Sustainability | ~ 3 min read

Data, data everywhere....

Controlling the scale and complexity of sustainability data is a big challenge for global asset managers. What’s needed is an efficient data architecture, a user-friendly interface – and a readiness for change. Step forward SusIE.

Sustainability data is proliferating. That’s a good thing because it supports more informed decision-making and more impactful outcomes. The challenge is to organise and deploy this data in a meaningful way. Therefore we developed our new Sustainability Insights Engine, or SusIE for short. This in-house digital sustainability data platform uses proprietary technology to fully integrate sustainability data into all of our front-office functions – so that our investment teams have easy access to invaluable insights.

SusIE extracts, processes and transforms complex datasets from multiple sources, ranging from generalist and specialist providers to those deploying new technologies such as artificial intelligence and natural language processing. Our investment professionals can sort and interpret this data to enhance investment decisions across all asset classes.

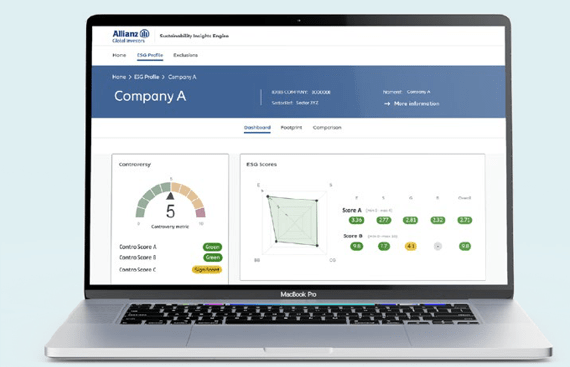

Example ESG profile from the AllianzGI SusIE showing Company A in the insurance sector

Image taken from SusIE dashboard showing ESG screening and controversy scores across several factors

Structured and systematic approach

SusIE’s powerful data architecture allows it to process thousands of datapoints every month, using a structured and systematic approach to scoping the data used, efficient data aggregation and the ability to populate front office tools with the right insights to support our clients.

The one constant in working with sustainability data is change, so SusIE is designed to incorporate new data, remove redundant data, and align with our new sustainable investment offerings. An example is our new Net-Zero alignment toolkit. The main output of this toolkit is derived from a transition metric focused on corporates’ potential to achieve net-zero targets and their implementation of those targets. Powered by SusIE, this will be launched in late 2023.

Ready for a technology-powered future

Our data strategy doesn’t end with SusIE. Here are three areas where we expect sustainability data usage to change:

- Data capture will move away from the current reliance on purchased data as alternative and independent sources are able to capture more perspectives.

- More granular E, S and G metrics will inform investment decisions and asset allocation while meeting client-reporting expectations.

- Risk assessments will benefit from new techniques, such as web scraping – the automated process of extracting data from the web. A fuller measure of unique non-financial risks will allow for investment diversification of these risks.

Over the course of next year, we expect rising investor demand for new KPIs across the themes of planetary boundaries, which focuses on life in a higher temperature world; and inclusive capitalism, which addresses the issues of living equitably with higher temperatures and an evolving global economy.

What this means for clients

This dedicated sustainability architecture will seek to allow us to inform and guide our clients through the complexities of the data. We can then develop and apply the most appropriate methodologies and solutions. By future-proofing our systems, we aim to help our clients achieve targeted outcomes alongside financial returns.