The China Briefing

Currency up, equities up

Micro and macro factors both have contributed to the recent recovery in China equities - MSCI China A Onshore index up 5.6%

Please find below our latest thoughts on China:

- The last few weeks have seen a period of recovery in China equity markets. In the last month the MSCI China A Onshore index is up 5.6%, the offshore-dominated MSCI China index is up 5.4% (USD).1

- Despite the similar overall outcome, offshore markets have been notably more volatile. The MSCI China index has seen 12 days with more than a 1% move in the last month,2 for example. By comparison, China A-shares have been a lot steadier.

- There are a number of factors, both macro and micro, that have contributed to this.

- At a micro level, the large internet platforms have recently reported their latest quarterly results which have generally been above market expectations. Internet companies represent four of the top five constituents in the MSCI China index, accounting for close to 30% index weight.3

- This is in contrast to the rest of the China universe which, both onshore and offshore, has generally seen downbeat results – not a big surprise given the tough operating environment.

- At a macro level, significant recent events relate to the currency and the state of US-China relations.

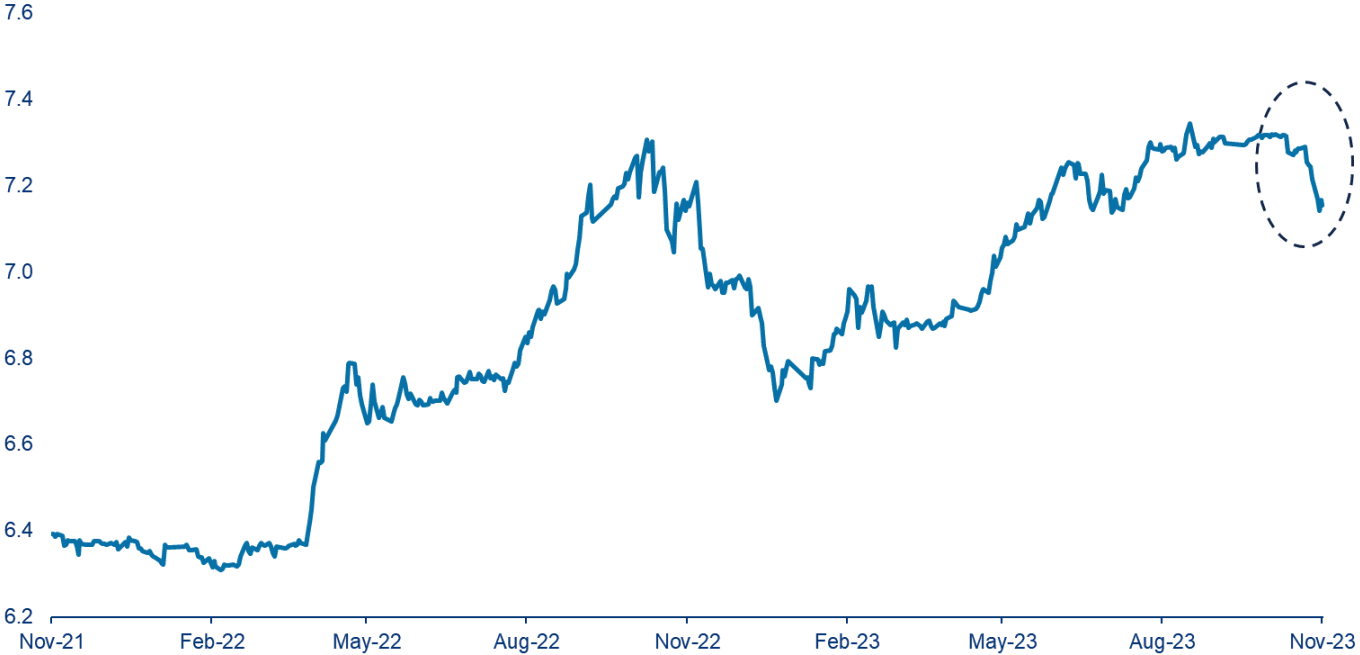

Chart 1: US Dollar vs Renminbi, last 2 years

Source: Bloomberg, Allianz Global Investors as at 23 November 2023. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

- First, the currency. The sharp rally in US bond yields, and subsequent weakening of the US dollar, has brought some welcome relief to the People’s Bank of China (PBoC).

- By way of background, each morning at 9.15am the PBoC sets an official reference rate for the currency. The yuan is allowed to move 2% around this in either direction.

- The level chosen for this daily fixing takes into account factors including the prior day’s closing level, the yuan’s move against a basket of currencies, and changes in other major exchange rates.

- In practice, the PBoC daily fixing typically sets a reference rate near the previous day’s spot close. Any reference rate that is significantly stronger or weaker than expected is considered a signal from Beijing.

- For much of the past three months, the PBoC has kept the reference rate in a tight range, even though the yuan/US dollar spot rate had weakened significantly. In other words, the PBoC had – very unusually – opened a gap between the official and market exchange rates.

- This, in turn, contributed to higher interbank interest rates at a time when the PBoC would typically have wanted to keep rates lower to support growth.

- More recently, the yuan/US dollar spot rate has strengthened by around 2% so far in November.4 And this easing of currency pressure gives the PBoC more flexibility to guide down interbank rates and to use other tools, such as cuts in the reserve ratio requirement (RRR), to provide a more supportive monetary policy setting.

- Turning to the US-China situation – last week’s meeting between Presidents Xi Jinping and Joe Biden has appeared to put a floor under the relationship, at least for the time being.

- The talks between the leaders lasted for around four hours. In China, the summit was hailed as “positive, comprehensive and constructive”, with the People’s Daily declaring that “San Francisco should become a new starting point for stabilising Sino-US relations.”

- From a market perspective, the main achievement appears to be the revival of military-to-military contacts which had been cut off in the wake of Nancy Pelosi’s visit to Taiwan in August 2022.

- While the Xi-Biden meeting will likely do little to alter the basic shape of US-China relations, it should help to restore a sense of predictability and lessen the risk of dangerous misunderstandings.

- With the US policy of selective technological containment now deeply entrenched, China’s response has become not to confront these efforts directly, but instead to work around them by investing heavily in domestic substitutes for technology it can no longer import.

- The development of these future technologies in China is increasingly where we see some of the most interesting investment opportunities in the years ahead.

1 Source: Bloomberg, 22 November 2023

2 Source: Bloomberg, 22 November 2023

3 Source: MSCI, November 2023

4 Source: Bloomberg, 22 November 2023