Sustainability | ~ 3 min. read

Counting what counts in sustainability

With so many sources and providers of sustainability data, it can be difficult to see the wood for the trees. We have a solution.

“Not everything that can be counted counts and not everything that counts can be counted.” This quote, often attributed to Albert Einstein, could be applied to the use of sustainability data. While there is consensus on integrating non-financial data into investment decisions, there is little agreement on how it should be done.

There is a circular loop between the two driving forces in sustainability data: investors and regulators. When something qualitative counts, investors want to count it to give them an edge. Then regulators want to decide how to count it. Then investors look to create an edge on that, and so on.

As a result, the growth in environmental, social and governance (ESG) disclosures has been dramatic and we are now at a point where almost 80% of the world’s largest global companies and 96% of the world’s top 250 companies report on sustainability1. But we expect the scale and complexity of measurement to continue evolving.

Too much of a good thing?

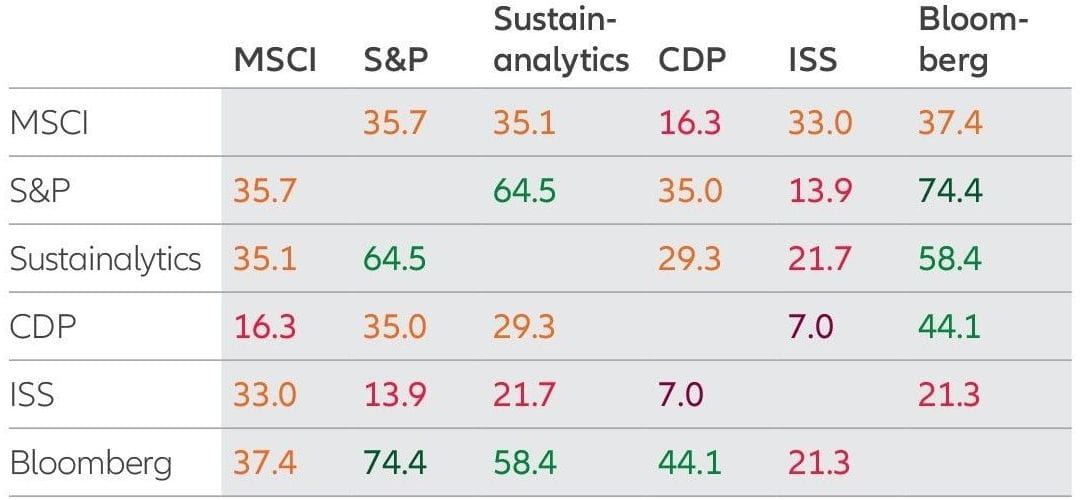

Investors now face a broad and scattered sustainability data landscape, with over 1,000 providers! Couple this with a multiplication of sources and methodologies and investors are understandably confused about which providers and data to use. This was neatly summarised by the below correlation analysis undertaken by the CFA Institute in 20212. This shows dramatically different levels of correlation between the various providers. Compare these numbers with a 94% correlation for the more mature credit rating agencies.

Chart: Correlation of ESG ratings (%)

Source: CFA Institute3

What is the answer?

At Allianz Global Investors, we recognise two key points: first, sustainability data needs its own data architecture and second, there is a need to move from data provider dependency to focus on transparent raw data with good coverage.

Our Sustainability Methodologies and Analytics team has a proprietary approach for selecting the most relevant data, providing centralised aggregation and integration with different methodologies, and deploying this insight to front-office tools across public and private asset classes.

By focusing on the raw data, we can isolate the most relevant data and employ data capture, interpretation, methodology and delivery techniques for greater understanding and alignment of non-financial outcomes alongside financial returns. And as the data landscape evolves, we can easily integrate new and better data sources.

Introducing SusIE

This approach is at the heart of our new sustainability insights engine, SusIE. More on SusIE in a future blog post.

In the meantime, find out more about our approach to sustainability data: https://www.allianzgi.com/en/insights/outlook-and-commentary/sustainability-data-turning-the-tide

1 Source: KPMG Survey of Sustainability Reporting 2022, KPMG International, September 2022. Worldwide sample of the top 5800 companies represent a worldwide sample of the top 100 companies by revenue in 58 countries or jurisdictions, 5800 companies in total. World’s 250 largest companies represent the world’s 250 largest companies by revenue based on the 2021 Fortune 500 ranking.

2 CFA Institute is a global association of investment professionals which offers the Chartered Financial Analyst (CFA) designation.

3 Study on ESG ratings of 400 companies in 24 industries, Kevin Prall, “ESG Ratings: Navigating Through the Haze,” blog posting at CFA Institute, 10 August 2021.