The India Briefing

Diwali 2025 – a celebration of lights and economic momentum

This month, we take a look at India’s most celebrated festival, Diwali. It has evolved into a powerful economic driver. It is effectively peak shopping time for hundreds of millions of Indians and an important barometer on the health of the overall economy.

Please find below our latest thoughts on India:

- India’s most celebrated festival season, Diwali, has been in full swing this month, symbolising the victory of good over evil, knowledge over ignorance, and light over darkness.

- Diwali greetings bring intentions of new opportunities, growth, and peace for friends and families.

- Diwali has also evolved into a powerful economic driver in India and a high-profile consumer event mirroring “Black Friday” in the US or “Singles’ Day” in China.

- It is effectively peak shopping time for hundreds of millions of Indians and an important barometer on the health of the overall economy.

- This year, in particular, trends are being closely watched as the opposing forces of US trade tariffs, weakness in India’s important IT services sector, a more subdued stock market, and sideways residential property prices in many major cities are met with significant policy stimulus measures to boost domestic consumption for India’s growing middle class.

- In 2025, it looks like the festival shopping has not disappointed. Diwali has “ignited” record-breaking consumer spending across both urban and rural pockets of India.

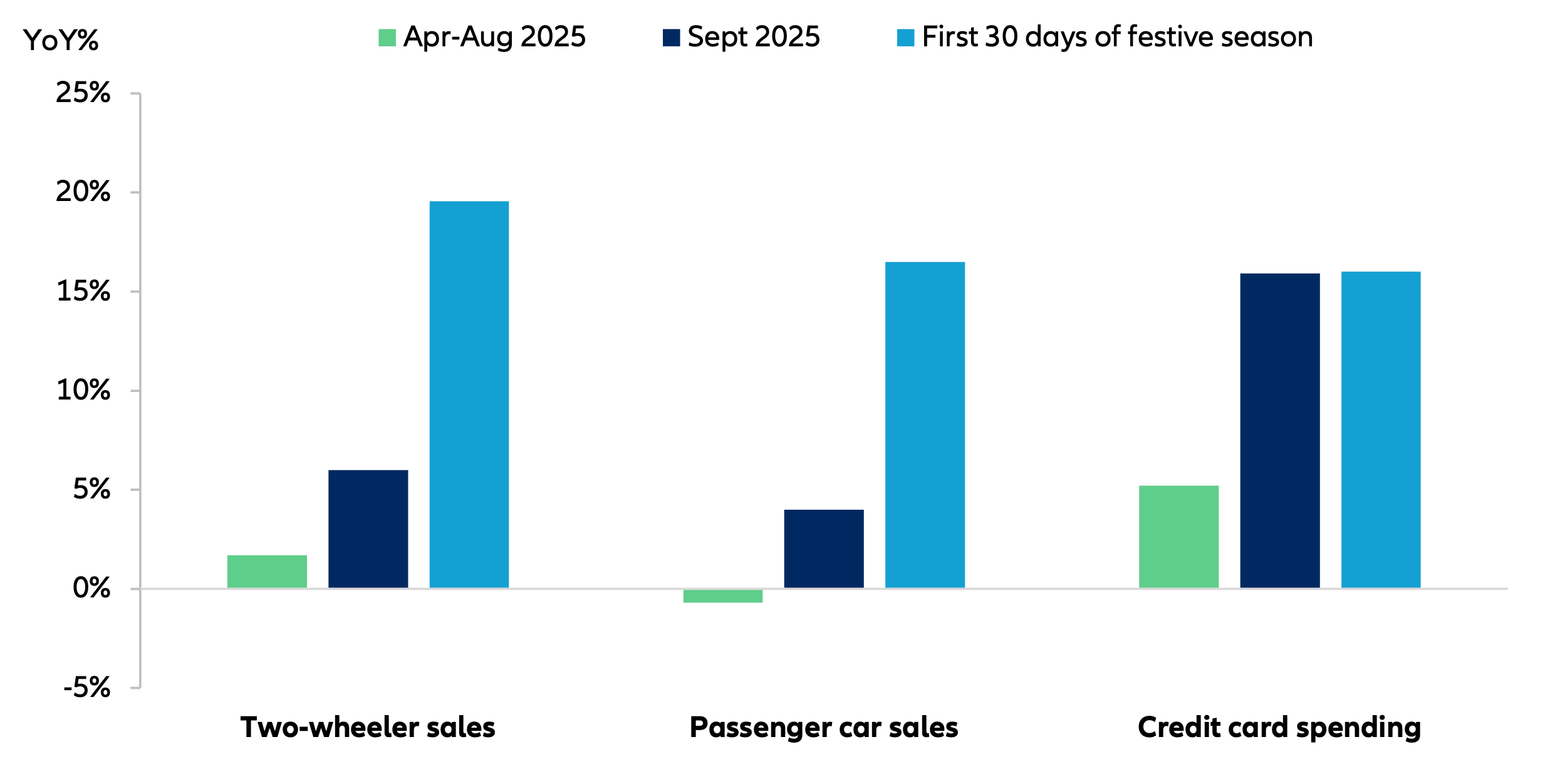

- Surveys of local consumers going into the holiday season suggested that urban Indian spending in 2025 would register around 18% above 2024’s trend.1 That estimate may actually be on the low side; credit card spending one month before Diwali was already up 16% YoY from the same period last year.2

- Festive spending this year has not only benefitted from the typical seasonal discounts, but also timely rationalisation of the Goods & Services Tax (GST) in September that rendered many goods more affordable, as well as income tax cuts that become effective in April (see India Equity Update - Sep2025 | Allianz Global Investors).

- Digital transactions have increasingly become the backbone of 2025’s festive commerce. The e-commerce sector recorded a 24% YoY growth in order volumes and a 23% rise in spending value during this year’s Diwali season.3

- Breaking this down even further, quick commerce platforms saw a 120% surge over last year, driven by demand for deliveries of festive essentials in as little as 10 minutes.2

- More bespoke gifting trends have also emerged, with personalised hampers, eco-friendly bamboo products, herbal teas, and artisanal chocolates replacing more traditional mithai boxes.

- Another area seeing a demand acceleration this season is the automotive sector. The last few weeks have witnessed unprecedented demand for passenger vehicles as Indian consumers look to upgrade from two- wheelers to entry-level cars.

- Indian auto workers have been clocking overtime, working nights and Sundays this October, just to keep up with surging demand.

Figure 1: Healthy consumption patterns this festive season

Source: UBS, as of 23 October 2025.

- Purchasing a car or any major asset during this auspicious time is believed to invite good fortune and blessings from Goddess Lakshmi, the deity of wealth.

- As such, aspirational products like electronics, smartphones, and wearables are also hot categories. Electronics are large beneficiaries of the newly introduced GST reforms, now taxed at 18% (down from 28%), making them significantly more affordable.

- Finally, despite record high gold bullion prices, jewellery and gold have remained popular Diwali purchases in 2025, sparking fears that jewellers could run out of gold bars and coins in an effort to fulfil domestic demand against the global momentum trade in gold.

- As far as gifts go, equity markets in India have received a couple of nice presents this October in the form of more positive earnings for the September quarter, especially among large bank index heavyweights, and renewed optimism about India-US trade talks.

- MSCI India is up nearly 6% in October, which is a welcome turn to green to ring in the festive cheer.4

1 India Today, “How Indians are likely to go all out on shopping this festive season,” as of 10 September 2025.

2 UBS, “India by the numbers: October 2025,” as of 14 October 2025.

3Fortune India, “Quick commerce lights up Diwali as e-commerce orders jump 24%," as of 17 October 2025.

4 IDS GmbH, Allianz Global Investors, as of 23 October 2025.