Navigating Rates

US elections monitor: policy impact

After an extraordinary election campaign, tensions are running high ahead of the US vote in November – and the implications for markets could be quite different depending on who wins. We analyse the policies of the two nominees. The result with the biggest market impact? Potentially a second Donald Trump presidency with a so-called divided government.

Key takeaways

- We see three main channels in which the policies of Vice President Kamala Harris and former President Donald Trump will impact markets: economic growth, inflation and demand for safe-haven assets.

- Given our underlying assumption for a divided government, we think a second Trump presidency could mean weaker international and US equities, but support for the US dollar and gold, with the implications for US Treasuries less clear.

- With Ms Harris likely to continue at least some of the policies of President Joe Biden, the market impact if she wins may be more neutral, with possible support for US equities and commodities.

- Regardless of who wins, we think fiscal policy could have a surprisingly limited impact, since the candidates’ more aggressive tax and spending proposals would fail to become law without support from Congress.

The two candidates in November’s US election have contrasting views on domestic and international issues – and we see the potential for a wide-ranging market impact, particularly on hot-button issues like immigration, tariffs, spending and taxation.

Overall, we think policies will impact financial markets via three main channels: economic growth, inflation and demand for safe-haven assets.

Our findings show that a second term for former President Donald Trump may cause bigger market ripples in the near term.

Analysing the costs and effects of campaign proposals has been a fluid exercise. New – potentially costly – announcements have recently been made without warning, frequently without detail.

To simplify, our analysis focuses on the dominant near-term (12-month) effects of policies announced thus far. We also assume that the incoming US president will be forced to navigate a divided government, where a single party does not unilaterally control the presidency, the House of Representatives and the Senate. This is important because it means the candidates’ most ambitious proposals – particularly on the fiscal front – could easily be stymied by opposition in Congress.

Starkly different policies may mean a varied market response

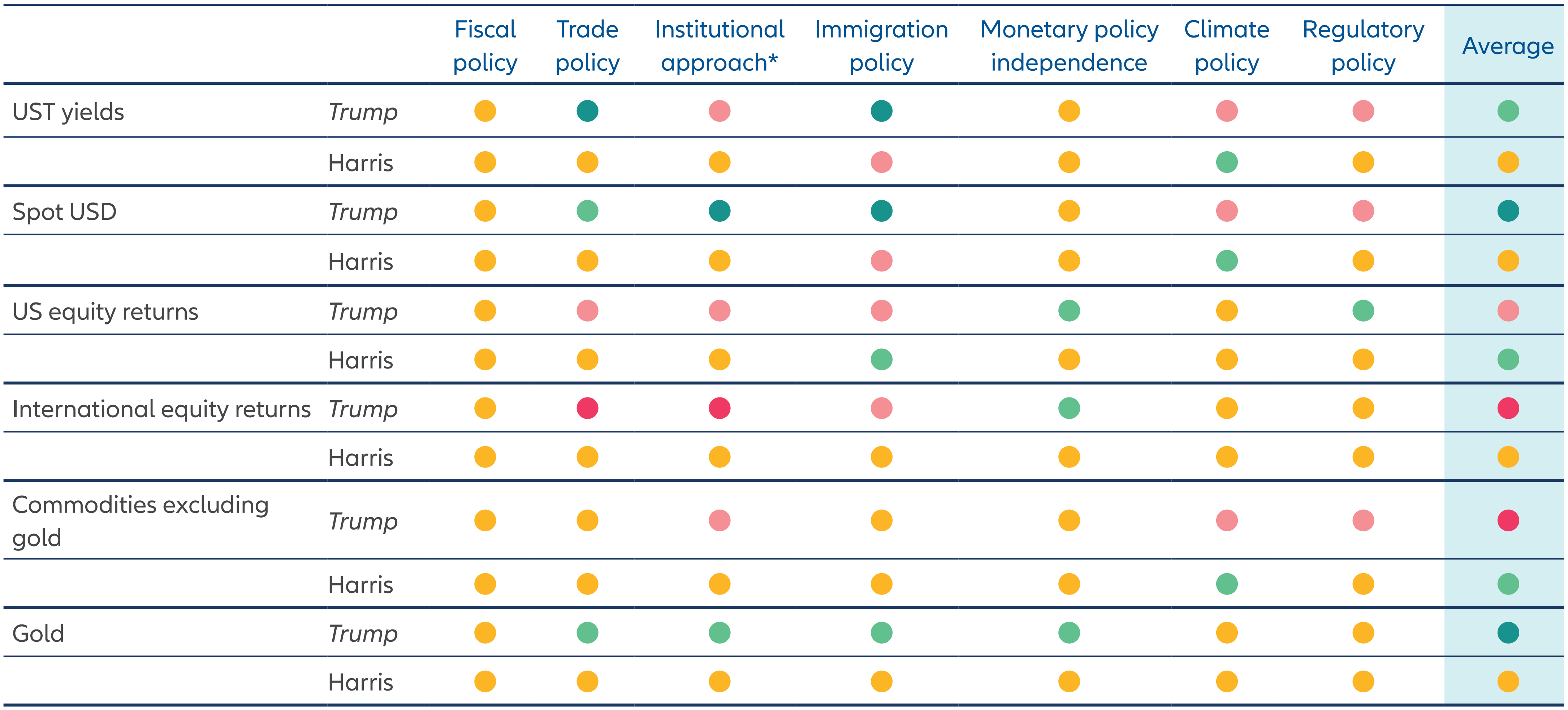

We’ve analysed the effects on markets across seven policy areas where we think the impact will be most pronounced (see below and Exhibit 1):

Fiscal policy: major stimulus is unlikely under a divided government

Vice President Kamala Harris and Mr Trump are both promoting big spending and taxation plans. Mr Trump’s proposals – including full extension of expiring 2017 tax cuts – could cost USD 11 trillion, according to the Tax Foundation, a right-leaning think tank.1 By comparison, Ms Harris’s commitment to raising taxes on corporations and wealthy households while supporting low-earners and families could reduce deficits slightly.2 The challenge for both candidates is that Congress controls the government’s purse and, under a divided government, opposition politicians can block the president’s fiscal plans. Importantly, while a divided government could mean tough negotiations around extending the 2017 tax cuts, we think a bipartisan majority of policymakers will act to prevent a fiscal cliff. As a result, regardless of who wins the presidency, the market impact from fiscal policy may prove rather neutral.

Trade policy: tariffs will be a focus for markets

Presidents can affect trade policy through tariffs without Congressional approval. This opens the door to unilateral actions that can influence growth, inflation and markets. Mr Trump’s approach includes a 20% blanket levy on all US imports plus a 60% to 100% tax on Chinese products. If implemented, this may defray some of the costs of Mr Trump’s tax proposals. But it could also create headwinds for foreign equities, in addition to a US inflationary impulse that could initially send US Treasury yields higher. The question is whether the US economy could withstand higher inflation and yields, suggesting a subsequent risk of recession and lower yields. Ms Harris does not support across-the-board tariff rises or raising tariffs on Chinese imports. She would likely retain the existing tariffs and sanctions that Mr Trump and President Joe Biden introduced.

Institutional approach: geopolitical backdrop could shift under Mr Trump

If Ms Harris wins, markets can expect continued support for the rule of law, Ukraine and other allies, as well as global institutions such as NATO. But Mr Trump’s approach might include efforts to undermine NATO, less consultation with US allies and an end of support for Ukraine. Back home, Mr Trump would likely seek to terminate the remaining court cases against him and pardon the convictions of those involved in the 6 January 2021 attack on Capitol Hill. At the margin, these efforts may bolster global demand for safe-haven assets and weigh on international equities.

Immigration policy: keep an eye on labour supply

Both candidates are indicating they will tighten immigration, in the wake of a rise in net immigration since the Covid-19 pandemic. American presidents have some power to unilaterally affect immigration policy, at least temporarily. This means a tightening of immigration under Mr Trump could dampen the supply of labour, suggesting faster wage and consumer inflation, higher US Treasury yields and tighter margins for US companies. Relatively easier immigration under Ms Harris could have the opposite effect.

Monetary policy independence: expect the Fed to be under fire from Mr Trump

Mr Trump has been critical of Federal Reserve (Fed) Chair Jerome Powell and we think he may undermine the Fed’s independence by openly and aggressively pushing for stimulus, before replacing Mr Powell at the expiry of his second term in May 2026. For US Treasuries, we think the impact may be felt more on short-term rates than long-term rates due to lingering inflation concerns. A narrower spread between US yields and the rest of the world could dampen the US dollar, while equities and commodities may benefit from the prospect of monetary stimulus.

Climate policy: energy policies will feed through to inflation and asset valuations

Mr Trump would likely undo many of his predecessor’s climate policies and aim to expand fossil fuel production. Such a move may initially boost the US economy via cheaper energy costs, prompting disinflation and lower US Treasury rates. Longer-term affects may be different. While Ms Harris has been relatively ambiguous on climate policy, she’s still expected to support the green energy transition, meaning reduced oil and gas supplies – a potential driver of inflation, US Treasury yields, the US dollar and commodities excluding gold.

Regulatory policy: Mr Trump’s plans to cut red tape may bolster US equities

We expect Mr Trump to put a greater focus on ease of doing business by reducing regulatory barriers across the energy, financial and consumer sectors. Mr Trump has even suggested that businessman Elon Musk could lead a special commission on reducing federal spending. If effective, those moves could soften the rate of inflation in the near-term, leading to lower US Treasury yields and a weaker dollar. All else equal, this could also support US equities. We anticipate Ms Harris’s regulatory approach to remain broadly in line with Mr Biden’s, meaning neutral affects for markets.

Exhibit 1: Our expected market reaction to policies under the two main candidates (based on a 12-month investment horizon under a divided government)

Dark green = very positive impact, light green = positive impact, yellow = Neutral or TBD, light red = negative impact, dark red = very negative impact

Note: Assessment based on our expectation of a divided government. We still don’t know the exact agenda of both main candidates, while the risks around our expectations are sizeable.

*Support for rule of law, traditional US allies, global institutions.

Source: AllianzGI Global Economics & Strategy. Allianz of America, Bloomberg, Washington Post; Whitehouse.gov, Associated Press, Politico; as at September 2024

Who would be better for markets?

In combination, we think Mr Trump’s policies may be supportive of the dollar and gold. He took a tough stance on a range of issues during his time in office – and we expect a similar approach if he is re-elected, potentially boosting these safe-haven assets.

US equities had a strong tax-cut-fuelled run during Mr Trump’s first administration. However, hopes for a repeat rally seem at odds with the fiscal restraint of a divided government and the inflation impact from Mr Trump’s trade and immigration proposals. For foreign equities, while the same dynamics apply, the impact could be amplified due to reduced access to US markets and diminished institutional support for traditional US allies.

Overall, we think the market impact from a Harris presidency might be more neutral. Ms Harris may not be the incumbent, but her views and policies will be similar enough to Mr Biden’s to suggest a measure of continuity.

While we consider a divided government the most likely election outcome, we are cognisant of the rising possibility of a unified government, under which the market reaction may differ meaningfully.

Finally, while our analysis focuses on near-term market effects, we recognise that second and third round effects are possible. Market pricing of prospective policy changes will also likely be uneven – some effects may already be pricing in, while others may take longer to materialise.

Staying invested is critical through the election

Recent polls indicate a deadlock between the two candidates.3 But in an extraordinary campaign that has already seen Mr Biden’s withdrawal, two assassination attempts on Mr Trump, and the first Fed rate cut in more than four years (a move that could boost Ms Harris’s prospects), further twists may lie ahead. Market participants will need to stay watchful in the run-up to November.

Markets don’t like uncertainty: ahead of the vote in election years, volatility typically rises. The tendency for some investors is to stay on the sidelines. However, once the results are known, markets are likely to return their focus to economic growth and interest rates. This means for most investors the important thing is to look through any volatility and stay invested.

1 Source: Trump Dangles So Many Tax Breaks Even Some Advisers Are Confused, Bloomberg, 23 September 2024

2 Source: Kamala Harris Tax Plan Ideas: Details and Analysis, Tax Foundation, 10 September 2024

3 Source: Harris Had Stronger Debate, Polls Find, but the Race Remains Deadlocked, The New York Times, 19 September 2024