The China Briefing

More buyers than sellers

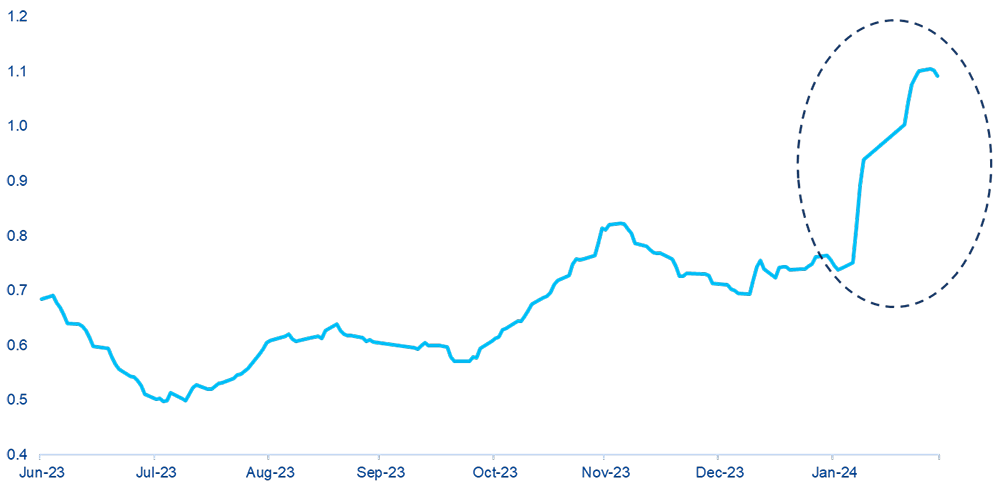

There have been increasing signs of government support for China equities. A big pick up in ETF volumes suggests the “National Team” has started to buy in considerable size.

Please find below our latest thoughts on China:

- China equities have had an encouraging pre and post-Chinese New Year rally. Since the low point on 5 February, onshore and offshore markets are both up by around 10% (USD). Most of the market losses year to date have now been regained.1

- Having been hit hardest in the sell-off, small caps have been particularly strong in recent weeks. The ChiNext Index – sometimes referred to as China’s NASDAQ – is up close to 16% since its low point.2

- There have been several catalysts for the rally which, to use a well-worn phrase, has resulted in more buyers than sellers.

- In particular, this year’s equity market weakness has resulted in a higher-than-usual level of scrutiny from senior politicians in China. The State Council – equivalent to a government cabinet – held a meeting specifically on capital markets. And the head of the securities regulator was replaced just before markets closed for the Lunar New Year holiday.

Chart 1: China Onshore ETF trading volume (30 day moving average, CNY billion)

Source: Wind, Allianz Global Investors as at 29 February 2024

- This change led to expectations that further measures will be taken to support the equity markets. In both 2016 and 2019, following periods of market weakness, the appointment of a new chairman of the China Securities Regulatory Commission (CSRC) marked the beginning of a stock market rally.3

- Indeed, there is strong evidence that the so-called “National Team” – a group of state-owned financial institutions under political direction – has started to buy onshore equities in considerable size.

- Central Huijin, one of the main “National Team” members, announced on 6 February that it has begun buying exchange-traded funds (ETFs) and would continue to increase the scale of its purchases. Daily trading volume in the larger onshore ETFs has picked up significantly since mid-January.4

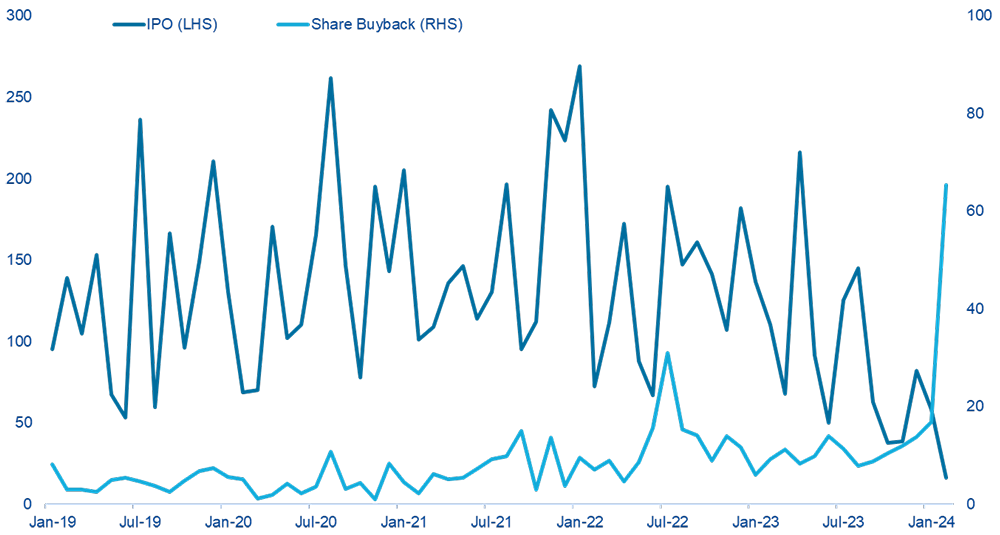

- Additionally, stock buybacks have increased notably. As well as large state-owned enterprises making a series of apparently coordinated buyback announcements, many smaller companies have also bought back stock.5 This potentially signals that valuations have become sufficiently cheap to make buybacks an attractive use of cash.

- In an average month over the last five years, 121 firms have bought back RMB 8 billion in stock. In February 2024 alone, 669 firms have completed or are implementing buybacks worth RMB 55 billion.6

Chart 2: China Onshore IPO vs share buyback volume (CNY billion)

Source: Wind, Allianz Global Investors as at 29 February 2024

- As well as an increase in demand for equities, the supply of equity has also reduced.

- Partly this is related to a managed slowdown in the pace of new IPOs where fundraising has dropped sharply. And the regulator has also introduced restrictions on short selling and securities lending.

- Selling pressure from brokers covering positions related to “snowball” derivatives has also eased (see China Briefing 8 February 2024). This had been a key factor behind the market weakness earlier this year. After the market fall in January, the AuM of snowball products is estimated to have shrunk by 70-80%.7

- Looking ahead, attention will turn to the National People’s Congress, part of the annual “Two Sessions”, which kicks off next week.

- Serving as China’s most important annual political event, thousands of government officials will travel to Beijing where top policymakers will discuss key economic issues. All eyes will be on the 2024 GDP growth target.

- Beijing, Shanghai and Guangdong have all announced local 2024 targets of “around 5%”. Historically, their GDP targets are broadly in line with the national average.8

- In the past 15 years, China has missed its GDP target only once. That was in 2022 when zero-Covid was prioritised over economic growth.9

- Although China achieved 5.2% GDP growth in 2023,10 it will be far more of a challenge to achieve a similar growth rate in 2024. Not only have the year-on-year comparisons become that much higher, the economically important property market also continues to be weak.

- Anything close to a 5% GDP target for 2024 will, therefore, require a significantly increased level of policy support.

- So far this year there has already been a cut in the reserve ratio requirement for banks and the 5-year loan prime rate, the reference rate for mortgages. Together with other measures, including moves to ease the funding stress of property developers, this suggests the previous gap that existed between policy rhetoric and policy action appears to be closing.

- The “Two Sessions”, therefore, is an important test in continuing this momentum and providing greater visibility on China’s macro outlook for the year ahead.

1 Source: Bloomberg, 27 February 2024

2 Source: Bloomberg, 27 February 2024

3 Source: Bloomberg, 8 February 2024

4 Source: Wind, 27 February 2024

5 Source: Gavekal,19 February 2024

6 Source: Gavekal, 19 February 2024

7 Source: HSBC, 20 February 2024

8 Source: Macquarie, 24 January 2024

9 Source: Macquarie, 24 January 2024

10 Source: Macquarie, 24 January 2024