Two-Minute Tech

Cloud computing is essential to fulfilling generative AI’s potential

The great promise of generative AI requires immense amounts of data and significant computational power which only cloud computing hyperscalers may be able to handle.

- The great promise of generative AI requires immense amounts of data and significant computational power – which only cloud computing hyperscalers may be able to handle. Sub-industries including semiconductors, semiconductor equipment and software will likely all be beneficiaries of this new ecosystem.

- Generative AI poised to positively impact not only hardware, software and security, but also how consumers create and absorb information

- AI-enabled industries could be key beneficiaries of generative AI growth catalysts across cloud-based software and services

Generative AI is a game-changing technology having an “iPhone moment,” thanks to its potential to disrupt entire industries. To further unleash its transformational power, generative AI needs significant computational power, adequate infrastructure, and the kind of data and processing power that only cloud computing can provide, not only to train AI models but to help companies make use of them. This, in turn can create attractive investment opportunities.

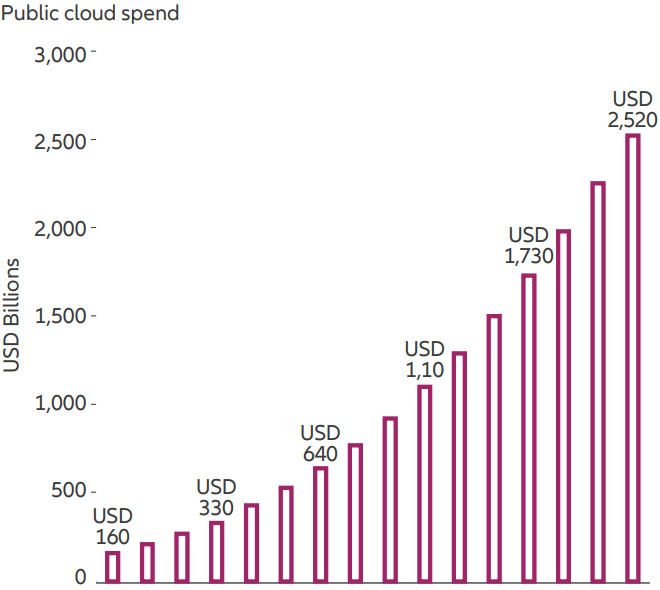

How AI spurs the substantial growth of cloud spending

The variety of technologies and training techniques (Natural Language Processing, NLP, virtual agents, robotic process automation, deep learning, machine learning, etc.) that AI as an umbrella term covers, need immense amounts of data and significant computational power to train and run their models.

Only cloud hyperscalers — large-scale cloud service providers — can handle the enormous data workloads. (To train the GPT-4 model, the hardware alone was estimated to cost USD 100 million1). But even these massive firms will need to expand as data volume and complexity continues to grow – in parallel to the volume of cloud spending related to AI:

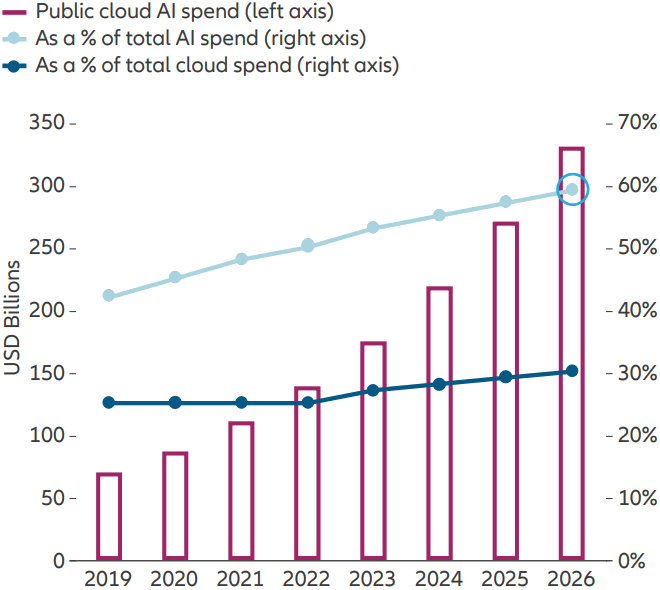

- The total volume of cloud spending related to AI is expected to grow substantially over the medium term to over USD 300 billion by 2026.2

- Of the total addressable market of AI related spending, the portion dedicated to cloud infrastructure and services is expected to grow from 50% today to almost 60%, reflecting the data intensive nature of future models and inference uses.3

- RBC Capital Markets projects an increase of 26% in the overall cloud providers total addressable market due to generative AI.4

Overall public cloud spending is projected to rise steadily…

… and by 2026, 60% of all AI spending will be on cloud infrastructure & services

Source: Morgan Stanley Research, IDC, as of March 2023.

Quite simply, as generative AI grows, nearly all the required data will need to funnel through the hyperscaler providers.

Why AI and cloud computing matter for investors

The release of the ChatGPT and image applications such as DALL-E and Midjourney “shocked” both consumers and company management into understanding how transformative and disruptive generative AI will most likely be. As a result, there is a rapid assessment taking place of which companies have been preparing for these moments for some time, which ones are new to generative AI but have the ability to still take advantage, and those companies which are either late to the game or fail to see the benefits. That’s why some industry watchers are saying the recent advances in generative AI are an “iPhone moment”, heralding the beginning of a new era of hardware and software development on the tech side, but also dramatically changing consumption patterns and multi-generational consumer preferences.

As AI experiences its “iPhone moment,” we believe generative AI will not only positively impact technology hardware (advanced GPUs, data centers, Edge Computing), software (cloud service providers, SaaS, customisation), and security (data protection, data audits, regulatory compliance), but also alter how consumers create and absorb audio, visual, and textual information. In addition, generative AI should have a unique impact on how businesses utilise the technology to increase productivity and streamline workflows. After cloud services became mainstream in 2006 with the advent of Amazon Web Services, we believe generative AI could be the next major catalyst for growth in cloud computing.

How AI-enabled industries could be key beneficiaries of generative AI as a growth catalyst

Based on a recent Grassroots Research® survey of 300 IT decision makers5 , AI was voted as the technology that will have the greatest impact on their business over the next five years. In terms of near-term spending priorities, cloud computing was the 2nd highest. The results of this report bolster our contention that generative AI is at an inflection point and that the greatest near-term investment opportunities are in the AI infrastructure and AI applications categories.

As generative AI is fundamentally changing the technology landscape at an unprecedented pace semiconductor and component makers should see benefits as the computational demands from the large language models underlying generative AI systems are orders of magnitude larger than existing infrastructure is capable of supporting.

Over the longer term, we believe AI-enabled industries to be key beneficiaries as they leverage large language models to gain efficiencies in their operations and focus their revenue generating efforts on the highest yielding areas. Given the expansive and transformative power of generative AI, especially in the near and medium term, utilizing multiple categories should investors hopefully give a more diversified and comprehensive approach to the opportunity set.

1 Me, Myself and AI — Artificial Intelligence Primer, Bank of America, February 2023

2 Morgan Stanley Research, IDC, as of March 2023

3 Ibid

4 Software and Internet Applications of Generative AI and Chat GPT, RBC Capital Markets, March 16, 2023

5 Grassroots Research “Global IT Spending Survey,” May 2023. Based on a survey of 300 IT professionals at companies with 100 or more employees