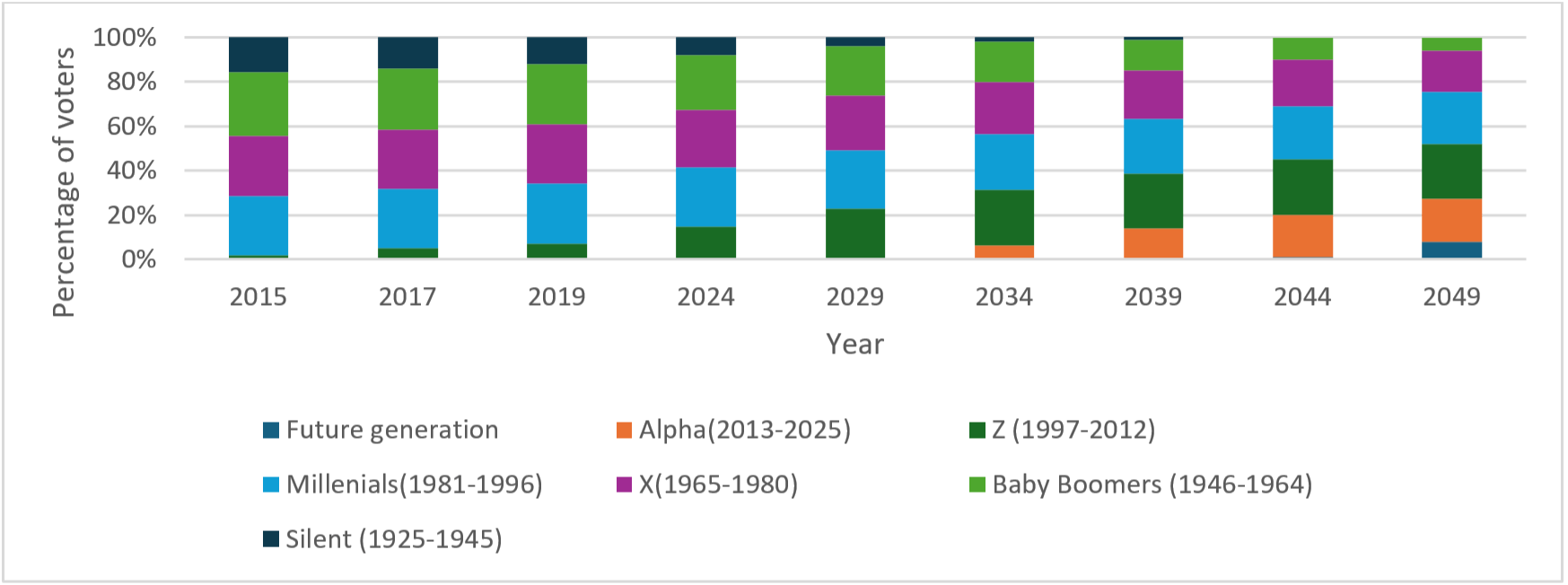

The second question is around the implications of a generational shift. Will Generation Z have an impact? In the UK, Gen Z voters have more than doubled since the last general election in 2019 (see Exhibit 1). However, compared to other age groups, Gen Z represented the lowest proportion of voters and the picture is likely to be similar when the UK’s 4 July election results are analysed (overall turnout was only 60%). Elsewhere in Europe, younger voters are more engaged than their UK counterparts,1 and press coverage has suggested younger voters’ support for far-right political parties is rising.

Bringing these questions together, a lack of real momentum in current environmental policies and limited political engagement among younger – typically climate-friendly – voters points to the climate agenda being tackled explicitly in the coming years, rather than during this electoral cycle.

Exhibit 1 – Breakdown of UK electorate by generation in election years

ONS population projections, Society Watch 2024

Reinforcing the shortfall

Current climate pledges are not ambitious. Any changes to the EU Green Deal may slow, but not derail, current attempts to restrict global warming to no more than 1.5°C. However, the existing Green Deal already falls short of this trajectory2. Meanwhile in the UK, revisions to the Climate Change Act are unlikely given the outgoing government’s perception of overachieving on certain targets.3 The opaque pledges and anti-pledges of both main parties’ manifestos will probably neither improve nor worsen the situation, but merely reinforce the investment shortfall.

Therefore, we expect the rising implication of climate risks - not elections - to be the catalyst for delayed transition4 in Europe and the UK.

1 2019 European elections: Record turnout driven by young people | News | European Parliament (europa.eu)

2 EU's Green Deal improved its climate performance: a 1.5°C pathway is close | Climate Action Tracker

3 UK overachieves another carbon emissions target and rejects rollover - GOV.UK (www.gov.uk)

4 As described by the Network for Greening the Financial System (NGFS) in ngfs_climate_scenarios_phase2_june2021.pdf